(Sort of) Happy Days

Similar to the famous sitcom’s “later years”, our current market is in a place that somewhat resembles happy days. Stocks are healthy, results respectable, but it’s not quite time to sing “Sunday, Monday, Happy Days, Tuesday, Wednesday, Happy days…”

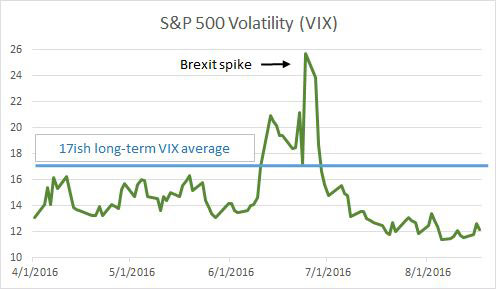

A late June surprise vote by Britons to remove themselves from the European Union lent a brief jolt to riskier assets in the second quarter. Global stocks traded off ~10% in two days in late June with the S&P 500 down about half that.

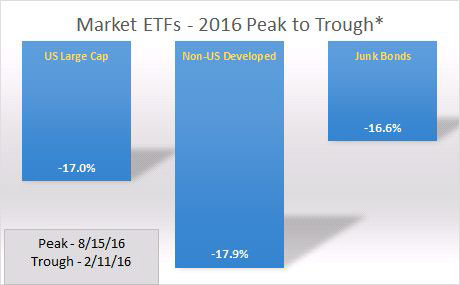

2016 has now witnessed two relatively brief though significant “risk-off” scares1. Prior to the US Fed leaning more dovish in mid-February and then again in late June around Brexit2 mania, stocks traded down quickly and sharply. This is about what we can expect when investment fundamentals deteriorate as economic and market cycles grow old, especially like the post-crisis recovery, tepid and monetary-policy-juiced as it is.

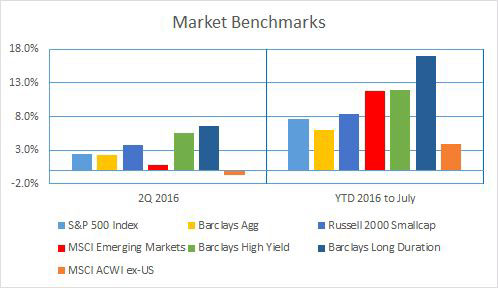

Still, “give us any chance we’ll take it” seems to be the major indices’ mantra, with stocks in healthy territory year to date. After much ado (for a week in late June), markets have thus far assumed a “Brexit-Schmexit” attitude, building respectable 2016 results across both stocks and bonds.

In a perhaps illustrative demonstration of overboard market trends, the riskiest assets have been off like a runaway bride this year. High yield (+12%) and long duration bonds (+17%), each with their own peculiar risk characteristics, boast enviable results in 2016.

Have Central Banks Jumped the Shark3?

Sitcom Mork and Mindy’s lead character, played by the late great Robin Williams, often did things a little backwards, being from Ork not earth. Regular readers know that we view the “free” money created by central banks in the past few years as a similarly confused exercise. In our view, minuscule yields on government securities (in fact billions of them offering negative yields) are distorting the most basic price signal that markets require: to what risk-free alternative do we compare economic activity or potential returns on other, risky investments.

An expanding pile of negative yield bonds (you pay more for them than you get back) is one measure of the other-worldly corridor of modern finance we seem to have entered.

Perhaps another manifestation of the complacency associated with low fixed rates can be viewed below, with measured equity volatility a fair degree below its long-term average. Mid-teens volatility is a pretty reliable long-term data series for stocks; when it’s much lower for long, a pending uptick is usually a pretty good bet.

Nothing in Common?

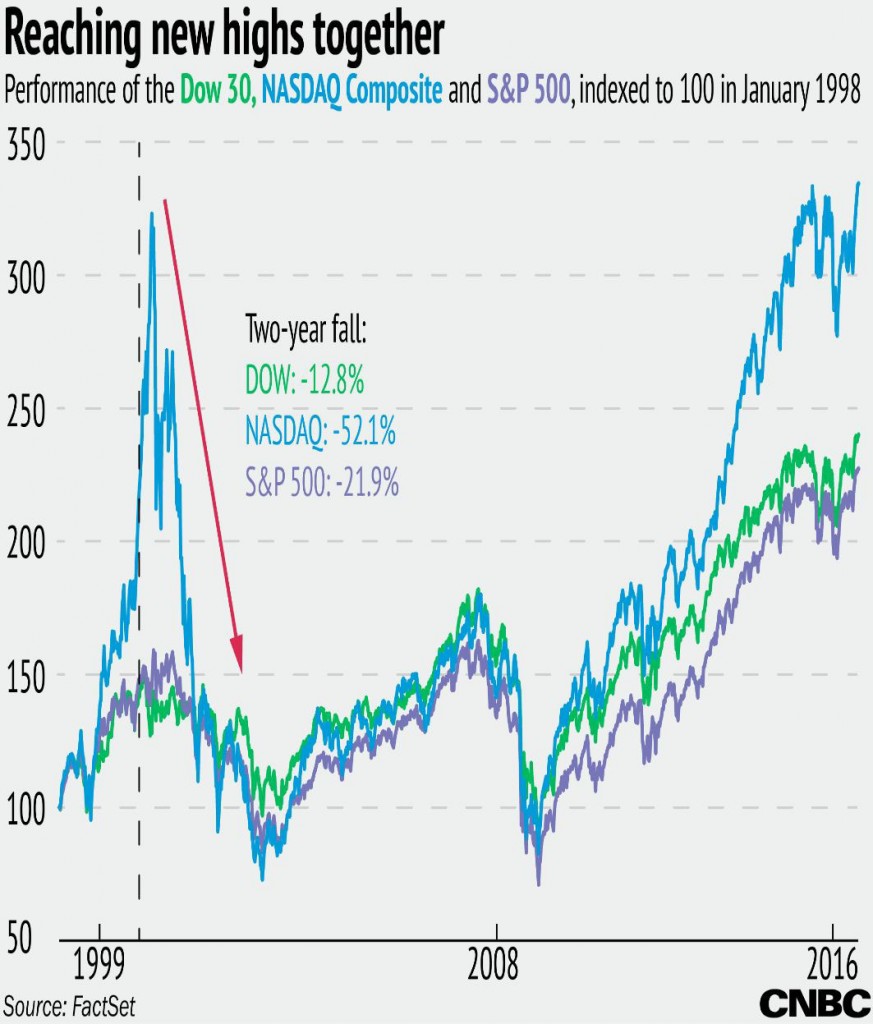

Meanwhile, for you Olympics enthusiasts, we note that the US equity markets are medaling in “synchronized swimming.” For the fans at home, 1999 was the last time all three major US indices reached simultaneous nominal peaks.

So what should investors do, or not do? Here are a few thoughts:

-

- Stick to basic long-term investing principles – goal setting, risk management, diversification, portfolio rebalancing. In our view, the post-crisis recovery is both long in the tooth and Fed-juiced. It is no time for heroics, portfolio wise.

- On the latter note, consider the annualized return data below in allocating to growth assets in a diversified portfolio, and ask this question: Is your allocation to US / Non-US Equity reflective of a bias in favor of your home-country and recent return patterns?

S&P 500 MSCI World-Ex US

5 Years +12.1% +0.1%

10 Years +7.4% +1.9%

- A less well-known asset class we’ve long advocated, managed futures, generally corresponded to equity market downside in the two drawdown episodes, but with a positive rather than negative sign.

- See “British Vote…Please Don’t say The B Word”

- A phrase coined to describe a phenomenon that may have more than fully run its course. Ascribed to the 1970s television series Happy Days, for the late run episode when, having exhausted more compelling situations over hundreds of shows, the main plot concerns one of the main characters water-ski jumping across a patch of water housing a man-eating shark. Way before Discovery Channel and Shark Week.

Copyright © 2016 FiduciaryVest, LLC; All rights reserved.

This publication is not a suitable basis for investment decisions.