End of the Line?

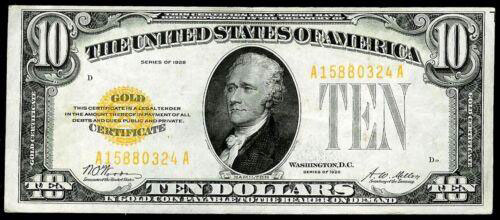

WHEN US MONEY WAS GOLD

Until 1933, in the Great Depression era, when US paper currency was a note that the Treasury promised to pay to the bearer, on demand, an amount of gold coins, when gold itself was $35 per ounce, any day, every day, every year. Then came President Franklin Roosevelt’s Executive Order 6102 that forced all holders of any gold coins and bullion (except jewelry and collectible valuable coins) to surrender their gold to the Treasury, within the next 3 weeks. Severe penalties for non-compliance were included.

A 54-YEAR DOLLAR/GOLD BATTLE

Then, it all came to a head at Camp David on August 15,1971 when, over the weekend, President Richard Nixon heard an urgent appeal from top government officials and economic advisors who portrayed a fast emerging, economically threatening situation for the US Government. Until then, the US Dollar had been backed by a guarantee that, on any business day, foreign banks and other entities who were US dollar-holders could present their dollars at the Federal Reserve’s New York “gold exchange window” and receive gold bullion valued at $35 per troy ounce (the globally-agreed value of gold since 1934). The Fed was being told by other central banks that thirty-five US Dollars were no longer believed to be “worth” one ounce of gold. Accordingly, dollar-rich countries were suddenly causing a “run” on the US Treasury’s gold deposits (which were then, and are now, by far, the largest gold-hoard in the world). So, on Nixon’s Sunday afternoon order in 1971, the Fed shut its gold window…. never to be opened again, as things have turned out.

Four months after the gold window-closing, the major trading countries’ representatives again gathered in Washington at the Smithsonian Institution. After deliberation, they announced a new exchange agreement: the dollar would be de-valued by 8.5% to $38 per gold ounce. But that rate didn’t hold. Less than two years later, the dollar took an additional 8% hit (via a revised gold exchange rate which, by agreement, would be $42.22 per ounce); the other countries’ local currencies were thus re-valued upward against the dollar. That maneuver didn’t work either.

Zoom forward to 2025… another 50 years of erratic worldwide currency de-valuations; the US Dollar has been devalued, in gold-price terms, by almost 99 percent! So now, at the end of March 2025, it takes a whopping 3,100 dollars to buy just one troy ounce of gold that would fit in your shirt pocket. (That’s up more than 40% in the past 12 months!) We conclude this bit of history by reminding ourselves that, unlike profitable companies, gold has done absolutely nothing to become 73-times more valuable now than it was 54 years ago, despite the production of new gold supply, via continuous mining of it.

CURRENCIES THAT HAVE NEITHER PLUMBING NOR FIXTURES

Beginning in 1974, major trading countries were commercially forced to simply begin punting the value of their currencies; traders would set free-floating exchange rates every day. (Meanwhile, gold’s price became un-mentionable.) Currency brokers’ trading desks created a new art form. So, for decades now, they have needed to use a daily published grid to find that day’s market determined value of the US Dollar, priced in units of other currencies.

As this paper is being written, one dollar can buy slightly less than one Euro (0.93 Euro).

Without a prescribed formula, the US Dollar is “valued”, for trading purposes, by relating it to the US’s total annual volume of domestic business transactions…. its 30-trillion-dollar gross domestic product (GDP) in 2024. The notion behind this dollar-valuation method is that the US Government’s “taxable pool” directly depends upon the size and growth rate of the GDP. For many years after the gold-backed dollar disappeared, the US Government’s accumulated debt was a comfortable 40-50 percent of the US’s robust and rising GDP.

At the end of 2023, the International Monetary Fund’s data includes the following all countries’ federal debt-percentage-of-GDP ratios; we have selected and arranged prominent countries, in descending order, from least to most indebted:

| Russia | 19% |

| Switzerland | 33% |

| Mexico | 53% |

| Germany | 62% |

| India | 83% |

| China | 84% |

| UK | 100% |

| Spain | 105% |

| Canada | 107% |

| France | 110% |

| US | 119% (now 130%) |

| Japan | 250% |

THE AGE OF UNLIMITED CURRENCY CREATION

International goods and services must be bought and sold, no matter how the various monies work. Because merchandise traders now have no agreed-upon money rules, countries which issue currencies simply create more money, when and as they need it to fund their governments. The functioning result of this “non-system” isn’t complicated: (1a) the governments that spend more than they produce in taxes, plus (1b) their increased borrowings from the investing public adds up to (2) the amount of new dollars, pounds, euros, yen, etc. they must create to “make ends meet”.

Denmark, Norway and South Korea are currently the only large, non-middle-east countries which routinely produce no annual deficits.

ZOMBIE CORPORATIONS

In modern times, “zombie” has become the vogue term to classify heavily indebted, publicly owned companies whose continued survival depends on continuous re-financing of its maturing debt, along with a healthy economy that has moderate, or falling interest rates. During zombie-hood, any possible pay-down of debt is almost impossible. Absent any options to re-finance maturing debt, most run-of-the-mill zombie companies must seek bankruptcy; its shareholders then lose their entire investment and the company’s creditors gather in court to oversee a semi-orderly dissolution of the zombie’s assets.

Not all zombie companies are permitted to belly-up. Some of them hang on to life wearing sweaters branded with scarlet letters: TBTF…Too Big To Fail. Even New York City clearly had a zombie government in 1975, when it squeaked-by bankruptcy via a combination of state intervention, union cooperation, and City promises of financial reform, on top of which was the shrewd creation of the Municipal Assistance Corporation and a state-monitored annual budget process.

Sovereign country bankruptcies are fairly rare, but in the 21st Century, Argentina, Greece and Venezuela became zombies and then defaulted on their debts.

US GOVERNMENT ZOMBIE-NESS, I.E. IS THE US BROKE?

Because of its massive physical assets, it would be a very long stretch to classify the US Government as a zombie. That said, if we look strictly to its financial operations (annual tax revenue and cash outlays) the US Government at least qualifies for zombie-hood, alongside Japan, its financially levitating cousin.

The US Government’s formal process is described as follows: the Congress negotiates within its committees and produces the twelve individual Departments’ budgets several months before the October 1st beginning of each fiscal year. But that process has not happened since 1989-91. Instead, there is no functioning budget process. Congress soldiers on, year after year, soaring into the trillions of dollars aboard a made-up, non-budget legislative magic carpet called CRs (“continuing resolutions”)… which is policy jargon that merely describes Just Keep-on Keeping-on.

Two credit agencies have observed the persistence of this syndrome and they downgraded their rating of the Treasury’s debt. Because of that, the US is now one credit downgrade away from facing higher interest rates that, by almost any reckoning would be catastrophic.

The government’s multi-trillion-dollar annual deficits (trillion =12 zeros) are hopelessly bound by unbreakable promises of benefit payouts. Even worse, the almost 90 years old US Social Security System was initially put together and operated as a long term retirement-insurance annuity plan; it even has two trust funds; they are still there, but, mostly since the President Lyndon Johnson years, they are merely accounting records; FICA tax collections being deducted from all paychecks are no longer deposited to the System’s trust funds…. instead, there is only bookkeeping, showing how much cash would have been deposited and would have been invested in special (un-marketable, but callable) US Treasury notes. Meanwhile, the Congress is giving no evidence of concern about the fact that the Social Security System has recently turned the corner; it is now cash-flow-negative. Which means, of course, this annually growing cash shortfall adds to the annual federal deficit spending (borrowing).

THE FEDERAL BUREAUCRACY – STRIKING OUT IN NEW DIRECTIONS

[We remind our readers that, over the past 20 years, we have continuously avoided taking viewpoints that are politically supportive, or critical. Instead, we strive to observe, define and translate emerging situations that are fundamental to the economy and financial markets. For context, we maintain a constant eye on history. We avoid speculating.]

It is reasonably clear that the strategy of the two-months-old Trump Administration does have a design. It is revolutionary, controversial and, according to many, quite risky. The president surely realizes that he has a mere 18 months of political leeway, until the 2026 Congressional elections will once again harvest the two seed-types of political wheat that will have grown from Trump-fertilized fields. If the thin membrane that now divides the Peoples House is punctured, the Constitutionally mandated conclusion of this president’s White House career will get underway, in earnest.

Facing that reality, the current Administration has a rapid-fire plan designed to completely re-orient the entire bureaucracy and its vast financing. It’s a blitzkrieg operation so broad and deep that it has produced an avalanche of speculation about hundreds of commentator-assumed outcomes broadcast by media outlets, from MSNBC to the Wall Street Journal, each of which presume to have a vision of the Administration’s plans and yet-unknowable reactions to globally unwinding wrinkles.

To us, there appear to be two fundamental keys to the Trump Administration’s strategy:

Key 1: Campaign “promises made/promises kept”: thus far, this Key appears to be a live commitment. If so (subject to machinations in the Congressional labyrinth), there are costly promises on the horizon: in particular, no tax on overtime, no tax on tips, no tax on Social Security benefits. The apparent method of “paying for” those tax reductions, without doubling-down on debt, is the ad hoc creation of the Department of Government Efficiency (DOGE). It’s top-down, computer screened, payroll-slashing cutbacks (waste), plus its discovery and elimination of improper payouts (fraud and abuse). DOGE’s objective is to permanently eliminate $1 trillion of bureaucracy within its first 130 days. Despite the attainment of that ambitious goal, if it actually happens, the government will still wind up in the hole by yet another 12-zero figure for the year.

Key 2: Impose import tariff rates that will match tariffs on all of the US’s foreign export products (until country by country negotiated deal-making can de-tox and replace the awkwardness of the initial sledge-hammer approach): The tariff-driven source of new tax revenue could be significant for the US’s coffers. But probably more important to the president is the tariffs are intended to cause the re-institution of US labor and goods production that have moved abroad in this century. The US re-made itself into a “service economy” (as foreseen by 3rd party presidential candidate Ross Perot in 1996). According to a bank of pundits including Federal Reserve Chairman Powell, the Trump tariffs will cause imported goods prices to rise. Foreign goods producers, they expect, will jack-up their prices to pay the cost of US tariffs. Likewise, the affected countries’ consumers will face an inflation effect on their purchases of US goods. The President may be figuring that the foreign consumers’ inflated cost of US goods will pressure those countries’ leaders to negotiate a deal which is the quintessential mode in which Mr. Trump hankers to operate. However, even if the Administration’s intended re-Americanization of manufacturing jobs by foreign-based companies actually works, it will surely take a few years (well beyond 2026 elections). A very complicating factor is that most assembled products contain numerous parts manufactured in various countries; the necessary atomizing of each tariff to maintain a fair multi-factor, integrated product-by-product system seems challenging, if not impossible.

A pertinent overall aspect: The Administration has little control over the Federal Reserve’s interest rate policy. If in fact the tariff programs are inflation-causing, the impact of rising interest rates could muffle, or curtail the Administration’s economic objectives.

In summary, the US Dollar has had a 90-years-long, progressively losing valuation battle with a shiny metal element that people have viewed as valuable for thousands of years, while, in this century, the financial order of the US Government has progressively deteriorated to a point that is currently undergoing drastic rearrangement that may deliver a permanently new world order.

***************

FED NOTES. In normal times, all governments’ treasuries go to the bond markets to borrow the cash needed to fund their annual deficits. Since 2020, the US Treasury’s cash shortfalls have grown too large for the bond market to digest them at interest rates considered palatable. So, the Federal Reserve has regularly “covered” a big chunk of the US Treasury’s continuously huge cash shortfalls (especially following COVID) by creating new dollars used to purchase a portion of the Treasury’s newly issued debt. In summary, the recent 5 years of government deficits, now running at a staggering 2 trillion dollars per year, were significantly funded by the Fed’s “money-printing function”, outside of the bond market.

The Fed is on record that it is striving to reduce its still (since 2021) huge holding of US Treasury debt and mortgage-backed securities. On April 2, 2025, it still held $6.4 trillion (down from $8.2 trillion at the end of 2021), now made up of $4.2 trillion of US Treasuries, plus $2.2 trillion of mortgage-backed securities. Notably, Fed participation in the overnight money funds market (reverse repos agreements) is now only $622 billion (down from $2.6 trillion two years ago). Presumably, this reduced Fed every-night participation will push down the recent high (4.3% to 4.5%) interest rates paid by money funds.

In normal times, the Fed runs an operating profit in its dealings with the country’s banks; those profits (typically billions) are paid to the Treasury. Not anymore. In fiscal years 2023 and 2024, the Fed’s operations lost $224 billion (nine zeros).

And so we find ourselves pondering despite the “unhealthy” spending and budgeting habits, will the show go on or are we witnessing the beginning of the end of the line.”?

COMMENTARY

Commentary was prepared for clients and prospective clients of FiduciaryVest LLC. It may not be suitable for others and should not be disseminated without written permission. FiduciaryVest does not make any representation or warranties as to the accuracy or merit of the discussion, analysis, or opinions contained in commentaries as a basis for investment decision making. Any comments or general market-related observations are based on information available at the time of writing, are for informational purposes only, are not intended as individual or specific advice, may not represent the opinions of the entire firm, and should not be relied upon as a basis for making investment decisions.

All information contained herein is believed to be correct, though complete accuracy cannot be guaranteed. This information is subject to change without notice as market conditions change, will not be updated for subsequent events or changes in facts or opinion, and is not intended to predict the performance of any manager, individual security, currency, market sector, or portfolio.

This information may concur or may conflict with activities of any clients’ underlying portfolio managers or with actions taken by individual clients or clients collectively of FiduciaryVest for a variety of reasons, including but not limited to differences between and among their investment objectives. Investors are advised to consult with their investment professional about their specific financial needs and goals before making any investment decisions.

We welcome readers’ comments, questions, criticisms, and topical suggestions about our Commentaries, which always contain a mixture of researched facts and conclusions about their impact. We diligently strive to avoid controversial, or partisan views. However, our conclusions clearly cannot always align with our readers’ various interests and personal points of view.

The research topics and conclusions herein are not “FiduciaryVest, LLC viewpoints,” nor are they attributable to its individual employees.

INVESTMENT RISK

FiduciaryVest does not represent, warrant, or imply that the services or methods of analysis employed can or will predict future results, successfully identify market tops or bottoms, or insulate client portfolios from losses due to market corrections or declines. Investment risks involve but are not limited to the following: systematic risk, interest rate risk, inflation risk, currency risk, liquidity risk, geopolitical risk, management risk, and credit risk. In addition to general risks associated with investing, certain products also pose additional risks. This and other important information is contained in the product prospectus or offering materials.