And Now for Something Completely Different…

If you had told us (as one prescient friend predicted over a year ago), that Donald Trump would win the White House in contravention of virtually all published polls, we probably could have forecast the level of discord and division among otherwise polite neighbors that might ensue. But if you coupled that with a Fed Funds interest rate increase a month after the election, the first words out of our mouths would not have been ‘stock market rally!’

If you had told us (as one prescient friend predicted over a year ago), that Donald Trump would win the White House in contravention of virtually all published polls, we probably could have forecast the level of discord and division among otherwise polite neighbors that might ensue. But if you coupled that with a Fed Funds interest rate increase a month after the election, the first words out of our mouths would not have been ‘stock market rally!’

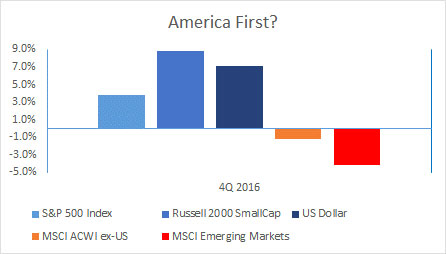

So you can count us in on “I did NOT see that coming,” where three months hence, one can still discern a generalized impression of disbelief over the outcome and reverberations. The disconnect from expectations is particularly evident in US dollar asset returns (see chart below), which appear to be at odds with conventional wisdom about markets disdaining and discounting uncertainty.

And there surely has been plenty of uncertainty in the form of a momentous reversal in governmental philosophy and formal political experience, coupled with an aggressive president eager to move down a seeming checklist of policies mooted on the campaign trail. Whatever one’s political views, it seems difficult (for us anyway) to imagine something more “completely different” in American politics than Donald Trump.

In an unsurprising follow up, the Fed played its hand consistent with our expectations, making no rate decision pre-election but nudging its federal funds target northward to 0.75% in December, as well as indicating a propensity to make three similar 25 bps increases in calendar 2017.

“…but apart from the sanitation, medicine, education, wine, public order, irrigation, roads, the fresh water system and public health, what have the Romans ever done for us?”

Divorced from the pressure of a political campaign, this Fed utterance of a path toward higher rates seems more credible than the similar (and subsequently abandoned) path charted for 2015/16. With the next Fed meeting a month away, markets are still measuring low odds for another hike at the March meeting. Interestingly, Fed chair Janet Yellen recently acknowledged 1 a concern over the necessary if not yet sufficient conditions for inflation courtesy of years of loose money and the risk of delayed action as the economy improves. (Such recognition of the blindingly obvious reminded us of the Martin Short wedding planner character’s mocking retort in the 90s classic Father of the Bride: “welcome to the 90s, Mr.Baahnks.”)

And yet, markets continue to perform one of their random (silly?) walks, going up when there are seemingly plenty of good reasons – e.g., policy uncertainty, rising rates, stretched valuation – to go down.

The plus side argument exists in the form of expectations for a positive equity market environment on three fronts:

- Income tax legislation that would a) lower the corporate income tax, freeing up corporate capital left offshore under current tax law, and b) lower marginal personal income tax rates putting more money in consumers’ pockets;

- Streamlined business regulation encouraging investment, bank lending, and innovation that will foster corporate risk-taking and the expected positive economic impact; and

- Infrastructure spending 2 (which we indicated would be a headline priority whomever took the White House) where a rare bipartisan consensus concurs that a period of past under-investment must be made up.

That this qualifies as “something completely different” from previous political priorities should be beyond reasoned debate. How much of the above will be accomplished as opposed to floated, and how quickly are however worthy points to ponder when considering market valuations. (The old market saw about buying the rumor and selling the news comes to mind.) It is quite possible and perhaps even likely that some of the optimism embedded in the “Trump rally” may bump up (or down) against the reality of what actually gets accomplished and how versus the current set of Great Expectations. Of Note:

- Large- and mid-cap stocks are up 14-15% in the past five years, ~2-3% annualized above their long term history. We’re still at peak-ish profit margins for corporate America, thanks in large part to low borrowing costs. What might happen to stock prices when interest expense and profits revert to more normalized levels?

- Bonds represent a uniquely challenging picture in our view. Rates look to be on the rise for real. If the summer of 2016 proves to be the trough in interest rates, bond investors are in for a series of negative capital adjustments in the years ahead. The negative sign in front of “fixed” income returns posted for 4Q ’16 may become a more familiar fixture for investors going forward. We are generally advising that investors manage that asymmetric risk (low likelihood and low reward for rate decreases/higher likelihood and greater losses for increases) via limited duration and expectations.

“Finally, Monsieur, A Wafer-Thin Mint”

Our primary concern these days revolves around decision making in what amounts to only the recovery portion of a capital market cycle. Indulging that last mouthful of portfolio risk (e.g., being enticed by last year’s high yield market returns despite wafer-thin spreads) may prove too much to ingest. Risk control should be valued above heroics, portfolio wise, and that includes not abandoning diversification that appears to “not be working” lately.

We have witnessed active/style strategies cycle through performance struggles before, often adding the most value in the kind of sharp/extended drawdowns that have been lacking since 2013 or so, and therefore we remain especially committed to the tools of portfolio hedging, for we have found they are appreciated least right before they are needed most.

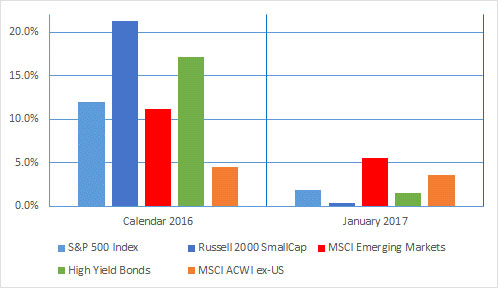

We see neither red alert signals flashing warning nor any “fat pitch” opportunities that are compelling on a risk-adjusted basis. The one area that comes the closest is the divergence between recent results for US and Non-US Equity benchmarks.

Our asset allocation modeling assumptions project roughly similar results over the long term for US and Non-US equity markets. We recently modeled varying proportions between US and Non-US, with little expected impact on expected long term portfolio outcomes. But we take Professor Keynes observation (in the long run we are all dead) to heart in thinking about tactical portfolio opportunities. US market returns have exceeded Non-US by ~60% compounded at the index level from 2007 – 2016 (table below). If mean reversion (one of the foundational pillars of modern asset allocation theory) has any practical application, it is to expect those numbers to converge over the next 5-10 years, rewarding those willing to overweight or rebalance to those investment areas that have been least rewarding in the post-crisis era.

Finally, in an epoch that looks to us a nadir in the level of civil discourse about the direction of American policy, we hope readers will accept our humor in the spirit it is intended. We close with what seems to us an apropos thought from the leader of the renowned British comedy troupe from whence this quarter’s thematic inspiration springs.

Finally, in an epoch that looks to us a nadir in the level of civil discourse about the direction of American policy, we hope readers will accept our humor in the spirit it is intended. We close with what seems to us an apropos thought from the leader of the renowned British comedy troupe from whence this quarter’s thematic inspiration springs.

- Ms. Yellen “cautioned that holding off too long on rate increases ‘would be unwise,’ since it could force the Fed to lift rates more aggressively if inflation shoots higher, which could risk pushing the economy into recession.”

- Whether a border wall is a good idea or represents “who we are” as Americans is a highly contentious point, but surely concrete and steel count as infrastructure, whomever “pays” for it.