You go back, Jack, do it again1

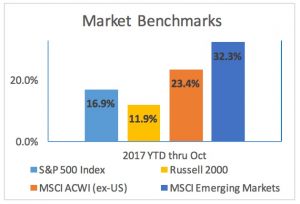

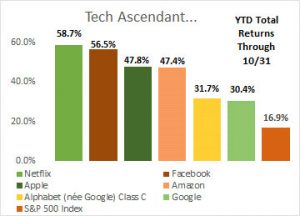

2017 continues to surprise pretty much everyone, this column included, with both the virility and longevity of its returns for investors. The hits just keep on coming, with stocks adding another robust quarter – and a healthy October – leaving year to date results running at >1.5X their long-term historical rates of return (e.g., S&P 500 +16.9% vs. ~10% average since 1926).

Batting three hundred against talented pitching is often a ticket to the major leagues, and has been working wonders in equity markets deep into 2017. When President Trump was inaugurated to a “record” crowd, the purported pillars of an improved environment for corporate profits (and therefore fertile ground for stock price increases) were a triad of reforms:

- health care finance;

- followed by income taxation, and;

- somewhere in between, (de)regulation.

Three (or four, we lost count) health care bills failed to gain the support even of their ostensible proponents, the circular firing squad … uh … Republican Party. Swing and a miss.

With American politics…divided (they say euphemistically, if not outright tongue-in-cheek) as to both the aims and demeanor of government, the cohesion required for major legislation remains elusive. Tax changes are in the dirty work stage of lawmaking as we speak, we note again on single party lines, usually unstable ground for implementing economic rule shifts impacting all Americans, and unfavorable for building an enduring popular consensus. [As Exhibit A, witness the Affordable Care Act, passed on Christmas Eve in 2010, with zero votes across the aisle, and a dividing line among politicians and ordinary people ever since. We have a sense that Thanksgiving dinner small talk among relatives of opposite political views has become more tense this century. Then again, if Hamilton and Jefferson had ever been on opposite sides of the wishbone it would have made a heck of a spectacle two centuries ago. But we digress.]

With American politics…divided (they say euphemistically, if not outright tongue-in-cheek) as to both the aims and demeanor of government, the cohesion required for major legislation remains elusive. Tax changes are in the dirty work stage of lawmaking as we speak, we note again on single party lines, usually unstable ground for implementing economic rule shifts impacting all Americans, and unfavorable for building an enduring popular consensus. [As Exhibit A, witness the Affordable Care Act, passed on Christmas Eve in 2010, with zero votes across the aisle, and a dividing line among politicians and ordinary people ever since. We have a sense that Thanksgiving dinner small talk among relatives of opposite political views has become more tense this century. Then again, if Hamilton and Jefferson had ever been on opposite sides of the wishbone it would have made a heck of a spectacle two centuries ago. But we digress.]

The third ingredient in the stimulative economic cocktail, “playing more nicely in the sandbox” with industry in the form of rolling back / decreasing the pace of new regulation, appears to be making headway, as it does not require the concurrence of a majority of 535 congress-folk.

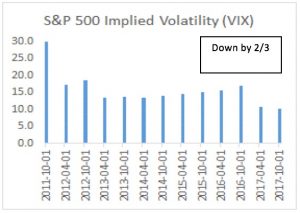

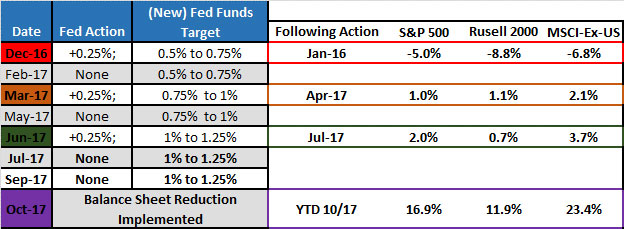

Even at one-for-three so far, risk appetites remain ascendant, evidenced by robust results in equities across the globe, coupled with generational lows in measures of volatility. Bonds have done okay even in the face of two rate hikes, earning roughly their low single digit coupon rates. Even a December Fed move still leaves rates WAY beneath what most readers would consider a “normal” interest rate/monetary environment. Yet note the market response to 2017 Fed action compared to just two short years ago.

Even at one-for-three so far, risk appetites remain ascendant, evidenced by robust results in equities across the globe, coupled with generational lows in measures of volatility. Bonds have done okay even in the face of two rate hikes, earning roughly their low single digit coupon rates. Even a December Fed move still leaves rates WAY beneath what most readers would consider a “normal” interest rate/monetary environment. Yet note the market response to 2017 Fed action compared to just two short years ago.

Hey (October) Nineteen

We noted over recent months a variety of articles referencing the 30th anniversary of “Black Monday“ the October 19, 1987 market crash (itself a reference to the 1929 calamity, which was we believe a Friday, and no we weren’t there). But, in 1987 when we were just a wet-behind-the-ears intern (and everyone knew Ollie North) we did observe the Dow Jones Industrial average plummeting ~22% (from 2,246 to 1,738) in a day. That fateful Monday continued a sell-off begun the prior Friday for a combined two day 25% plunge. (The 1980s did nothing small scale.) A similar move today would look, well, similar, because the reference index now is the S&P 500, and it trades in the same measurement neighborhood as did the Dow in the 80s. So about the 508 point drop of market lore would do it. Many pundits shaped articles in a way to suggest the possibility (we agree) if not the imminence (doubtful in our view anytime soon) of a repeat debacle, in light of the duration of the current bull market and perhaps the symmetry of market index levels.

We noted over recent months a variety of articles referencing the 30th anniversary of “Black Monday“ the October 19, 1987 market crash (itself a reference to the 1929 calamity, which was we believe a Friday, and no we weren’t there). But, in 1987 when we were just a wet-behind-the-ears intern (and everyone knew Ollie North) we did observe the Dow Jones Industrial average plummeting ~22% (from 2,246 to 1,738) in a day. That fateful Monday continued a sell-off begun the prior Friday for a combined two day 25% plunge. (The 1980s did nothing small scale.) A similar move today would look, well, similar, because the reference index now is the S&P 500, and it trades in the same measurement neighborhood as did the Dow in the 80s. So about the 508 point drop of market lore would do it. Many pundits shaped articles in a way to suggest the possibility (we agree) if not the imminence (doubtful in our view anytime soon) of a repeat debacle, in light of the duration of the current bull market and perhaps the symmetry of market index levels.

Our best guess? A garden-variety pull-back, say down 8% – 13%, is more likely than freefall in the near term, perhaps even warranted if the 115th Congress goes home with another whiff on tax reform. But current economic fundamentals show improving top line growth globally, low unemployment, renewed business confidence, and nominally very low risk-free rates as competition for investment returns. A market free-fall, > 20% in a matter of days/weeks/months is ALWAYS possible given the huge emotional component – fear and greed – of broad market dynamics. But in our view it isn’t terribly likely, probably <10% chance in calendar 2018.

There are always reasons to worry of course. Limited market leadership may be one cause for concern, with capitalization weighted indices led by – and captive to – its largest components, lately all of a decidedly “new economy” flavor. We recall watching (often in horror) the internet bubble of the late 1990s and its excessive valuations for often profitless, easily imitated ideas. We cringed at the pretzel logic by which online anything briefly built up massive market valuations in spite of (sometimes it seemed because of) having zero protection from the competitive dynamics inherent in capitalism. Pets.com 2 was a poster-child,

There are always reasons to worry of course. Limited market leadership may be one cause for concern, with capitalization weighted indices led by – and captive to – its largest components, lately all of a decidedly “new economy” flavor. We recall watching (often in horror) the internet bubble of the late 1990s and its excessive valuations for often profitless, easily imitated ideas. We cringed at the pretzel logic by which online anything briefly built up massive market valuations in spite of (sometimes it seemed because of) having zero protection from the competitive dynamics inherent in capitalism. Pets.com 2 was a poster-child,  which we to this day memorialize by keeping the sock-puppet in our office. “Because pets can’t drive. “ But we digress. Again.

which we to this day memorialize by keeping the sock-puppet in our office. “Because pets can’t drive. “ But we digress. Again.

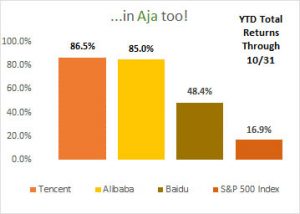

And yet. We’re pretty sure Apple is not “eToys“, Facebook is not “Dr. Koop.com“, Google / Alphabet are not GeoCities. And Amazon is not Kozmo nor Webvan, Whole Foods purchase notwithstanding. Indeed, Amazon has rocked both the retail and real estate industries, delaying their proverbial black Friday (as in, “in the black,” finally making money close to year-end courtesy of holiday sales) in many cases forever. They also run a little web hosting business in their spare time3 and are looking for a second headquarters, including at least as of this writing possibly our own ‘Hotlanta.’

Now, we have no idea if Amazon (decidedly lacking in cumulative retained earnings and paying no dividend) is worth its lofty market cap, nor any of the other tech poster children indicated in the charts above. We are fairly certain that one or more of them will have an adjustment in underlying economics and then sentiment, deflating the stock price, perhaps massively, someday.

Now, we have no idea if Amazon (decidedly lacking in cumulative retained earnings and paying no dividend) is worth its lofty market cap, nor any of the other tech poster children indicated in the charts above. We are fairly certain that one or more of them will have an adjustment in underlying economics and then sentiment, deflating the stock price, perhaps massively, someday.

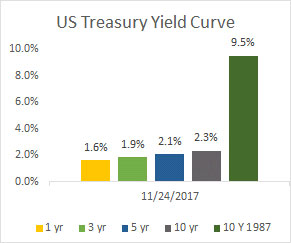

We are also aware that valuations across the US markets are looking stretched. Going back to the 1980s again (one might say we’re reelin’ in the years), stocks were at much cheaper valuations, though it was “good luck with that argument” when the Minnesota Twins were playing the St. Louis Cardinals during the closing days of October 1987 in the “homer dome.” A P/E of 9 – 10X back then beats 20+ today, but what was the risk-free alternative when there were still two Germany’s and Donald Trump was a New Jersey landlord? 9.5% for the 10 Year United States Treasury Note.

NINE POINT FIVE PERCENT! – for the full faith and credit of the US of A. You read that right; now drink your big black cow and get outta here! 4 Yes, 20+X is historically expensive for stocks, but the comparable for risk-free investment today offers a puny 2.3%. You needn’t to be a Bodhisattva4 to have compassion for the impoverished bond buyer of today.

NINE POINT FIVE PERCENT! – for the full faith and credit of the US of A. You read that right; now drink your big black cow and get outta here! 4 Yes, 20+X is historically expensive for stocks, but the comparable for risk-free investment today offers a puny 2.3%. You needn’t to be a Bodhisattva4 to have compassion for the impoverished bond buyer of today.

As we’ve said in this space previously, our primary current concern revolves around decision making in what largely amounts to only the recovery portion of a capital market cycle, what our emeritus CIO termed “a half cooked pancake, un-flipped.” Risk control should remain foremost on investors’ minds, above chasing returns, though our experience with clients reveals many being tempted to do just that. Markets are cyclical, and that implies drawdowns, eventually. (Sorry to be a downer but, hey, even the vaunted Alabama the Crimson Tide of late has some Deacon Blues3.)

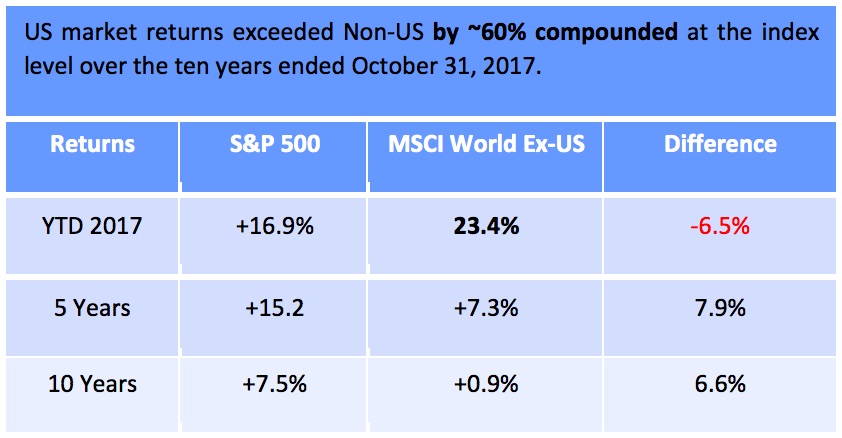

The one area that comes the closest to a “fat-pitch” opportunity is the divergence between results for US and Non-US Equity benchmarks, leading to active discussions with clients related to portfolio adjustments in that regard. Despite a sizable outperformance in 2017, we still expect Non-US equity results will outpace US going forward by virtue of reversion to a roughly equal long term expected mean outcome.

Of course we never know for sure whether calamitous market events are around the corner or not. On that front, our primary proprietary indicator for making tactical rebalancing decisions remains neutral (no action) on asset classes. We have certainly fretted aloud in this space over a number of structural concerns, most notably strange experimental monetary policy globally and its unknown and unknowable unintended consequences. For now, there’s no static at all, but there’s always the unexpected, isn’t there?

HOWEVER, truly long-term investors take note: since 1987, both the Dow Jones Industrial Average and the S&P 500 are ten baggers measured by index level, lo these three decades (and a few gray hairs… well, all of them really) later, compounding at 8% or 9% from either the peak or the trough way back in the waning years of the original “me” decade. That is without dividends, which when added puts results, unsurprisingly, at long term equity market returns in the 10-11% range. Not a bad outcome, and one which doubles investors’ dollars every seven or eight years. As any major dude will tell you.

- Rest in Peace Walter Becker, co-founder of Steely Dan, to whom we pay homage as we sprinkle their (admittedly often unfathomable) lyrics herein.

- In fiscal 1999, Pets.com registered $619,000 in revenue despite spending $12,000,000 in advertising, including a Super Bowl ad, and selling products for 33% of their wholesale price. After raising and spending $300 Million, Pets.com went from IPO to liquidation in 268 days.

- Amazon Web Services generated $4.6 billion in sales and $1.2 billion in operating income for the third quarter of 2017.

- We did say “often unfathomable” Steely Dan lyrics, did we not?

COMMENTARY

Commentary was prepared for clients and prospective clients of FiduciaryVest LLC. It may not be suitable for others, and should not be disseminated without written permission. FiduciaryVest does not make any representation or warranties as to the accuracy or merit of the discussion, analysis, or opinions contained in commentaries as a basis for investment decision making. Any comments or general market related observations are based on information available at the time of writing, are for informational purposes only, are not intended as individual or specific advice, may not represent the opinions of the entire firm and should not be relied upon as a basis for making investment decisions.

All information contained herein is believed to be correct, though complete accuracy cannot be guaranteed. This information is subject to change without notice as market conditions change, will not be updated for subsequent events or changes in facts or opinion, and is not intended to predict the performance of any manager, individual security, market sector, or portfolio.

This information may concur or may conflict with activities of any clients’ underlying portfolio managers or with actions taken by individual clients or clients collectively of FiduciaryVest for a variety of reasons, including but not limited to differences between and among their investment objectives. Investors are advised to consult with their investment professional about their specific financial needs and goals before making any investment decisions.

INVESTMENT RISK

FiduciaryVest does not represent, warrant, or imply that the services or methods of analysis employed can or will predict future results, successfully identify market tops or bottoms, or insulate client portfolios from losses due to market corrections or declines. Investment risks involve but are not limited to the following: systematic risk, interest rate risk, inflation risk, currency risk, liquidity risk, sociopolitical risk, management risk, and credit risk. In addition to general risks associated with investing, certain products also pose additional risks. This and other important information is contained in the product prospectus or offering materials.

Pets.com Macy’s Parade Float, circa 1999