Banking and US Treasury Backing Gone Amok

Who’s On First?

“Bank run”: A rumor-driven mass withdrawal panic among a bank’s depositors and investors which ignites a chain-reaction collapse of one bank and then others. The seldom discussed fact that lies deep under all depository banks is that, since medieval times in Italy, “fractional banking” works off the notion that a bank can dependably expect that all depositors won’t withdraw their money at once. But, if mass withdrawal does occur, hardly any bank can survive without external aid. Left unchecked for even a few days, a run will swiftly inject panic into the financial pillars and then interrupt global financial order.

Underneath it all, we have observed an apparent three-element, rapid-fire trigger for bank runs:

- an overlooked, poorly managed risk exposure suddenly flames up, and

- burns away its essential, accumulated trust… i.e., its systemic glue, which

- produces a financial implosion,

all within a matter of days; worse still, the initial run is likely to spawn others, overnight.

In 2008, classic cases of this sudden risk/trust flipflop were the failures of two major Wall Street investment banking names: 99-year-old Bear Stearns and 173-year-old Lehman Bros. And they begat a systemic credit crisis in the US which quickly infected European markets and beyond…. an economic pandemic, as it were. [Japan had already been, for 18 years, in a market quasi-collapse mode, following a pre-1990 stock market binge that made Japan the darling of the world’s investors.]

Antidote prescription: Flood the infected marketplace with muscular assurance-underwritings that will quickly rebuild and sustain systemic trust. Risk regulators and their minions, along with the failed institution’s competitors quickly collaborate to construct a stop-loss package of measures and/or mergers that can be presented to the world on Monday morning as a nasty, but orderly solution façade. And finally: the regulators testify that stability is at hand.

Deposit insurance: The Federal Deposit Insurance Corporation (FDIC) has been around since 1933, when the country was in deep economic Depression. Its deposit insurance pool is funded and underwritten with premium assessments on the member-banks. Since 2008, the FDIC officially insures up to $250,000 of deposit accounts at all US national banks and many other depository institutions*. The FDIC is an “independent” corporation, regulated by the Office of the Comptroller of the Currency which is an “independent” bureau of the US Department of the Treasury. Thus, in the event of recent bank failures, the buck officially stopped at the desk of Treasury Secretary Janet Yellen (former Chair of the Federal Reserve).

Registered brokerages have “asset disappearance” insurance up to $500,000 of value per account, provided by the Securities Investor Protection Corporation.

Amid the disorder following two nearly simultaneous US bank failures that began on March 10, 2023, Madam Yellen publicly delivered systemic assurances in three rapid fire days; in each of them, she painted action pictures that were inconsistent, initially vowing that the $250,000 deposit insurance limit might likely just be ignored. Next (perhaps having been chastened in private by members of Congress), she seemed to partially walk back that blanket-coverage notion. Finally, on a third day, she re-introduced the no-coverage-limit concept on a strictly “when absolutely necessary” basis. Meanwhile, a 3rd prominent US bank fell ill from the same bank-run causes and a very large, very sick Swiss bank, Credit Suisse, was forced into a marriage with one of its competitors, Union Bank of Switzerland (UBS). Public assurances and re-assurances about the soundness and stability of our banking system were in abundance, including one issued by President Biden who had no apparent role in the situation and, hence, he amplified the government’s high-level nervousness.

Inflation as root cause of bank runs: Similar to 2007-08, the Federal Reserve became the root cause of actions that emerged in 2023 as bank failures. The Fed’s aggressive choke-hold on interest rates at or near 0% for most of the 14-year period from 2008 to 2022 was accomplished by “printing” the eight trillion new US Dollars needed (a) to furnish the US Treasury with a buyer of its new Treasury bonds which were issued to fund massive annual budget deficits, and (b) to fund a massive amount of new and re-financed low interest home mortgage borrowings provided by Ginnie Mae, Fanny Mae and Freddie Mac.

Those trillions of new dollars were curiously digested without a noticeable inflation rise. The new money was especially welcome in 2020 in order to fund a massive bi-partisan Federal rescue of the frozen national economy during its Covid shutdown. However, along came December 2020 and March 2021. Nearly three trillion more dollars were legislatively injected into the already recovering economy that convinced millions of workers not to work. Inflation suddenly and robustly kicked in but was infamously deemed “transitory” by both the Fed Chairman and the Treasury Secretary who, by late 2021, had publicly eaten that word. (Neither of them went so far as to use a suitable replacement word; we had suggested “rampant”.) Thus, by the end of 2022, after furiously paced rounds of ½% and ¾% interest rate bumps, the following predictable reactions occurred in the economy, during 2023’s first quarter:

- 30-year home mortgage rates more than doubled, from about 3% to 7%.

- Money market funds are now paying their customers an astounding 3.75% to 5% annual, because the Fed is now borrowing $2.3 trillion every night from that market segment and is paying the money funds more than 4% annual rate for it. This uncommon money market situation has brought many delighted Americans into a suddenly rich return on their cash, after so many years of receiving a few pennies of interest, per $100 of their money market deposits.

- Floating rate commercial loans’ interest rates are likewise double, or more. And maturing commercial loans are re-financing at similar doubling of rates. Commercial credit availability, in general, is likely to tighten and most zombie companies may not be able to refinance loans at any price.

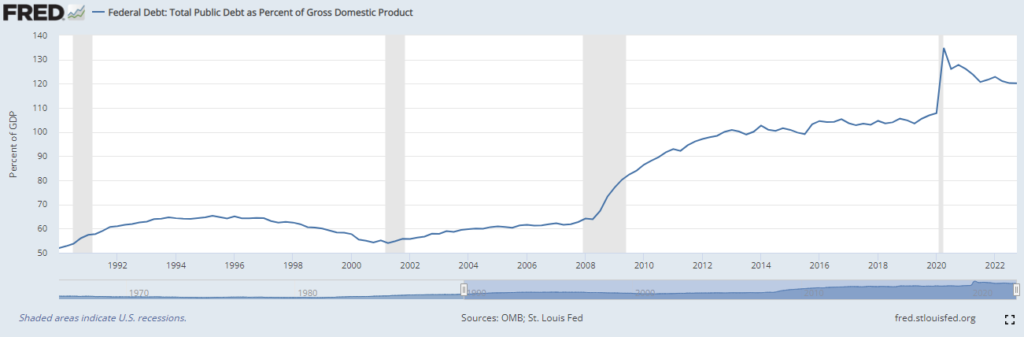

- As of this writing, the US Treasury’s public debt outstanding is $31.4 trillion. Essentially all of it will likely never be retired; instead, it will continue to roll over and merely take on new current interest rates and maturity dates. Thus, the Treasury’s future interest costs compared to the recent 14 years since 2008 will be substantially higher. (And, of course, those much higher interest costs will add more debt burden, on top of the Treasury’s massive annual budget deficits and their accumulated predecessor-deficits.)

Contrarian fact: Inflation is a good thing for fixed rate debtors…. i.e., the borrowers who are individuals, families, businesses and especially governments. Inflation literally devalues fixed rate outstanding debt. During inflationary periods, lenders lose and borrowers win. How? It’s because cash loan payments will buy fewer eggs for the lender, while the borrower gains “inflation-equity” and can afford to buy a more expensive house, among other inflation-dividends.

The US government’s public debt: A $31 trillion mountain with no peak; that’s up by 344% from $9.0 trillion in 2007. (To imagine these numbers, try closing your eyes and visualizing the outer edges of the universe.)

The US, UK, EU, Japan and the others who, in the modern world, electronically create additional money without specific authorization-orders from their respective legislative bodies. They have operated in this little discussed mode since 1971, when President Nixon issued an Executive Order that simply shut down the US’s obligation to exchange gold for dollars that were held by other governments. In order for newly created dollars to be recorded as assets on the Fed’s balance sheet, the Fed uses them to buy bonds in the public markets; bond investors routinely accept payment without question, granting equal value to both the old dollars and the new dollars being created with which to pay the bond sellers (mostly the US Treasury).

The astounding rise in US Treasury debt since 2007 is deemed by it and the other world governments to be as creditworthy as ever**, despite the blowout change in its ratio of debt-to-tax base (GDP) which ratio is now well above 100%, compared to around 45% from the post World War II era to 2000 (including budget surpluses in the 2nd Clinton term).

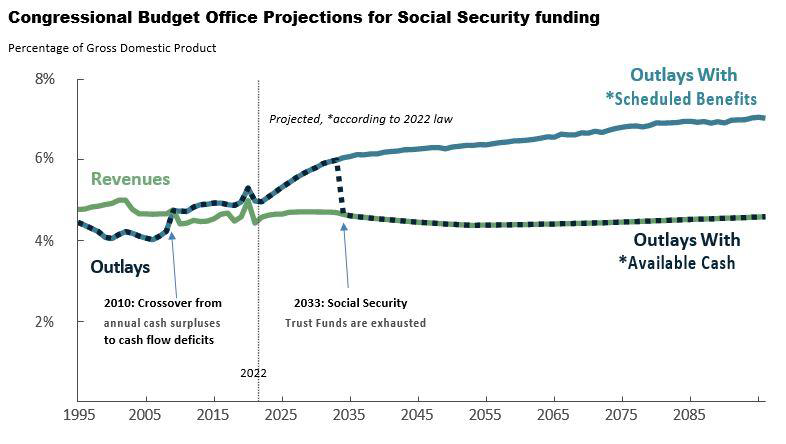

Yet another elephant: Besides issuing the typical US Government debt instruments to the investing public, the Treasury has, for many years, also borrowed away the entire assets of the Social Security System’s Trust Funds to pay forother government spending. For decades, the System was a net cash cow, but, beginning in 2010, its Trust Funds are no longer accumulating money, because the System’s outlays now exceed its revenues. Now the Treasury is quietly and steadily eating up the remaining recorded assets of the Social Security Trust Funds. As of December 31, 2022, the total of US Treasury’s accumulated indebtedness to the Social Security Trust Funds was an estimated $2.7 trillion. [Fiscal year 2023 budgeted Social Security expenditures are $6.2 trillion…. versus $4.8 trillion of budgeted revenues.]

By 2033 or so, if there are no new legislatively created Social Security revenues, there will be zero Trust assets… none, not even in bookkeeping records. Social Security benefits will thereafter be limited to whatever the System collects in annual payroll tax revenues. Because payroll taxes that feed the System are wage-percentage based, Congress will have a very tough political hurdle to increase the tax formula.

**In recent years, Standard & Poors rates US Treasury debt at AA+ and stable, while all the other credit agencies still rate it AAA and stable.

A possible System remedy being circulated is to simply raise the tax rate on high-earning taxpayers, under a “fairness” doctrine that says low-earning people now unfairly pay a higher wage percentage than high-earners. That fairness argument sounds logical, but Social Security’s 3-tiered benefit formula has always been skewed so that the lowest wage-earner bracket receives a much higher monthly benefit-to-wage payout than the higher wage people receive. In fact, the benefit payout formula was specifically designed to deliver monthly lifetime benefits to the low-wage bracket (and their spouses), beginning at age

67, that will maintain and continue their personal pre-retirement standard of living, indexed to add annual inflation adjustments.

On the other hand, the collection of considerably more wage tax from high-wage earners, under current law, will not result in more benefits for those people; hence, fairness is in the eye of the beholder. US Dollar vs Inflation As we have said in previous commentaries, the rate of US inflation is basically an inverse measure of dollar-devaluation. Indeed, since 1933 when, on the face of paper dollar currency was a written promise by the Treasury to exchange the paper for a fixed amount of gold, the dollar has floated downward, compared to the number of eggs it can buy. In our last edition, we graphed the inverse relationship between the US Dollar’s global trade-weighted value [the DXY Index] and the market price of gold. As this is being written, gold’s market price is above $2,000 per Troy ounce, near its 3-year-old, all-time high of $2,075. [In pre-recession 2007, gold was $600.] So, unless the 21st Century’s economic rules and customs overturn history’s thousands of years of value accorded to gold’s implied, inherent monetary strength, one outcome is that the world’s universal use of fiat currencies may eventually give-way to gold, or some other “hard” source, as a basis for determining a dollar’s value.

Commentary

Commentary was prepared for clients and prospective clients of FiduciaryVest LLC. It may not be suitable for others, and should not be disseminated without written permission. FiduciaryVest does not make any representation or warranties as to the accuracy or merit of the discussion, analysis, or opinions contained in commentaries as a basis for investment decision making. Any comments or general market related observations are based on information available at the time of writing, are for informational purposes only, are not intended as individual or specific advice, may not represent the opinions of the entire firm and should not be relied upon as a basis for making investment decisions.

All information contained herein is believed to be correct, though complete accuracy cannot be guaranteed. This information is subject to change without notice as market conditions change, will not be updated for subsequent events or changes in facts or opinion, and is not intended to predict the performance of any manager, individual security, currency, market sector, or portfolio.

This information may concur or may conflict with activities of any clients’ underlying portfolio managers or with actions taken by individual clients or clients collectively of FiduciaryVest for a variety of reasons, including but not limited to differences between and among their investment objectives. Investors are advised to consult with their investment professional about their specific financial needs and goals before making any investment decisions.

Investment Risk

FiduciaryVest does not represent, warrant, or imply that the services or methods of analysis employed can or will predict future results, successfully identify market tops or bottoms, or insulate client portfolios from losses due to market corrections or declines. Investment risks involve but are not limited to the following: systematic risk, interest rate risk, inflation risk, currency risk, liquidity risk, geopolitical risk, management risk, and credit risk. In addition to general risks associated with investing, certain products also pose additional risks. This and other important information is contained in the product prospectus or offering materials.