Market Insights – May 2017

“Oh, mercy, mercy me; things ain’t what they used to be”

– Marvin Gaye

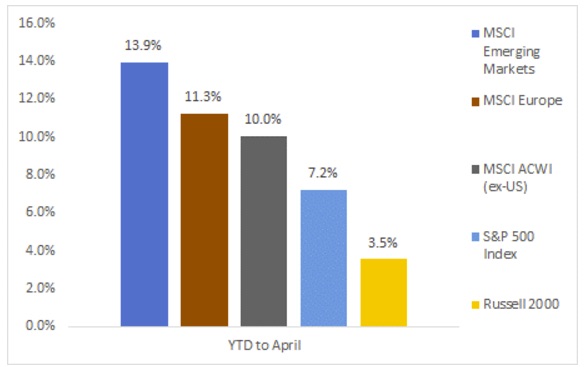

We suggested three months ago in this space that the 2016 election results heralded changes of the likes not seen in America in decades1. The one sure thing at the time was that financial markets had been registering enthusiasm and positive results from mere hours after Election Day forward. That trend has largely continued well into 2017, with Non-US markets showing some of the Love (American Style) witnessed in late 2016.

Clearly, attitudes about several primary economic influences – healthcare finance, tax policy, and regulatory interpretation – have shifted significantly from the worldview that remained intact through most of 2016. As Exhibit A, repeal and replacement of the Affordable Care Act played out in a multi-act drama over the winter and spring, with no passed legislation to date. Making transformative tax changes are similarly front-loaded into the 2017 political calendar, presumably in the hopes that their purported economic benefits will bend the economic growth curve upward from its recent doldrums2.

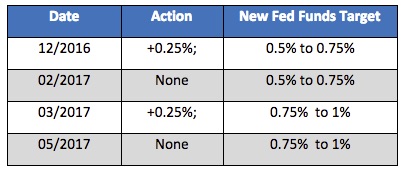

Second, only to the Trump agenda summarized above, recent investor concern also centers around interest rates and the Fed’s announced upward path for short-term interest rates. Bonds roughly earned their (low) coupon for the first calendar quarter, with a bit of capital gain added since then with rates dropping as the Fed backed off its early 2017 more hawkish stance (see table).

Health finance and tax legislative priorities are inter-related, complex and controversial, and will be more arduous to implement than a shift in regulatory policy, subject as they are to action from Congress (with the attendant personal grandstanding and horse trading inherent in the body’s functioning). While value judgments about the efficacy of these as yet unknown outcomes, of course, vary by political philosophy, markets continue to discount things expected to be positive for business and economic welfare if they get done as if they have already been done.

Disappointment, should one or more of those expectations (for example, lower corporate tax rates leading to repatriation of hundreds of billions of overseas US corporate cash hoards) would likely take some wind out of equity markets’ sails. With US stocks up 7/10th of their long-term average already in 2017, investors might be forgiven for considering the old market saw of “sell in May and go away,”

Perusal of print and video media of late indicate that there appears to be more than passing interest about whether President Trump’s unorthodox style or his opponents antipathy toward him (which seem quite tightly intertwined) will cause his agenda to stall or him to stumble badly enough to immunize his stated economic growth agenda. This column pursues political neutrality, and we thus have no particular dog in the hunt related to the policies being vetted in Washington. We trust for a workable (though imperfect) outcome in the wisdom and durability of the American government’s system of multiple checks and balances – federalism, split authority among branches, frequent elections, etc.

We have gleaned from our frequent conversations with clients that investment decision makers remain concerned about, in no particular order:

- producing adequate future returns in a world that is largely expecting lower ones;

- making up “lost ground” if portfolios include capital protection strategies instituted in the aftermath of 2008;

- the specter of “payback” for the now eight-plus “fat” return years of the post great financial crisis

For our part, as we’ve said in this space previously, our primary current concern revolves around decision making in what largely amounts to only the recovery portion of a capital market cycle. Much about investing is uncertain, and the older we get the more we value humility, are suspicious of absolutes, and find great value in answering queries with “it depends,” before trotting out a pre-fabricated solution. Risk control should be valued above heroics, portfolio wise, and that includes not abandoning diversification that appears to “not be working” lately.

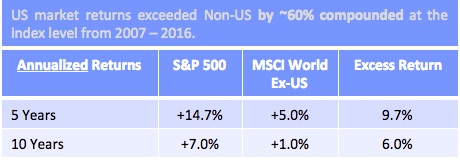

We do not see in our review of the asset class landscape any obvious “red alert” signals, and yet find few if any “fat pitch” opportunities that are compelling on a risk-adjusted basis. The one area that comes the closest to the latter is the divergence between results for US and Non-US Equity benchmarks, leading to active discussions with clients related to portfolio adjustments in that regard.

The one area that keeps us up at night3 relates to an unknowable; and yet we cannot help but wonder how the strange, experimental monetary policy that has been lately wrought globally might impact asset values, inflation, interest rates, currency values and other such opaque macroeconomic influences on long-term returns on capital, which is after all what our clients seek. Central bankers have taken it upon themselves to dampen near-term financial market instability via the expansion of paper money and credit with what we suspect is little actual knowledge of the long term consequences. (We cannot recall the source, but found the comment accurate that future central bankers will look back and observe that the Fed, after 2012 or so, had likely created much more in the way of future financial excesses to be corrected than the financial crisis excess of 2008 for which they were trying to compensate. Feeling no pain, on their watch anyway.) We take little comfort that Fed chair Janet Yellen recently acknowledged4 a concern over the necessary if not yet sufficient conditions for inflation, courtesy of years of loose money.

In fact, thinking about the 1970s and its rampant price inflation provided the inspiration for this quarter’s series of (mostly) song lyric headlines. Things “ain’t what they used to be,” as the late, great Marvin Gaye put it, when the financial ecosphere obsesses over the minute increments of Federal Reserve fed funds rate tinkering, yet appears little concerned with precisely how the same Fed might unwind the 3+ TRILLION dollars in securities that have ballooned its assets and thereby surreptitiously expanded the supply of US dollars5. We don’t want to get off on a rant here, but…What normally happens to the price / value of something for which supply dramatically expands? And what about the monetary expansion the rest of the globe has been on?

Experience tells us that market volatility, again plumbing new lows of late as measured by the VIX index, is unlikely to remain perennially quiescent. That a hedge fund manager we respect, long closed, recently raised capital to be ready for future dislocated opportunities on a large scale is not predictive necessarily, but it isn’t comforting either. The famous line from the film Bridge on the River Kwai, “of course there’s always the unexpected” is a wise mindset to adopt in our view.

Several recent musings we read in the plethora of investment opinions we gather were somewhat dour about debt expansion and monetary mischief. This sent us in search of primary insight into prior times – again, the 1970s – when the linkage between economics and social policy created a backdrop of similar societal discontent. It’s not a light read, but for the intrepid, we highly recommend The Anguish of Central Banking, by former Federal Reserve Chairman Arthur Burns (link below6) for its lucid assessment of the connection between political pressures and monetary debasement on the one side and the values and (expanding list of) wants, priorities and baseline expectations of America’s citizenry. It is difficult in our view to read the ideas this treatise so thoroughly outlines and not connect them to today’s societal debates over resources and their appropriate use and (re)distribution.

Promises are hard to unmake, once-proffered benefits difficult to reduce, political consensus problematic to achieve, and the clock is ticking on some sizable problems, like large on balance sheet US debt ($18 trillion and counting), as well as perhaps five times that figure in future promises to pay for Social Security and Medicare. As the late Herb Stein observed, when a thing cannot continue forever, it will end. Surprises are coming, but they remain in the “someday,” and we have a divided democratic republic, so making progress is slow, painful, fitful, and only eventual. There will be unexpected shockwaves occasionally given this set of conditions. As we observed many years ago about capitalism, we repeat now about democracy: It’s tough; wear a cup.

It is interesting (depressing?) to witness how little progress has been made in addressing the challenges highlighted when Arthur Burns penned his transparent display of central banking angst nearly 40 years ago. It is unlikely to improve one’s mood to note that the dollar figures then causing such great concern have long since been surpassed, some by orders of magnitude. But we suppose that if the problems were easy, even the US Congress could solve them. The price inflation which so vexed the 1970s had more than one root cause, but monetary expansion was a big one, and required sometimes painful financial and economic retrenchment to control.

But before this tract descends into a financial version of Manchester By the Sea, we note that for all of the substantive changes in the world since 1979, for example:

- US consumer inflation was 11%!, and required huge interest rate increases by Arthur Burns successor at the Fed, Paul Volker;

- Belgrade, where Burns delivered his sobering comments, was part of Yugoslavia, then a communist dictatorship like much of Eastern Europe (millennials, hit Google or watch Bridge of Spies – there was once both an East and West Berlin and Germany!); and

- Senator Al Franken from Minnesota was doing comedy bits on television, and thinking mostly about himself (well, some things never change); and

Since then, the S&P500 has then turned in decades-long annualized returns of:

- 1980-1989 +17.5%;

- 1990-1999 +18.2%;

- 2000 – 2009 -3.6% (ouch!);

- most recently adding +13% from 2010-2016

- (plus another 7% in 2017)

The entire 37 year period average return: 11.5%, right on top of stocks’ very long term (since 1955) returns. Stocks for the long run (not ONLY stocks, and not always the same proportion of stocks, but definitely including stocks in a portfolio) remains a sensible investment approach. Of course that’s only our opinion; we could be wrong.

- And Now For Something Completely Different – https://fiduciaryvest.com/now-something-completely-different/

- Gross domestic product increased at a 0.7 percent annual rate… the Commerce Department said on Friday… the weakest performance since the first quarter of 2014. https://www.cnbc.com/2017/04/28/first-estimate-of-2017-q1-gdp.html

- We say, somewhat metaphorically, though some midnight oil is burning as we type.

- Ms. Yellen cautioned that holding off too long on rate increases ‘would be unwise,’ since it could force the Fed to lift rates more aggressively if inflation shoots higher, which could risk pushing the economy into recession.”

- What’s Another Trillion Among Friends? – https://fiduciaryvest.com/whats-another-trillion-among-friends/

- The Anguish of Central Banking, The 1979 Per Jacobsson Lecture, Belgrade