In March We Dotted The “i’s”; Now We Cross The “t’s”

Writing during a curiously chilly Atlanta March a few weeks ago, we listed income taxes, infrastructure, inflation, interest rates, and integrated global growth as the “i’s of March“ for investors to beware as they considered the then-shaky early results of 2018. Our alliterative bent has carried into a better-late-than-never spring, with our minds pondering the variables of income taxes (a two-fer), trade/tariffs, Treasuries, talks, Tehran, and of course Trump (all the time, it seems) influencing market mood and moves.

2018 has featured a distinctively altered environment–returns are puny, equities have changed directions sharply (several times), interest rates are no longer pinned down, and at least in the US, the central bank is reversing course on almost a decade of the economic experimentalism known as QE (quantitative easing). Market outcomes are a bit ironic, given that GDP and corporate profit expectations are generally positive, with unemployment figures, especially in the States, plunging to historic lows.

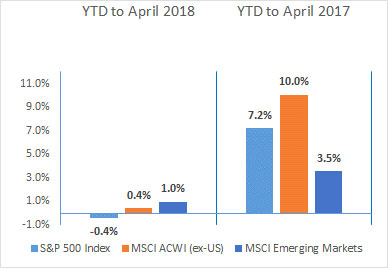

Both US and Non-US stocks were down a bit in the first quarter and remain about flat year-to-date. But if you have a value style tilt in your portfolio, results are negative by a few percent, whereas the growth style is positive about as much, across capitalization sizes. Bonds lost money for the quarter and remain in the red for the year, an anticipated outcome as interest rates march upward and the new higher yields take time to make an impact on portfolios. Yield-oriented assets such as REITs and MLPs were also impacted by rising interest rates.

There are other important factors influencing market results beyond healthy economic statistics—valuation and markets’ discounting mechanism for starters. With stocks having gone on a “melt-up” of roughly 15 months since the 2016 election, a pause was likely inevitable, perhaps even healthy. So where do we stand as we approach the midpoint of 2018 and what are the market drivers? We‘ll organize comments below around our series of “i’s” and “t’s“ in our estimated rough order of importance/impact.

“Not Anymore” – Jacques Clouseau

Treasuries/Interest Rates/Inflation

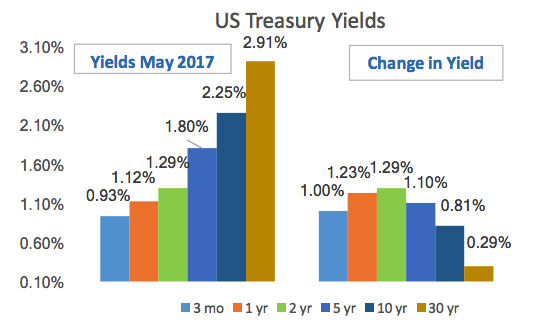

After nearly a decade of central bank manipulation, which concealed or at least obscured the cost of money, the US Federal Reserve has clearly put markets on notice that it intends to raise the short-term interest rates it directly influences. January saw the fourth such increase and March the fifth one; May’s pause was accompanied by an intimation that at least two more and perhaps even three 0.25% hikes are slated for 2018.

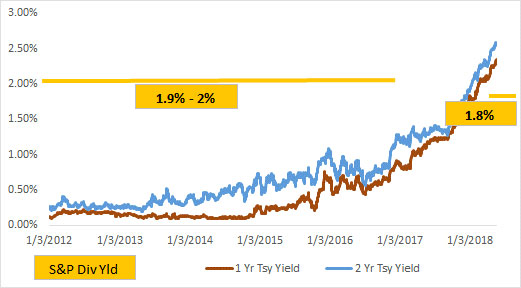

If no other objective was accomplished by 2009-2017’s QE interest rate policy, it at least made riskier assets look more attractive by comparison to government bonds, at least partially influencing the post-financial crisis asset price recovery. The issue investors are wrestling with now is that since the Federal Reserve has acted—and adamantly indicated it will keep doing so – what downward price adjustment is appropriate for assets with more risk than Treasuries? For years, the S&P 500 sported a dividend yield significantly great than short risk-free Treasuries. Well, not anymore 1.

One additional note pressuring the interest rate backdrop relates to the technical supply/demand dynamics of the bond market. While European and Japanese central banks remain buyers in the markets for securities, the US Fed switched to a seller last fall. This represents, if not the markets’ new favorite phrase, QT (quantitative tightening), at the very least Quantitative Un-Easing. Q-Un-E is likely to be less fun for investors than QE.

The Fed’s balance sheet reduction represents the mother of all asset sales. In a planned gradual runoff of accumulated balance sheet assets, the Fed is not reinvesting interest receipts, principal prepayments or maturities, to the tune of $20 billion monthly, headed to $30 billion monthly by 3Q 2018. That is a $360 billion annual run rate of former buying power in bond markets being removed. Which leads us to…

“There are no Americans at the airport! I will take you there2!” – Mohammed Saeed al-Sahaf (aka “Baghdad Bob”)

…Income Taxes

…Income Taxes

…the 2018 tax bill which has had such a major impact on capital markets in a myriad of ways. As its main feature was a reduction in the corporate income tax rate, markets spent early 2018 adjusting earnings estimates for this new reality, which Warren Buffett termed akin to having a former partner in business voluntarily agree to take a smaller share of profits. The resulting adjustments trimmed a nosebleed p/e ratio in US stocks to at least less elevated levels.

There are other aspects to the tax reform story of course, and a big one is the anticipated immediate and longer term government deficits it may bring. According to the recent Budget and Economic Outlook of the Congressional Budget Office, “…for the 2018–2027 period, CBO now projects a cumulative deficit that is $1.6 trillion larger…As deficits accumulate…debt held by the public rises from 78 percent of GDP ($16 trillion) at the end of 2018 to 96 percent of GDP (or $29 trillion) by 2028…” Predictions are hard, especially about the future, and CBO is notoriously conservative in their growth and therefore revenue estimates. Still, no one thinks trillions and trillions of new debt (pretty soon you’re talking real money) is a healthy development.

For the coming years, it’s the combination of the deficits, Fed actions, and their influence on interest rates that may well hem in market returns. In one sense, fiscal policy largesse—government spending even more than it takes in—may be considered an offset to more restrictive monetary policy, where increasing rates slow down borrowing at the margin and reduce GDP. But one thing is for sure—Uncle Sam will be a big, big, big seller of debt, $600-700 billion to finance itself this year alone. Add in the ~$300 billion the Fed is selling/not buying from its balance sheet and we need a home for ~$1 trillion in Treasuries, again real money.

How do you attract marginal buyers? Lower the price, i.e., raise the interest they get paid. All else equal, higher interest rates mean lower asset prices. Counting on p/e multiple expansion when competing risk-free rates are increasing is asking a lot, unless multiples started low, which they did not. Stocks can go up when and as earnings increase, so…

Trade / Tariffs

…all steel articles imports specified in the Annex shall be subject to an additional 25 percent ad valorem rate of duty with respect to goods entered, or withdrawn from warehouse for consumption…

– Presidential Proclamation on Adjusting Imports of Steel

…trade wars are good, and easy to win. Example, when we are down $100 billion with a certain country and they get cute, don’t trade anymore-we win big. It’s easy!

– @Twitter 3/2/18

…everyone looks to see what might impact corporate revenue and earnings growth negatively. Trade is a complicated and inherently political topic, but it’s generally accepted that having more markets to sell into is better than fewer. Not better for every single person, in every single job, everywhere, but on balance. So the possible significant disruption of the existing trade equilibrium qualifies as a threat to corporate sales and profits. Cue President Trump, elected on a platform, among other things, of making “better trade deals” for America in the world, using sharp-elbowed tactics where necessary.

“Which, anyone? Raised or lowered? …raised tariffs…” – Ben Stein in Ferris Bueller’s Day Off

Steel and aluminum tariffs prompted countermeasures from China, and there’s been some back and forth – if you tax, this, we’ll tax that3. The brouhaha to date has brought about inevitable comparisons to the… anyone, anyone… the Smoot Hawley Tariffs4, bugaboo of the 1930s and villainous augur of the Great Depression and World War. The uncertainty is contributing to a stock market with a lid on it, but our curiosity caused us to compare the breadth of current proposals with the dreaded tariff bill of lore. We’re not sure precisely what this comparison says, but the final text of Smoot-Hawley runs 332 pages (looks like about a 7 font), while the lists of proposed tariffed goods referenced above run 54 pages.

The United States and China are the world’s largest and second largest economies. They have vastly different political and economic philosophies and many competing interests. We expect longer term that they are both disposed to and likely need to learn how to adjust policies in a way neither loves completely but both can live with. It’s called compromise, and with recent news sounding less confrontational we expect it will work itself out over time.

Tehran and Talks

Speaking of confrontational, recent months have seen much discussion and even some action related to the world’s self-interest in restraining the growth into nuclear armed states of Iran and North Korea. In the Middle East, President Obama negotiated an agreement to delay Iran’s nuclear research in return for sanctions relief. Because the agreement did not receive Senate approval as a formal treaty, President Trump was free to withdraw from its terms without congressional approval, which he did a few weeks ago.

That he did so may have been with one eye on a then-pending “summit” meeting with North Korea’s Kim Jong Un, who spent most of the late winter and spring on a charm offensive and mooting a face-to-face sit-down with the American President. These geopolitical developments, shifting in tone and content over weeks have also directionally impacted markets and will continue to do so.

As we went to publication, the proposed Singapore June 12 meeting has been called off, to some degree robbing both political right and left of narrative hopes and suppositions—the left that Kim can be managed and reasoned into safer behavior, the right that only President Trump’s tough (“little rocket man”) rhetoric can be counted on to wrangle the rogue state into a conciliatory frame of mind.

The world will presumably be a safer place if people who hate freedom, repress (or starve) their own citizens and have been known to sell their lethal technology to the truly criminally insane are less able to do so. A safer world is generally a more prosperous one, and that’s our angle in this space. Safe is more certain, more certain is less risky, less risky is better to grow capital in, so we‘re for more safety, though we know it is achieved slowly, painfully and never perfectly. It isn’t safe now, and it won’t be even if Kim Jong Un shaves his entire head, dons a peach colored robe and sells flowers in downtown Pyongyang. (Though we’d like to see the post on Facebook.)

“A Little Less Talk And A Lot More Action” – Toby Keith

In the grand scheme of things, we think North Korea is a starving little prison state, albeit a potentially dangerous one. As to the wisdom of an actual ”summit“ meeting between him and the American head of state, we’re dubious. Is meeting with a neighbor who has threatened to burn your house to the ground a good or bad idea? We’re not sure; some people cannot be reasoned with.

But we are fairly certain that Kim Jong Un has more in common with an Under Assistant West Coast Promo Man5 than he does with Nikita Khrushchev. President Kennedy rose to the prospect of nuclear missiles 90 miles from America, and while Lloyd Bentsen (among others) would surely sneer that President Trump is “no Jack Kennedy,” we suspect with the right advice, he’ll navigate the inevitable ups and downs of international diplomacy as he will the challenges of world trade—imperfectly, in a way neither side loves completely but both can live with. That compromise thing again. And speaking of the President…

and Trump

We don’t want to get off on a rant here, but……we just think everyone hears his name and his voice (virtual or otherwise) too much, whatever your view of him or his policies. Single issue politics is both unhealthy and boring, and single person media dominance even more so.

Again, expressing no opinion one way or another (we have readers who differ greatly), we think it is fair to observe that President Trump talks. He talks a lot in aggregate, and in our view either too much in rambling stream of consciousness interviews or too little, 140 characters at a time where nuance may be lost. He may have been sworn in on the sixteenth president’s bible, but he appears to eschew Mr. Lincoln’s observation, adapted from it,6 that it is ‘better to remain silent and be thought a fool than speak and remove all doubt.’

He’s the President of the United States of America, not an Under Assistant West Coast Promo Man7. Someone close to him – Melania, Ivanka, Jared Kushner, Chief-of-staff Kelly, Rudy Guiliani, anyone – should tell him so. (Just don’t tell him we said so – we don’t want a 3AM tweet!) We follow markets, and they prefer certainty to its lack. In our view markets could do with a little less talk and whatever action he deems appropriate and can get Congress to agree to where the Constitution requires it. Of course that’s just our opinion…we could be wrong.

Conclusion

As of this February, all the “winning” came to end, at least if the judgment criteria is upward market price adjustments. We’ve outlined a fair bit of uncertainty in these pages, and it will all likely take some time – probably years for major ones like the Fed’s new direction – for markets to digest and adjust accordingly. More near term, we note that most presidents experience a “sophomore slump” in terms of economic progress and market returns. The honeymoon always wears off, and President Trump never had one to begin with, politically speaking anyway.

As to positioning, while every portfolio is unique, we still find Non-US the more attractive marginal bargain for equity exposure. We’re neutral on equity ownership – portfolios have to have it for growth to one degree or another, and where asked for our opinion, we’d be at target weights as of February/March (whereas we were contentedly overweight for the past several years, up to policy maximum limits). Intra asset-class, as we indicated earlier, the growth style has outperformed value across capitalization sizes to a degree where we would expect a profitable reversal for those with the investment latitude, structure and flexibility to overweight value above growth, with our suggested shift being a 2:1 ratio value: growth, or at a minimum a rebalance back to equal weighted between styles.

- Clarice Starling: That doesn’t interest me, Doctor, and frankly, it’s … it’s the sort of thing that Miggs would say. Hannibal Lecter: Not anymore.

- Who is old enough to catch the reference? Gulf War I, 1990, when Saddam Hussein promised “the mother of all battles,” which, while combat is always perilous, lethal and best avoided, was over in fairly short order. More like the parakeet of all battles, and whatever happened to Baghdad Bob? He was the Iraqi spokesman for those few brief weeks that made CNN, who promised ‘there are no Americans at the airport! I will take you there.’ That he expressed such…chutzpah may be the mother of all ironies. But we digress.

- Hey kids, forget Fortnite; in your spare time, view and search list of 1,382 tariffs the US proposed on Chinese goods (e.g., aromatic drugs, hygrometers), or the list of 106 items from the US that China will tariff (e.g., whiskeys, flue-cured tobacco). Have fun with your friends!

- Save Ferris!

- Hat tip: Sirius XM, Deep Tracks

- Proverbs 17:28

- We liked this previously unknown gem so much, we had to use it twice! (And half of America thinks it fits.)

COMMENTARY

Commentary was prepared for clients and prospective clients of FiduciaryVest LLC. It may not be suitable for others, and should not be disseminated without written permission. FiduciaryVest does not make any representation or warranties as to the accuracy or merit of the discussion, analysis, or opinions contained in commentaries as a basis for investment decision making. Any comments or general market related observations are based on information available at the time of writing, are for informational purposes only, are not intended as individual or specific advice, may not represent the opinions of the entire firm and should not be relied upon as a basis for making investment decisions.

All information contained herein is believed to be correct, though complete accuracy cannot be guaranteed. This information is subject to change without notice as market conditions change, will not be updated for subsequent events or changes in facts or opinion, and is not intended to predict the performance of any manager, individual security, market sector, or portfolio.

This information may concur or may conflict with activities of any clients’ underlying portfolio managers or with actions taken by individual clients or clients collectively of FiduciaryVest for a variety of reasons, including but not limited to differences between and among their investment objectives. Investors are advised to consult with their investment professional about their specific financial needs and goals before making any investment decisions.

INVESTMENT RISK

FiduciaryVest does not represent, warrant, or imply that the services or methods of analysis employed can or will predict future results, successfully identify market tops or bottoms, or insulate client portfolios from losses due to market corrections or declines. Investment risks involve but are not limited to the following: systematic risk, interest rate risk, inflation risk, currency risk, liquidity risk, sociopolitical risk, management risk, and credit risk. In addition to general risks associated with investing, certain products also pose additional risks. This and other important information is contained in the product prospectus or offering materials.