A 2024 Catalog of US Financial Concerns

Consumption Is all 4 wheels of the economy

For nearly a century, the US has been the world’s leading economy. It was built on a platform of tireless creative effort, efficient business management and a massive banking system committed to profitable financing of savvy risk-takers’ growth plans that are tailored to deliver products and services that people want.

That said, China is emerging from its near-primitive mid-20th Century economic status to a modern giant that, like the US, is built on consumption. However, China’s economy is absent the US Government’s Constitutional design that specifically separates business from government. Another key difference: despite China’s explosive decades of growth, it has yet to match the US’s bright-shining talent pool that is constantly replenished from both home-grown and immigrant sources. Largely because of that gap, China has for decades depended upon emerging technologies developed by mostly US sources, sometimes via “market access” contracts (e.g., China located Tesla manufacturing plants), but often via outright theft.

This just in (July 15): A massive $11 trillion of previously unrecognized debt by Chinese local governments to build industrial infrastructure and huge housing projects has just been disclosed; this news falls heavily on top of China’s clearly slowing economy.

What’s up with the Dollar? A threshold of sea change?

As we have discussed in earlier columns, the US-dominated global economy has, for 80 years delivered “reserve” status to the US Dollar; worldwide international purchases and sales are settled using US Dollars (thus the need for all countries to maintain a significant “reserve pool” of dollars). The latest news in this scheme: An important 50-years-old side deal within the global dollar conundrum has been an informal 1974 US/Saudi Arabia “petro-dollar” deal, to wit: Saudi oil would always be priced in dollars and Saudi’s sales proceeds would be invested in US Treasury debt. Notably, on June 9, 2024, that informal petro-dollar arrangement was reportedly not renewed. Just now (early July), Treasury secretary Janet Yellen has recently warned about what we have been saying: that countries around the world are moving away from dependency upon trading in U.S. Dollars.

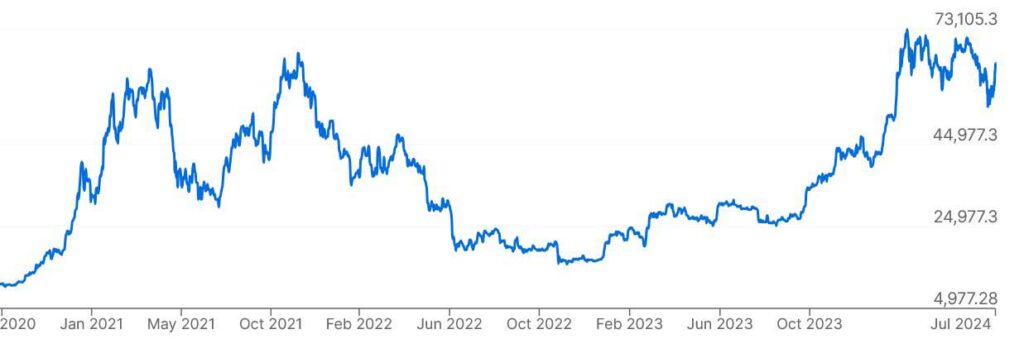

Secretary Yellen is also saying that other countries, urged by Russia, will resort to Bitcoin and other crypto currencies in place of the dollar. In so doing, Russia will render the US’s financial sanctions impotent (to the extent they were not already ineffective). Meanwhile, the coalition of nine BRICS countries that include China, India and Russia make up an expanding trade group that already produces about 1/3 of global GDP.

Bitcoin/USDollar price history since 2020

The US Treasury faces tough math

Current conditions:

- The U.S. government is adding $1 trillion to its accumulated debt every 100 days. Number Psychology: numbers with 12 zeros are reported as 1 and 2-digit trillions; the current annual US Treasury debt growth is equal to 3.5% of the entire current $28,300,000,000,000 US economy, according to the BEA.

- Wars and rumors of them have sprouted across the globe [Ukraine, Iran, Israel, Taiwan, Yemen, North Korea]. The US is creating and appropriating significant billions of new debt to fund proxy war gifts of war-making machinery.

- Central banks, notably China’s, are acquiring and hoarding gold.

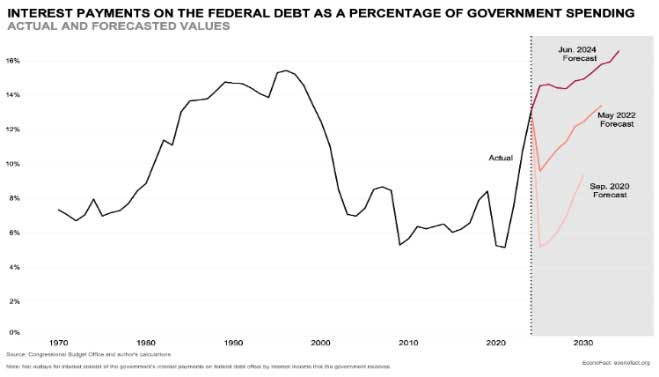

Conclusion: Besides the facts above, the US Congress’s philosophically hardened, organizationally unstable, politically loggerheaded budgeting positions, coupled with its rapidly growing fiscal deficits during non-recessionary, non-wartime conditions are absolutely unsustainable.

Many of these conditions have already been cited by two of the three major credit rating agencies as their reasons for first-ever downgrading of US Treasury notes and bonds. The philosophically hog-tied Congress is doing nothing to prevent more of the same, as they spend much of their focus on upcoming re-election. If there is another debt-driven Treasury credit downgrade, the impact would seriously affect not only the Treasury’s interest cost burden, but also global investors’ appetite for investing in “risky” US Treasury debt. Ergo, deterioration, or forfeiture of the US Dollar’s precious and unique global reserve status would almost surely follow.

Strong dollar impact on investors’ international equity returns: Two years now and counting, the US’s globally high interest rate dependably delivers a “strong” US Dollar… for as long as the US’s dominant interest rate exists… meaning that non-US stocks which are not hedged back to the dollar will tend to underperform in dollar-investors’ portfolios.

Below is a chart, not of dollars spent, but of the interest cost portion of total federal spending.

Commercial real estate debt: the dependable economic coal mine canary

According to National Bureau of Economic Research paper (February 2024), about 14 percent of all commercial real estate loans and 44 percent of office loans are underwater — the properties are worth less than the debt behind them.

From San Francisco to Washington, D.C., the story is the same. Office buildings remain stuck in a slow-burning crisis. Employees dispatched to work from home at the start of the pandemic have mostly not returned, a situation that, combined with high interest rates, is wiping out value in a major class of commercial real estate.

Those forces have put the banks that hold a big chunk of America’s commercial real estate debt in the hot seat. Analysts, and even regulators have said the reckoning has yet to fully take hold. The question is not whether big losses are coming. It is whether they will prove to be a slow bleed or a panic-inducing wave. According to data provided by Trepp, a real estate research firm: “Banks are sitting on a bunch of unrealized losses. If that slow leak gets exposed, it could get released very quickly.”

Hmm. Sounds to us a lot like 21st Century Round 3 [Rounds 1 and 2 were 2003 and 2008.]

Creative Value: New York Community Bank’s stock plunged earlier this year, after that lender disclosed unexpected losses on real estate loans tied to both office and apartment buildings. On July 2, 2024 the bank announced a “reverse stock split”: it is issuing 1 new share in exchange for 3 old shares…. It’s the same cup of coffee, just modestly stronger taste. The maneuver cosmetically transforms a penny stock into a big-boy price.

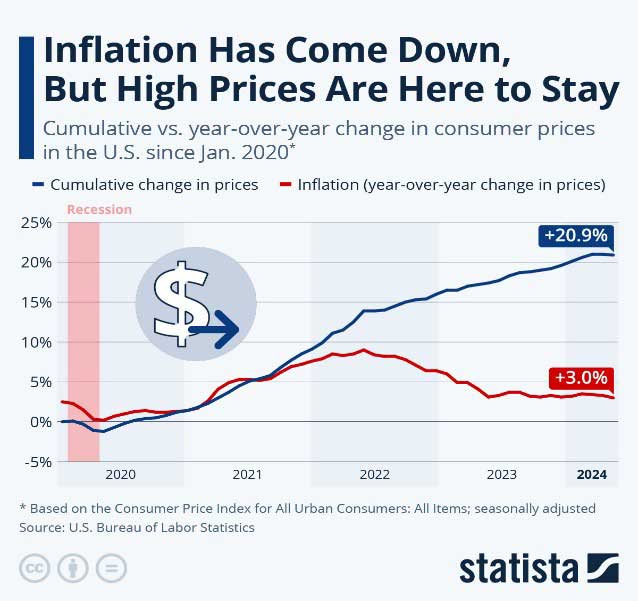

The Fed’s intense battle with inflation

Exactly two years ago, the Fed-ignored, “transitory” rate of US price inflation peaked at a 4-decades high of 9.1%. Now, it is much closer to the 2.0% policy target. Depending upon the reference source, inflation is now around 3%, or slightly less. More importantly, Fed Chairman Powell’s recent chit chat in a June forum in Portugal divulged his view that maybe the goal (if not the target) has already been reached, because it attained a “mid-to-low-twos” inflation rate. So, the early July US equity markets have apparently translated that overview into an expected September relaxation of the 5%+ Fed Funds interest rate. Although those equity markets were already robust, they are now in expansion mode. If a September rate reduction does happen, we should understand what there is about the current economy that needs or requires stimulation.

Inflation…. In the eye of the beholder

In 2024, nationally elected politicians are having to deal with the sticky issue of inflated prices, some categories of which are more than 20%, compared to 2021. The official overall 2024 inflation rate is a mild 3% or so, but the lingering impact of 2022’s fiery 9%+ inflation rate is still roosting on everyone’s paycheck…. despite the 2022 Inflation Reduction Act, described as… “one of the largest investments in the American economy, energy security, and climate that Congress has made in the nation’s history”.

It will be interesting to discover what, if anything, next year’s US President and Congress actually do, or can do about this cumulative-cost-of-living problem.

Pulse of the Economy: Deteriorating Consumer Credit Status

In 2020 to mid-2021, consumers mostly lived in seclusion, did not travel, did not vacation, did not eat in restaurants and could not engage in out-of-home entertainment. Hence, credit card transaction volume slumped and the US Congress even provided free money to keep them from defaulting on debt payments. In the 14 years after 2008, interest rates on credit card balances and on new mortgage originations were extremely low, not by comparison, but absolutely. So, beginning in 2023, the home-selling industry’s machinery was facing a rare monkey wrench: many homeowners sitting on 15-30 year mortgage interest payments in the super low single-digit range. They aren’t inclined to give them up, even if it means they won’t buy their next dream home.

Household Debt Rose by $184 Billion in Q1 2024

Transition Rates into delinquency increased Across All Debt Types.

According to the New York Fed, the 1st quarter of 2024 saw overall household debt increase at an annualized rate of 4.5% since year-end 2023.

In the first quarter of 2024, credit card and auto loan transition rates into serious delinquency continued to rise across all age groups. An increasing number of borrowers missed credit card payments, revealing worsening financial distress among some households.

Limits on home equity lines of credit (HELOC) have grown by 14% over the past two years, following 10 years of declines.

Delinquency rates increased in Q1 2024. Annualized, just under 9% of credit card balances and almost 8% of auto loans transitioned into delinquency.

Household Debt and Credit Debt: Q1 2024 (compared to one year ago)

Flow into Serious Delinquency (90 days+ past due)

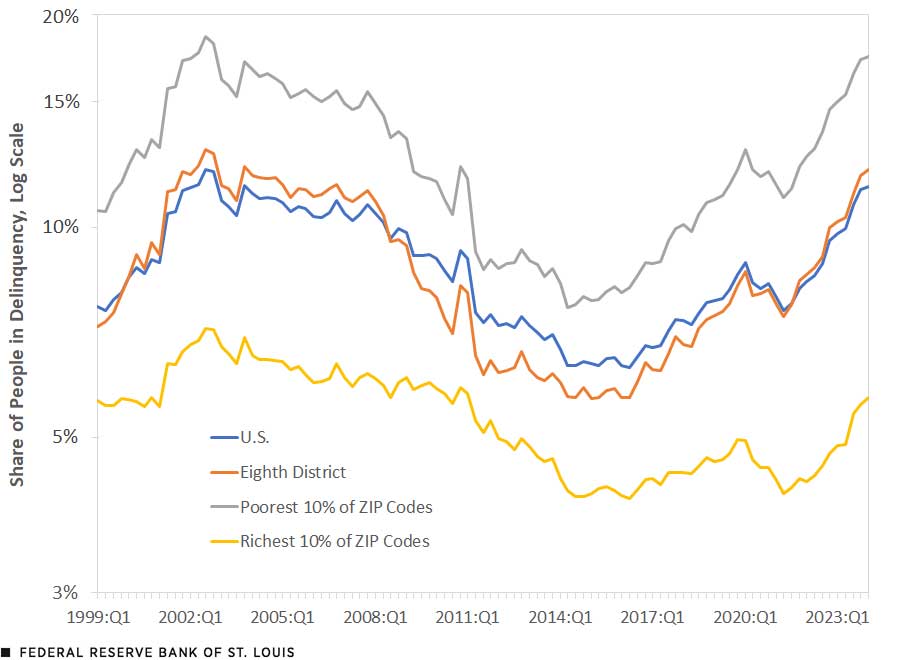

In the chart below, note that since early 2014, the poorest slice of US households and the US national average have seen very steadily increasing rates of debt delinquency.

Since early 2023, consumers no longer have low interest rates on which to drive growth of their consumption-debt.

Suddenly higher consumer credit interest rates have a very expensive negative-compounding effect on consumers, particularly credit card debtors.

U.S. Household Debt Is at an All-Time High. The total household debt of $17.3 trillion entering 2024 is a new high for the U.S. The largest increase in any category was credit card debt, which swelled by 16.6% between Q3 2022 and Q3 2023 (the most recent federal data available).

Interest rates are no longer benign. Of the six categories of household credit, home mortgage and credit card balances are the most significant. We looked at the Flow into Serious Delinquency (90 days+) for indication of current consumer “credit health”.

Between March 2023 and March 2024 (latest available); the incidence of…

- Serious mortgage debt delinquency increased by 56% and

- Serious credit card debt delinquency increased by 50%.

- Serious delinquencies of all debt categories (including HELOC, student loans, auto loans, debit cards) rose by 42%

IN SUMMARY

As this paper is written in mid-July, 2024, the US stock market is aglow with visions of a Fed interest rate sugarplum and increasing corporate earnings. New all-time equity index highs are being reached regularly, driven by numerous recent single-day, across the board upticks.

Herein, we have examined the

- status and condition of China’s economy,

- US Government’s profligate debt spiral and its sustainability,

- Federal Reserve’s current inflation challenges,

- widespread, significant commercial real estate financing showdowns, possibly also taking down their banks, and

- current credit status of consumers,

in the search of trends that lie beneath the economic enthusiasm of market pundits (who mostly take their cues from daily equity market movements). We have noted that the US Government is in turmoil,

- in Congressional inability to devise pathways to address increasingly spiraling deficit spending. [In a previous paper, we had reviewed the crisis in the Social Security System’s depletion which floats on Treasury IOUs and is already in negative cash flow.]

- in the US Treasury’s withering options to finance increasingly unfunded Congressional spending which is steadily bringing the US Dollar into jeopardy as the world’s reserve currency which Secretary Yellen admits and speculates that non-US economic activity is already transitioning to Bitcoin and other cryptocurrencies. We once again visited the fact that currently unsustainable deficit spending and legislative obstinacy could produce another credit downgrade, an event that we would view as a financial doomsday.

- in the Federal Reserve’s continuous pursuit of a stable 2% annual rate of inflation which apparently has turned 2.99% into an acceptable achievement of the goal, so that the Fed can proceed to knock off 25 basis points of the Federal Funds interest rate this year (a 4 3/4% move down from 5.25%).

- among debt-financed urban office towers that have seen occupancies plummet and, collectively, the banks that have financed large portfolios of such loans.

- in the world of consumer credit, where credit growth is record-setting and where there is rising volume of new transitions into “serious delinquency”, particularly among the credit cards that now handle a huge share of all consumer purchases.

Commentary

Commentary was prepared for clients and prospective clients of FiduciaryVest LLC. It may not be suitable for others and should not be disseminated without written permission. FiduciaryVest does not make any representation or warranties as to the accuracy or merit of the discussion, analysis, or opinions contained in commentaries as a basis for investment decision making. Any comments or general market related observations are based on information available at the time of writing, are for informational purposes only, are not intended as individual or specific advice, may not represent the opinions of the entire firm, and should not be relied upon as a basis for making investment decisions.

All information contained herein is believed to be correct, though complete accuracy cannot be guaranteed. This information is subject to change without notice as market conditions change, will not be updated for subsequent events or changes in facts or opinion, and is not intended to predict the performance of any manager, individual security, currency, market sector, or portfolio.

This information may concur or may conflict with activities of any clients’ underlying portfolio managers or with actions taken by individual clients or clients collectively of FiduciaryVest for a variety of reasons, including but not limited to differences between and among their investment objectives. Investors are advised to consult with their investment professional about their specific financial needs and goals before making any investment decisions.

We welcome readers’ comments, questions, criticisms, and topical suggestions about our Commentaries, which always contain a mixture of researched facts and conclusions about their impact. We diligently strive to avoid controversial, or partisan views. However, our conclusions clearly cannot always align with our readers’ various interests and personal points of view.

The research topics and conclusions herein are not “FiduciaryVest, LLC viewpoints,” nor are they attributable to its individual employees.

Investment Risk

FiduciaryVest does not represent, warrant, or imply that the services or methods of analysis employed can or will predict future results, successfully identify market tops or bottoms, or insulate client portfolios from losses due to market corrections or declines. Investment risks involve but are not limited to the following: systematic risk, interest rate risk, inflation risk, currency risk, liquidity risk, geopolitical risk, management risk, and credit risk. In addition to general risks associated with investing, certain products also pose additional risks. This and other important information is contained in the product prospectus or offering materials.