Joyland1. Market Insights – August 2017

It has always struck us as a bit peculiar when, every summer, a small carnival rises from the blacktop of the local shopping mall adjacent to our decidedly suburban Atlanta office. (Whether that will be the space’s only use decades from now when Amazon has made all malls obsolete is a matter for another forum.) Still, when the Ferris wheel, tilt-a-whirl and merry-go-‘round show up, we’re always taken with a bit of total recall for the anticipation, enjoyment and simple fun that our local hometown carnival brought with it in our formative years.

It has always struck us as a bit peculiar when, every summer, a small carnival rises from the blacktop of the local shopping mall adjacent to our decidedly suburban Atlanta office. (Whether that will be the space’s only use decades from now when Amazon has made all malls obsolete is a matter for another forum.) Still, when the Ferris wheel, tilt-a-whirl and merry-go-‘round show up, we’re always taken with a bit of total recall for the anticipation, enjoyment and simple fun that our local hometown carnival brought with it in our formative years.

Who doesn’t love hot fried food, games of chance, giant plush toys, the thrill of a hastily constructed round-up, or a chance to hit the haunted house or tunnel of love with a current or prospective date? The concessions might score a solid B- from the local health inspector, the games may be mildly rigged, a trip to the petting zoo only a precursor to the follow-on in ER, and the “carnies” a breed all their own, but some level of risk is good red-blooded American fun, no? (It was when we were young anyway.)

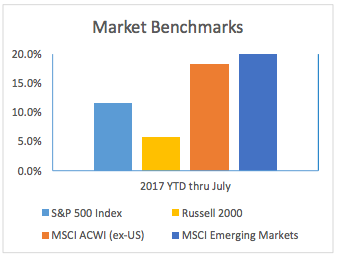

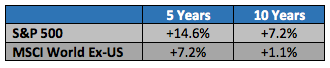

Risk assets have been on a merry ride of their own during 2017 to date, with equities of all stripes strong to quite strong for the year, some substantively ahead of long term results in just half a year. Look at the charts – pretty much everyone is making money, and returns outside the US are downright giddy. But the best part is that it’s been a rally suited even to the faint of heart, no disclaimers required – more Ferris wheel than coaster or even spinner. It’s Joyland out there!

Risk assets have been on a merry ride of their own during 2017 to date, with equities of all stripes strong to quite strong for the year, some substantively ahead of long term results in just half a year. Look at the charts – pretty much everyone is making money, and returns outside the US are downright giddy. But the best part is that it’s been a rally suited even to the faint of heart, no disclaimers required – more Ferris wheel than coaster or even spinner. It’s Joyland out there!

At first glance, there’s solid underlying support for markets’ price progression. The US economy is reportedly growing a bit faster at a recent 2.6% for 2Q ’17; not the 3-4% President Trump is hoping for, but near the higher end of post-Crisis levels, and trending up.

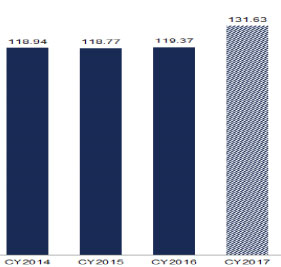

Moreover, after flat lining for three years, 2017 appears poised for double digit growth in corporate profits, the primary driver of stock prices over time. All this without much in the way of actual “reform” from Congress of the variety which presumably reignited markets’ animal spirits with a more “business- friendly” Washington.

Moreover, after flat lining for three years, 2017 appears poised for double digit growth in corporate profits, the primary driver of stock prices over time. All this without much in the way of actual “reform” from Congress of the variety which presumably reignited markets’ animal spirits with a more “business- friendly” Washington.

Our nexus of summer amusements with recent returns is the sometimes invisible risks lurking beneath the surface of an otherwise easy season for investment returns. Stephen King being who he is, a healthy dose of peril and misfortune are inherently embedded in the thrill-ride crime novel that inspired our title. Joyland’s fictional amusement park’s owner asks, “Do you know what we sell here? We sell fun.” Wall Street sells fun too, yet there is mystery and danger afoot in both contexts as well. Clichés are often thus for good reason, and the hackneyed Wall Street expression that bull markets climb a “wall of worry,” assuredly applies.

There seem to us to be a handful of easy to recognize, but hard-to-quantify reasons to worry. The most obvious example is that as we type, the markets have been largely shrugging off (-1.4% week ended 8/11/17) the first public dialogue about a realistic possibility of nuclear weapons exchange we can recall since, well, the 1980s, which President Obama as recently as 2012 observed “called and wanted their foreign policy back.” If one client is inquiring about investing in gold as, in effect, “disaster insurance,” thirty others are likely thinking it and not asking, and that seems new to us, again a throwback to when a fictional screen star rather than a reality one occupied the West Wing. All this around the Hiroshima / Nagasaki anniversaries. Scary stuff.

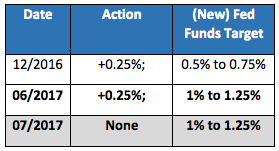

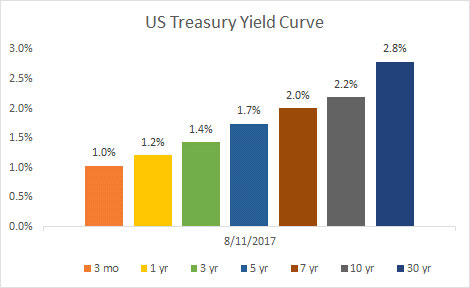

On a more mundane level, we confess admiration for the market’s ability thus far to adjust to an altered state for Federal Reserve interest rate policy. The Fed’s moves are still rather muted, and rates remain far, far below what most readers would consider a “normal” interest rate/monetary environment. But so far it’s a much different reaction than early 2016, when markets fell out of bed over the December 2015 rate hike; that January posted mid to high single digit losses, in one month. With discretion the better part of valor, the Fed chose not to raise just weeks ago, and markets currently discount moves at the fall meetings as unlikely.

On a more mundane level, we confess admiration for the market’s ability thus far to adjust to an altered state for Federal Reserve interest rate policy. The Fed’s moves are still rather muted, and rates remain far, far below what most readers would consider a “normal” interest rate/monetary environment. But so far it’s a much different reaction than early 2016, when markets fell out of bed over the December 2015 rate hike; that January posted mid to high single digit losses, in one month. With discretion the better part of valor, the Fed chose not to raise just weeks ago, and markets currently discount moves at the fall meetings as unlikely.

The longer term issue as we’ve indicated in this space many times is the divergence between market participants’ obsession over the minute increments of Federal Reserve fed funds rate tinkering, oddly juxtaposed with much less concern over how same Fed might unwind the $3+ TRILLION dollars in securities that have ballooned its assets and thereby surreptitiously expanded the supply of US dollars.

Lo and behold, the Fed in mid-June reiterated its plans to “shrink” its balance sheet via a limited plan of not reinvesting maturities and prepayments on the securities it owns.2 (Until recently, the Fed had been in what we in the South might call “fxin’ to get ready” mode.) The guidelines were first promulgated in June 2014 and updated twice since (at least once in a way we find frankly baffling3). The limited shrinkage is now hinted to be headed for implementation in the fall of 2017.

As readers likely know, central bankers took it upon themselves, gradually over the past two decades, to dampen near term financial market instability via the expansion of paper money and credit, with what we suspect is little actual knowledge of the long term consequences. It will be interesting to see how market participants – fresh from the Hamptons, Nantucket and other such tony beach enclaves – process the reality, as opposed to the theory, of the Fed’s diminishing role as (price insensitive) bond buyer of first resort.

As one clear manifestation of Fed influence, there is the curious case of 2017’s disappearing VIX, a measure of stock market volatility, which kicked around all summer in the 10-12 range before “fire and fury” North Korea rhetoric nudged it closer to its normal teens. We doubt it’s done on the upside. Corporate bond spreads (their yield advantage above low risk Treasuries) are flirting with historical lows, indicating both little concern over immediate credit risk as well as appetite for yield. Argentina was 3.5 times over-subscribed in demand for $2.75 billion in bonds maturing in 2117. The country has defaulted on its sovereign debt eight times since independence in 1816, most recently in 2001 on $100bn of bonds. Appreciation of irony is not the current market’s strong point.

While such items can be dismissed as anecdotes, the famous line from the film Bridge on the River Kwai, “of course there’s always the unexpected” comes to mind when the mosaic of market intelligence is stacked in its current direction.

Notably, the lack of anything resembling dual-party compromise in the 115th Congress on health legislation does not exactly set an encouraging stage from which to discuss the next agenda item, income taxation. The initiation of the current market rally phase was predicated on a “reform” agenda, and continued lack of legislative success – especially on a bipartisan basis – is likely to eventually weigh on stock prices.

The “specter” of “pay-back” for the now eight plus market recovery years of the post great financial crisis is no reason, by itself, for stocks to stall or tumble. (We’re well aware that “bull markets don’t die of old age,” and we respect the wisdom embedded in the old market saw.) True, US price-earnings ratios have been expanding steadily, but so have corporate profits. When analysts roll forward to discounting 2018 expectations in a few months, the S&P 500 market multiple will drop below 17 on a forward basis. That’s hardly cheap, but in a yield curve environment like the one above, (a critical cavet) p/e’s aren’t obscene either. (We believe that is known as damning with faint praise.) Still, earnings multiples globally remain much more muted, with even lower local levels of interest bearing instruments as competition.

Equity markets traditionally run out of steam with one or some combination of:

1. exogenous events causing a wholesale shift in the pricing of risk;

2. business recession crimping corporate profits broadly;

3. rising interest rates persuading investors broadly to shift capital.

Number one above is unsuitable to prediction, by definition. Conditions two and three always bear scrutiny, but little in the current backdrop appears imminently problematic on these fronts. In fact, global economies are expanding, albeit slowly, not yet robustly. Interest rates of course remain well below most investor’s required return hurdles, recent Fed action notwithstanding.

For our part, as we’ve said in this space previously, our primary current concern revolves around decision making in what largely amounts to only the recovery portion of a capital market cycle. Risk control should be valued above heroics, portfolio wise. One example: high yield bonds look tired and priced for almost perfection, with a yield advantage over Treasuries that looks awfully thin to us.

Conversely, as we’ve said for a time now, we find few if any “fat pitch” opportunities that are compelling on a risk-adjusted basis. The one area that comes the closest is the divergence between historical returns for US and Non-US Equity benchmarks, leading to active discussions with clients related to portfolio adjustments in that regard.

We agree that the US economy has structural challenges we’d like to see addressed, many of which will require a significant change in the US political tone. But we’re realists; democracy is a messy business, the worst system of government ever except for all the others, as Winston Churchill observed. (Unlike Thomas Friedman, we never think it would be a good idea to be “China, for a day – just one day4.”) For now, our review of the asset class landscape indicates few obvious “red alert” signals.

Against such a background, there are worse places to be than at or close to target asset weights. It may be hard to take home that giant stuffed unicorn, but the game isn’t rigged. It’s late season, but still summer after all. Maybe there’s even a carnival in your town, and as of late, investment returns are ever gentle on investors’ minds5.

- Stephen King’s diversion from pure horror into the crime genre, set in the story’s eponymous fictional small-town North Carolina amusement park in 1973, Joyland tells the story of a summer “carny” job, an unsolved murder, a brave but terminally-ill child; and it is unequivocally… fun!

- Fed Press Release On Balance Sheet Reduction 2017

- The March 2015 update included the following excerpt: “Allow aggregate capacity of the ON RRP facility to be temporarily elevated to support policy implementation; adjust the IOER rate and the parameters of the ON RRP facility…” We have no idea what that means, but the technical clarification was for someone’s benefit, and it certainly speaks to the complexity of the exit from the realm of strange experimental policy. I don’t think we’re in Kansas anymore, Toto.

- As quoted in his book, Hot, Flat, and Crowded

- Rest in Peace, Wichita Lineman; Glen Campbell 1936-2017

Commentary

Commentary was prepared for clients and prospective clients of FiduciaryVest LLC. It may not be suitable for others, and should not be disseminated without written permission. FiduciaryVest does not make any representation or warranties as to the accuracy or merit of the discussion, analysis, or opinions contained in commentaries as a basis for investment decision making. Any comments or general market related observations are based on information available at the time of writing, are for informational purposes only, are not intended as individual or specific advice, may not represent the opinions of the entire firm and should not be relied upon as a basis for making investment decisions.

All information contained herein is believed to be correct, though complete accuracy cannot be guaranteed. This information is subject to change without notice as market conditions change, will not be updated for subsequent events or changes in facts or opinion, and is not intended to predict the performance of any manager, individual security, market sector, or portfolio.

This information may concur or may conflict with activities of any clients’ underlying portfolio managers or with actions taken by individual clients or clients collectively of FiduciaryVest for a variety of reasons, including but not limited to differences between and among their investment objectives. Investors are advised to consult with their investment professional about their specific financial needs and goals before making any investment decisions.

Investment Risk

FiduciaryVest does not represent, warrant, or imply that the services or methods of analysis employed can or will predict future results, successfully identify market tops or bottoms, or insulate client portfolios from losses due to market corrections or declines. Investment risks involve but are not limited to the following: systematic risk, interest rate risk, inflation risk, currency risk, liquidity risk, sociopolitical risk, management risk, and credit risk. In addition to general risks associated with investing, certain products also pose additional risks. This and other important information is contained in the product prospectus or offering materials.