2016: At Over Three Quarters Done, Not Half Bad?

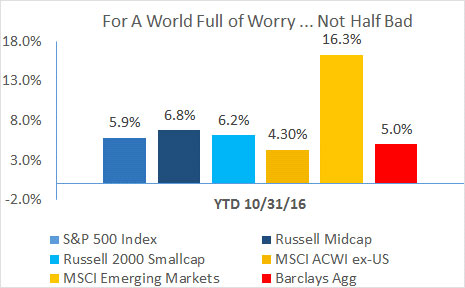

Market outcomes in 2016 have thus far confounded expectations for significant correction, posting attractive results across the major components of investor portfolios. A typical, largely liquid, diversified portfolio in 2016 might be up 6 to 7%, awfully close to many target return bogeys, using the benchmark numbers above. What’s not to like?

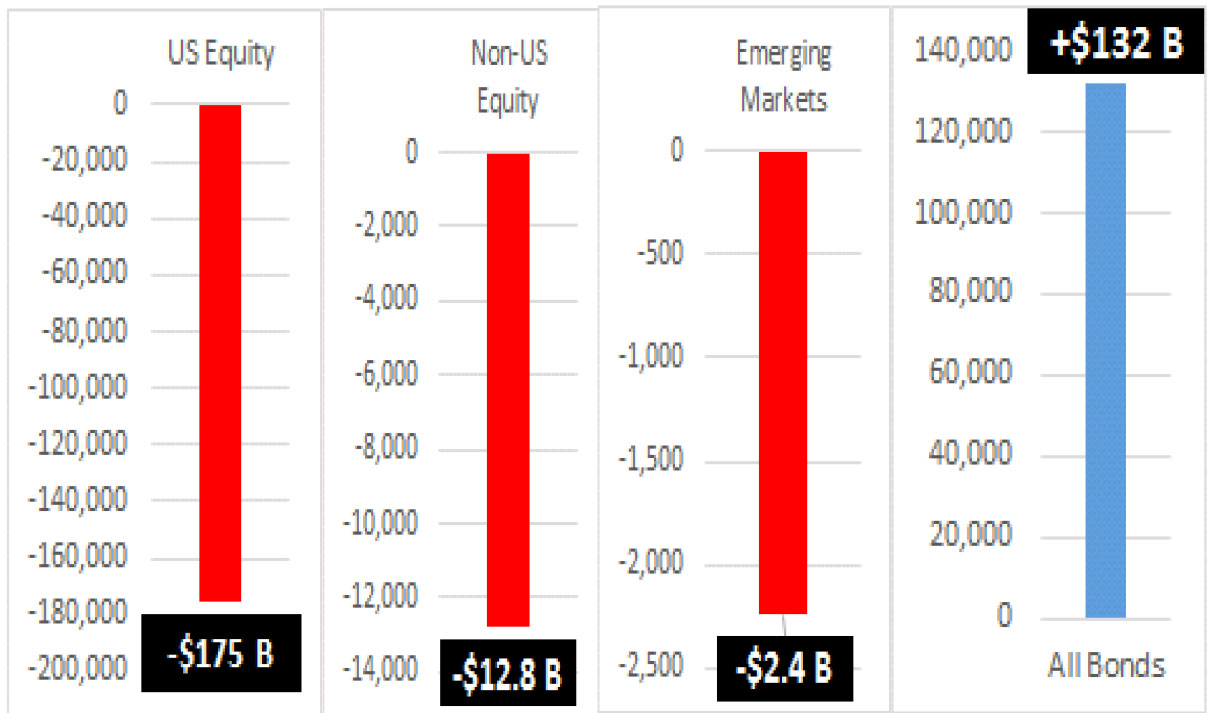

In one sense, we’re as happy as anyone to cheer continued positive outcomes. Judging by mutual fund asset flows (see charts), the continued rally is one investors love to hate. By this measure, cash has been fleeing from riskier equities – even red hot emerging markets – and into “safer” bonds, including (ironically in our view) high yield bonds. Such technical readings are not displaying the telltale signs of “one-way” sentiment typical of the very waning time of a bull market cycle.

At the same time, we are as subject as any market observer to feeling that investors are poised on an increasingly sharp edge. 2016 has already witnessed two brief though significant “risk-off” scares (winter and mid-summer), in which stocks both traded down sharply and appeared headed lower until dovish central bank comments calmed frayed nerves. The Fed meets as we type, highly likely to emerge with no rate movement prior to the presidential election, Director Comey presumably having injected more than enough drama into an already fill-in-your-disheartening-adjective-here election.

Do you realize what would happen if I turned in MY homework in your handwriting?1

We dislike having to write about Fed action (or as we might more accurately say in the South, Fed fixin’ to get ready to think about taking 25 bps worth of action) so often, but it really seems to be the elephant in the investing living room. Well, that’s not quite right; no one wants to acknowledge the elephant, whereas everyone talks about the Fed.

What nobody wants to contemplate is exactly what all the strange experimental monetary policy2 the Oz-like central bankers may have wrought on market economics. For instance:

- What do you get discounting 2017’s expected $129 of S&P 500 earnings at today’s 1.8% less the zero growth we are getting used to? A “value” of 7,166 for the Index (!!!), 3.4X today’s level. (Note how laughable the 1999 book projecting “Dow 36,000” looks today; the assumptions were similar3.)

- Why was Russia recently offering a $1.25 billion placement of 10-year bonds with a 3.99% yield? The Kremlin DEFAULTED on its sovereign debt as recently as 1998; we know we’re getting older, but that isn’t exactly the era of Peter the Great.

- How many years of future returns have been borrowed into the past five? Note that large- and mid-cap stocks are up >13% in the past five years, ~2% annualized above their long term history. We’re still at peak-ish profit margins for corporate America, thanks in large part to low borrowing costs. What might happen to stock prices when interest expense and profits revert to more normalized levels?

- When will investors start to show some caution in a world where Japan’s central bank is almost out of securities to buy, European economic mandarins prop up its companies with corporate debt purchases on the ECB balance sheet, and Fed chair Janet Yellen muses about buying equities at the Fed and helicopter money?

- Who thinks this is healthy?

Save Our Roads and Bridges Now, Save Our Roads and Bridges Now4

Where are investor dollars to go when low / negative yields are distorting the most basic price signal that markets require: to what risk-free alternative do we compare economic activity or potential returns on other, risky investments?

We provide a practical answer below, but first, here’s an election prediction: no matter who wins the White House this week, or even controls Congress for that matter, governments the world over, starting in the U S of A, are going to answer our capital allocation question above with a unified voice: infrastructure spending5.

Politicians and economists of most all stripes seem to be lining up behind the idea that politicians and economists having perhaps exhausted the limits of monetary policy, fiscal stimulus on planes, trains and automobiles is next up, to the tune of billions in spending.

While we love a good solid bridge as much as the next person, Congress’ pork-barrel track record in this regard is not stellar6. And it’s not like we haven’t already piled up a good healthy pile of IOUs – outstanding US Treasury debt already exceeds US GDP. Adding in unfunded liabilities takes the debt / GDP ratio to ~5X.

While abrogating none of the very real concerns indicated above, not all is doom. Our system for monitoring asset class rebalancing adjustments is not indicating any significant under- (no surprise there) or over-valuation areas in asset classes. Traditional fundamental valuation metrics for equities are also indicating mid-range, so we don’t think wholesale asset class rebalancing is in order.

Bonds are definitely a challenge, though risks there can be managed by managing both duration and expectations. The risk / reward is skewed against investors with such low current yields, so more bad than good can happen; soft-pedaling duration and credit risk are both sensible ideas in fixed income at this stage.

Diversifying strategies of all kinds have fallen in to disfavor of late. Equity market beta (indexing) looks permanently ascendant right about now, but we’ve watched active / style strategies cycle through performance struggles before, often adding the most value in the kind of sharp / extended drawdowns that have been lacking since 2013 or so.

It seems to us that the last time the idea of a central bank protective floor under securities prices was as popular as today was 2006-07. In that light, we remain especially committed to the tools of portfolio hedging, for they are appreciated least right before they are needed most.

We Wouldn’t Build a Portfolio Wall (even if Mexico would pay for it)

Equity long short has fallen short of long-only benchmarks in part because not many stocks go down much or for long, so why bother shorting? Managed futures have proven a past propensity for buffering portfolios in very large drawdowns but those too have been in short supply.

As we’ve said in this space before, the post-crisis recovery is both long in the tooth and Fed-juiced. Risk control should be valued above heroics, portfolio wise, and that includes not abandoning diversification that appears to “not be working” lately.

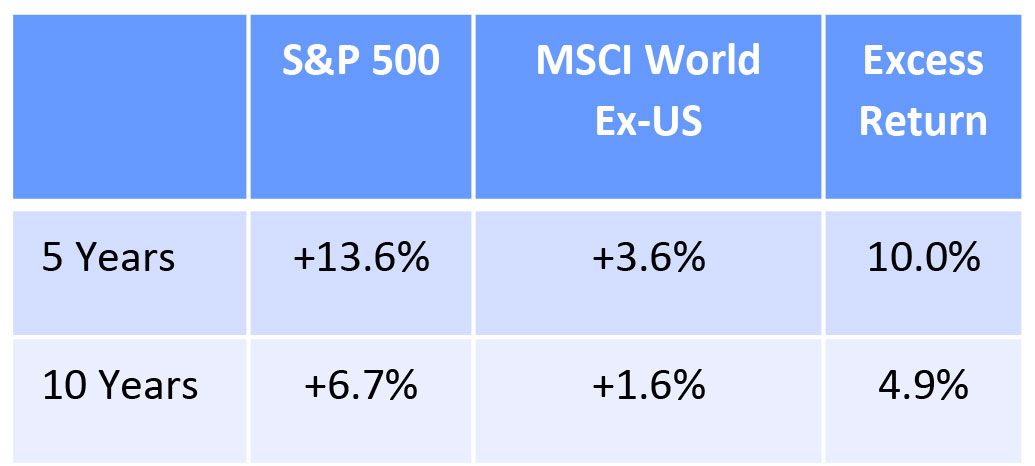

Finally, consider the divergence between recent results for US and Non-US Equity benchmarks:

In a globalized economy, over the long term, there is no compelling reason why returns to shareholders of, say, GE in the US should outpace those of Siemens of Germany by 61% compounded.

So here’s one idea to gobble up over turkey this year. If you haven’t rebalanced equities in a while, think about the relative weights between the recently winning US and the lagging rest of the world. We’d take that bet whether Donald Trump spends the next four years building a wall or only building his brand.

Happy Election Day; vote for the candidate of your choice (only once please!). And Happy Thanksgiving!

-

- Back to the Future

- During the week ended 10/19, the Fed’s balance sheet was further fattened by $18 billion of newly printed money, in the form of “purchased” mortgage-backed securities (almost ½ of 1% of the total balance sheet) …. In the week ended 10/5, the opposite happened…. mortgages were reduced by $12 billion. Five weeks before that (week ended 8/31), the Fed had dumped another $19 billion of said securities.

- Hat tip to Cove Street Capital: Dow 36000 and the Grumbling Hive

- 1980s Massachusetts political campaign ad background chant.

- Don’t believe us? Look at recent Google search results: Russian hackers – 6 million results; tax cuts – 6.4 million; Obamacare – 22 million; email server – 66 million; rigged election –65 million; infrastructure spending – 96 million. Get your shovel ready.

- “Shovel-ready was not as … uh .. shovel-ready as we expected.” – President Obama in 2011 on 2009’s $800+B stimulus bill.

Copyright © 2016 FiduciaryVest, LLC; All rights reserved.

This publication is not a suitable basis for investment decisions.