Saying Goodbye to A Music Legend… and Free Money

Commencing countdown, engines on; Check ignition and may God’s love be with you1

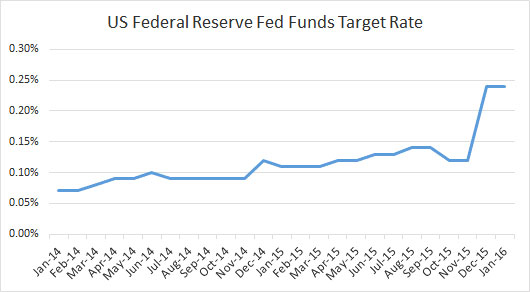

After all but Snapchatting the chart above in advance, the US Fed made its much-heralded move off of zero interest rate policy (ZIRP) in December. And so we have interest rate lift-off for the first time this decade.

Perhaps more importantly (ominously?), the Fed guided markets to expect gradual rate normalization over 2016 – 2017 in orderly 25 basis point increase increments.

While monetary policy is not the only thing that matters to markets, the strange experimental- ness of “free money” for so long – see Fed Funds chart – brings a heightened importance to this inflection point. Even more so, given that other major global central banks are easing, and most others who have raised rates post-2008-crisis have had to reverse course.

Ground Control to Major Tom…

…Your circuit’s dead, there’s something wrong; Can you hear me Major Tom?2

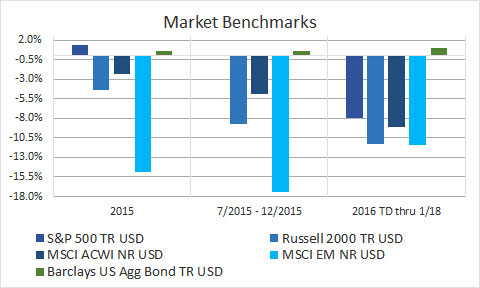

Markets across the globe pretty clearly would like nothing more (short term) than a return to ZIRP, given punk results across asset classes in 2015. Almost every major asset type and strategy was flat-ish, with lots of chances to lose money surrounding numerous sharp monthly reversals. 2016 thus far seems to be similarly skidding3 (on the “ice ice baby”).

Earning meaningful returns in a traditional diversified portfolio setup was challenging, with stocks only positive due to dividends, bonds struggling with rate increase concerns, and the most common diversification tools (size, style, geography) losing to the S&P 500.

Market breadth was famously poor, with the equal weighted US index losing money even with dividends. Value style, Non-US, and Emerging Markets also “de-worse-ified” 2015 results. Active management was consequently of little help, while alternatives fared a bit better, unless you owned commodities, a free fall elevator (-13.5% 5 Years annualized, i.e., cut in half) for years now.

Pressure pushing down on me… Pressing down on you

I feel a wreck without my… little China girl. I’m a mess, without my… little China girl.4

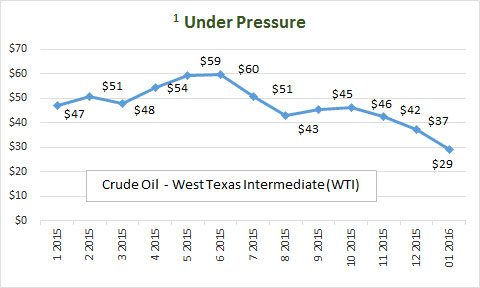

It used to be said in economics that when America sneezes, the world catches a cold. While the long term US impact of the global economy retains its outsized status, it seems fair to suggest that China has supplanted the US as today’s investment “typhoid Mary” in the short term.

It would be difficult to overstate China’s impact on the global economy, capital markets, and investor psychology here in mid-decade. Its huge population, rapid growth, and commensurate appetite for materials – especially energy – have created much angst as it matures and inevitably slows its consumption rates.

Coupled with ample supply and a strong US dollar, expected slowing in China’s growth rate3 (not its absolute level) for oil consumption has kept oil prices testing previous price “support levels” in 2015 and into January. While no one knows exactly where the bottom is, $10 rather than $100 has become the headline price for predictors.

As we have seen with other major price adjustments (e.g., 90s tech stocks, ‘06 housing prices / subprime loans), collateral damage often spreads to market prices seemingly far afield. It would not be surprising for oil’s negative price ch-ch-ch-changes4 to similarly shift the risk perception and impact asset prices (junk bonds? currencies?) for areas outside of the initial commodity market adjustment.

- David Bowie, 1947 – 2016; Rest In Peace, Ziggy.

- David Bowie.

- Hat tip Vanilla Ice.

- Queen / David Bowie

- David Bowie

- Editorial note: actual mileage may vary; reported growth rates from this very top-down, information- controlled society may well vary dramatically from actual results.

Copyright © 2016 FiduciaryVest, LLC; All rights reserved.

This publication is not a suitable basis for investment decisions.