Iron-Fisted US Dollar Throws a Knockout Punch

Low and falling US Treasury interest rates (QE) have been the only scenario in US bond markets for 6 years… until now. But, the Fed has stopped its massive QE bond-buying program and seems to be sitting with its collective finger on its Rate Increase button, awaiting enough signs that there is some reason, such as rising prices of goods and services, to press that button. But, there is drama; after all, the Fed has never been here before.

Unfortunately, the Fed’s counterparts in Europe, Japan, India, and the UK have all cranked up their own versions of QE to combat general economic shrinkage in their domains. Because interest rates were already low, their interest rate compressors have driven some government bonds to negative interest yields (which is to say that investors are actually paying out a “lender’s premium” for the privilege of having the government borrow from them). This startling turn of events is directly causing another variable to wobble-up the global economic picture: the value of the US dollar is rising, dramatically and rapidly, vs. nearly all other currencies, except China. Exactly 6 months ago, if you bought one euro, it would have cost you $1.30; today [March 11, 2015], you can buy it for only $1.08… that’s a 17% decline… and apparently still falling!

A slide of lesser steepness has also happened to the currencies of Japan and Britain. Even Canada and Australia are down by double-digits versus the US dollar. So what? you may ask. All the better for Americans to visit Europe. Get great buys and cheap luxury, you may be thinking. Even if you can’t get away for a cheap weekend in Paris, the strong dollar will hold down prices of all that we import (except the stuff from China, whose currency has kept pace with the dollar). Did we mention oil? Recall that, wherever oil is bought and sold anywhere in the world, it is priced in USD; so, the rest of the non-US globe is not enjoying quite so much of the 8-month-old, almost-50% price plummet in the dollar price of oil. [Brent crude spot price moved from $110 to $59, which, translated to euros, was from 85€ to 64€ (down only 25%).

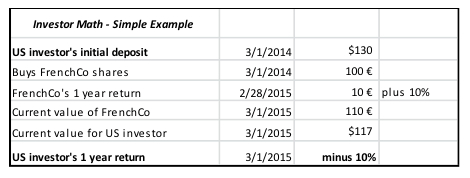

BUT, if you have non-US investments that are not hedged back to the USD, the currency drama is playing a very strong hand against you. The S&P/Citigroup International Treasury Fund (IGOV) is an ETF that benchmarks broad duration, global non-US government bonds, with no currency hedges, has returned minus 11.7% over the 12 months ended today. Other negative aspects of the powerful dollar are: US exports are getting/have gotten much more expensive than they were less than a year ago, hitting hard on US businesses that have gotten used to an expanding and attractive global market for their products.

The trading world is agog over pending increase(s) in US interest rates, which will surely do more damage to dollar-investors’ foreign investments, unless they hedge the local currency back into dollars.