What’s Another Trillion Among Friends?

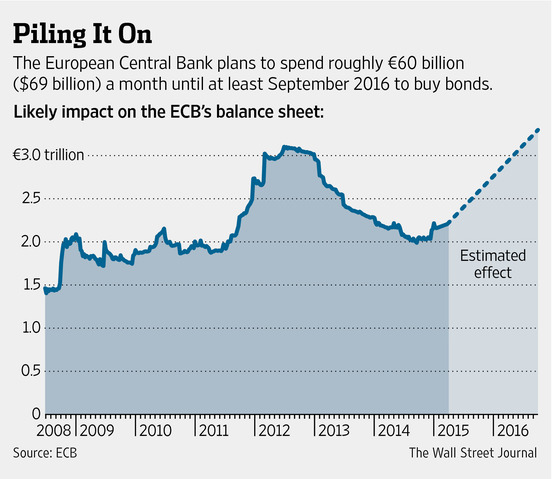

Head of the European Central Bank, Mario Draghi, famously said in 2012 he would do “whatever it takes” to preserve the euro common currency. He made good on that pledge last month[1], announcing a new $1.1 trillion bond-purchasing scheme that will last through 2016. This brings Europe formally into the trillion dollar club and fully aligned with the monetary policy ethos of the day.

As former Monday Night Football host (we know, it was a bad fit) Dennis Miller used to say, we don’t want to get off on a rant here, but… have any of the economic wise men (or women – Janet Yellen heads up the US Fed) of the world ever considered following old-fashioned pro-growth tax, political and labor market reforms, the kind that focus on helping to make workers more productive, infrastructure safer and more secure? How about pursuing simpler, more efficient taxation, implementing effective, practical, regulations that are tested for cost-benefit? Restraining new spending (of money governments don’t really have), tackling accumulated on- and off-balance sheet government debt obligations, encouraging trade and modernizing our technically bankrupt entitlements states? Hello? McFly?

https://blogs.wsj.com/briefly/2015/01/22/5-things-to-know-about-the-ecb-stimulus-plan-in-charts/

Maybe the lack of progress on these fronts – always encouraged, almost as footnotes to the headline trillions in new liquidity, but so far undelivered – are why the velocity of all these new “boga-dollar[1]” (or boga-euro or boga-yen) monies is about zero. Banks don’t want to lend them when they either need to repair balance sheets they know are filled with holes under mark-to-market to reality or await the next regulatory extortion racket[2], ah, we mean “investigation.” Companies don’t want to invest the monopoly money in new projects because they find stock buybacks (funded with hyper-cheap long term debentures and higher stock prices) a lower risk endeavor. And ordinary people are just numbed by numbers with which Einstein might have struggled; they only have a general sense that if all is so well, why is every government printing new money like common counterfeiters?

“So what?,” you might reasonably ask. In our humble opinion, these kinds of reforms matter, because they create a foundation for enduring economic growth. They build and nurture durable institutions that support appropriate risk-taking and undergird decades of as-yet-undreamed-of ventures and enterprises that will improve people’s lives and allow them to flourish, both economically and personally. This is “you didn’t build that” in the positive sense in which it was perhaps intended: making sensible sacrifices now to metaphorically dig wells and plant groves from which posterity will benefit.

Or not, if reforms are “kicked down the road.” Corruption in New Orleans was a punch line for decades until Katrina swamped the place and people asked why George W. Bush was sitting around Washington DC singing “When the Levee Breaks[3].” But the levees weren’t adequate, in part because the money to pay for them was siphoned off for years by every Tom, Dick, and Harry – or Thibodaux, Delacroix, and Hebert if you prefer – politician and his amicis, while they should have been watching out for the public good, that’s why. In our view, global central bankers may well be characterized as doing the same thing, except they are printing the money to do it, instead of purloining it. Of course that’s just our opinion; we could be wrong.

[1] A term coined some years back by Jeffrey Gundlach, CIO at Doubleline Capital, to capture, as we understand it, the “bogus” or less than stated value characteristics of various financial engineering transactions, securities or other economic schemes which periodically create the illusion of having greater value than they can or will ultimately realize according to their underlying economics, rationally determined; in our view the massive monetary expansion undertaken post-crisis by global central banks may well fall within these parameters during our investment careers / time left on earth.

[2] “So if you mention extortion again….” https://www.imdb.com/character/ch0030844/quotes

[3] “All last night, sat on the levee and moaned…” https://www.youtube.com/watch?v=9NaQZojWi6U