Market Commentary October 2015

3Q 2015 Market Results

A famous Blues Brothers film line, “we got both kinds of music: Country and Western” comes to mind in reviewing investment outcomes to date through September 2015–both kinds of losses:

Bad…

…and worse1

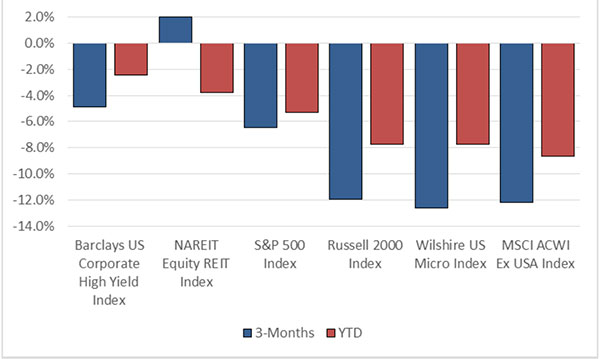

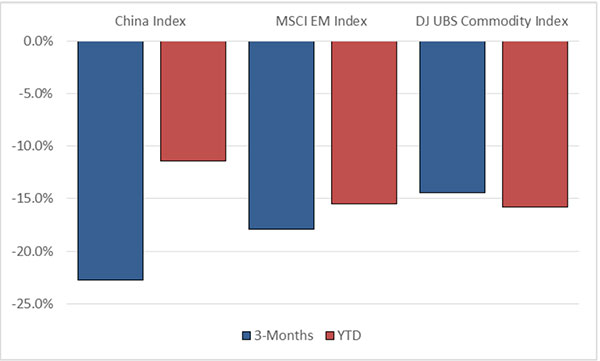

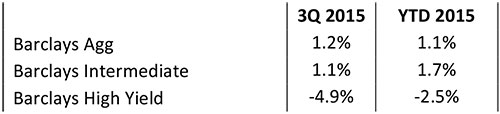

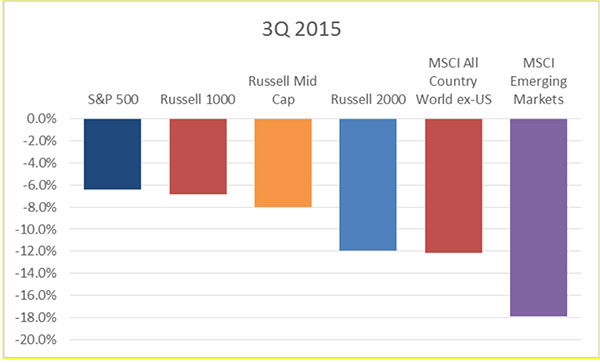

China’s slowing economy and tumbling stock market, Greece’s serial restructuring talks and worries over a possible Fed September rate hike (now moot) combined to move the first half’s uninspiring array of market returns into almost universal negative territory for calendar 3Q. Bonds stumbled into barely positive territory for the year, courtesy of the typical quality-flight in drawdown periods, but risk assets were punished proportionately to their commonly perceived peril.

US Equity returns were just plain bad, and the smaller the market capitalization, the worse the outcome. Non-US was worse, with emerging markets testing correction territory (-20%) and individual countries crossing it. Long-only commodities remain the capital markets’ whipping boy (taxable investors have been tax loss selling the category for six years running).

[callout]It is plausible that value-oriented investors with long time horizons and decision making structures that encourage patience and a contrarian bent might want to consider averaging their way into a commodity exposure in the face of what is sure to be near revulsion among investors considering trailing historical results. For our part, we still do not recommend “catching the falling knife” that commodities today appear to be, though we generally support keeping existing positions as well as maintaining managed futures target weights for that portfolio position which is derivatively (pun intended) related to commodities, and which historically provides a form of insurance against the underperformance of traditional stock/bond positions.[/callout]

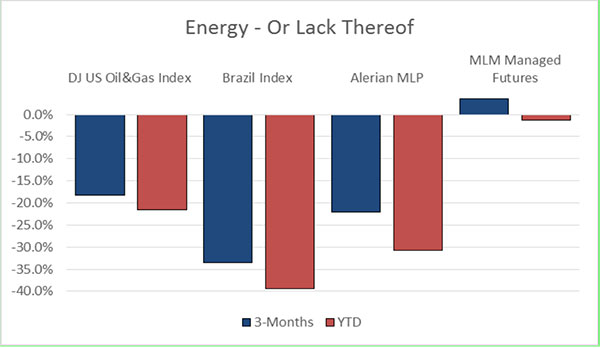

With energy having been in free fall going on a year, the true negative outliers with a connection to oil have turned in 2015 outcomes so far that harken back to the 2008 financial crisis — or perhaps the abominable Sylvester Stallone / Dolly Parton film partnership in Rhinestone — for sheer dreadfulness.

The one notable bright spot was managed futures strategies which bucked the negative trend, continuing the “2D, diversification in drawdowns” behavior for which we generally favor their use in portfolios.

Generalissimo Francisco Franco Is Still Dead2

–“Weekend Update”, circa 1975, Chevy Chase

Federal Reserve Doesn’t Increase Interest Rates at September Meeting

— Washington Free Beacon

The September Fed meeting came – and went – without the rate hike that investors around mid-year had seen as a near-certainty. US economic headline data (low headline unemployment, cheaper oil, weak but positive GDP expansion) lends support to the Fed’s still-stated goal of a 2015 upward hike. Yet China’s summer surprises make the Fed’s job demonstrably harder, and the European Central Bank’s Mario Draghi last week did Janet Yellen no favors (see sidebar – How’s Your Super Mario Cart Game, Madame Chairwoman?), indicating that the ECB governing council is prepared to provide additional stimulus to raise inflation to its target, probably as soon as December, two weeks before the US Fed’s final 2015 meeting.

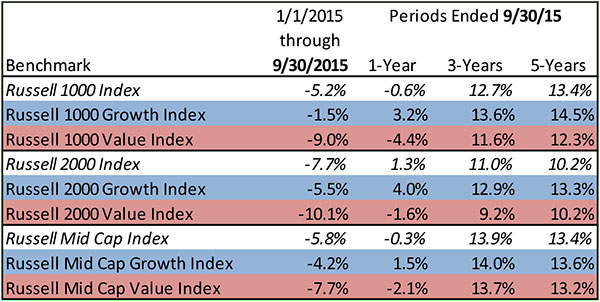

As we’ve noted previously, a sizable gap has opened up between the growth and value equity management styles, particularly in calendar 2015 and in a consistent fashion across the capitalization indices. While not a formal component of our proprietary rebalancing methodology, the gap between growth and value shares likely suggests at least a return to an equal weight between the two styles where both are present in portfolios, if not a slight tilt towards the under-performing value segment.

[callout]How’s Your Super Mario Kart Game, Madame Chairwoman?

“European Central Bank President Mario Draghi’s … very dovish comments succeeded in driving the euro lower … and Mr. Draghi even said that a further cut in the already-negative deposit rate was under consideration. – Five Takeaways From the ECB New Conference, WSJ 10/22/15

The US Fed is loudly on record as indicating they want a gradual return to normalized interest rate policy, sooner rather than later, though it faces a bit of a circular dilemma in now delivering said move. To a degree, Fed Governors have painted themselves into a corner on interest rate policy – if they don’t raise soon, they are inconsistent at best and markets rightly worry: ‘when exactly will it be a good time to get back to normal?’

If they follow through on an initial hike, they risk sending an already strong US dollar higher, denting exports, dampening liquidity, and extending recent market jitters, perhaps into a full blown bear market. Markets via forward contracts on future interest rates were reported recently to be assigning less than a 30% probability of a rate hike in 2015, and that was before China cut its interest rate (and bank reserve requirement to boot!). We’ll go “out on a limb” and concur that the Fed is unlikely to move rates in 2015.[/callout]

- We’re just saying 2015 returns have been closely related, NOT rendering an opinion on country music. Even the “Yankees” among us enjoy the genre; we’re enjoying some as we type in fact.

- Chevy Chase / SNL