Which Way From Here?

Market Commentary July/August 2019

The US stock market keeps piling on new record highs. Will it continue, or are we headed toward a precipice?

Everyone (always) wants to know. And because rising demand always begets the supply (of anything), an expanding pool of published pundits stand ready to provide us with their brand of speculative answers. Market good-times are, and have long been upon us, which predictably compounds the number of anxious investors who are either: (a) bailing, to avoid The Next 2008, or (b) smitten by FOMO (Fear Of Missing Out syndrome), or (c) both.

Very simply, stocks are going to rise in value…. faster than prevailing economic inflation… and stocks will also pay significant dividends to owners. But that forecast was also appropriate in 2008 and 2002, and at almost any other point-of-interest in market history. Why? Because businesses that routinely earn robust profits will always accumulate wealth. The value of publicly owned common stocks reflects not only the results of doing business, but also the investors’ faith in future profitable growth. All the while, US common stocks serve as the world’s primary depository for its liquid wealth.

In 2008, amid widespread panic in businesses and governments, Fed chairman Bernanke (February 2006 – January 2014) confidently announced that adequate tools were at his disposal to deal with the economic collapse. The tool he selected was a sledge hammer: the creation of money by decree (fiat currency)… not just billions, but almost 4 trillion of new dollars were born and added to the assets of US banks, ready for lending to people and businesses at very low interest rates. Because of its one-click birth, the new money needed tangible proof that it actually exists. So, the Fed used the new electronic money to make open-market purchases of trillions of long term US Treasury debt and 10- to 30-year homeowners’ mortgages. Those debt purchases had a major favorable impact on liquidity and pricing in the public bond market. Nearly all of the 2008-15 fiat money that was created is still with us and predictably will be far into the future.

In recent years, we have witnessed a steepening of the 10-year-old US stock market growth-curve, which pushes out some significant “offset questions”:

Q1: Are most US public companies committed to execute long run objectives and investment plans, or do most of them now focus on current earnings growth?

This issue is perennial, but it goes through phases of popularity. We have created a torrential output of daily stock data, daily jabber about it and universal, palm-of-your-hand access to it by even the most un-sophisticated investors. Every-day Joe’s are day-trading stock options. So, it comes naturally for corporate managements to strongly fear the consequences of a misstep in their quarterly numbers. However, most of the Masters of Silicon Valley’s tech companies seem to be getting the long term picture in proper focus. Perhaps founding a company with a buddy in a garage, working 20-hour days, 7 per week and finally realizing the accomplishment and wealth bestowed by an IPO is THE way to building a proper long run perspective. Compare that to the likely focal points that drive a CEO each day at BigCo, after spending 25 years of rising through its managerial ranks.

Q2: Can S&P 500 companies produce ever more profitable revenues, when more than half their sales now occur in downward-spiraling non-US economies beset by tariffs, weakening currencies and continued creation of money by global central banks, operating (for almost 11 years) in crisis-mode?

Unfortunately, the battleground for such a fundamentally important question is not under control. There will of course be an answer, but it will be determined by the decisions and actions of various functionaries who sit behind the steering wheels of various adversarial governments.

Q3: Can the US stock market ignore the current Interest Rate Inversion (very short term US Treasury debt trading at higher interest yields than longer term Treasuries)?

Inversions present a classic chicken-and-egg dilemma…. Does an inversion predict a recession and stock market decline, or does an inversion actually cause a recession, or neither?

Traditional market conditions that have led to, or created past inversions resulted from a slipping economy (GDP growth) and Fed-driven manipulation of short term interest rates. But, that was then; this is Century 21.

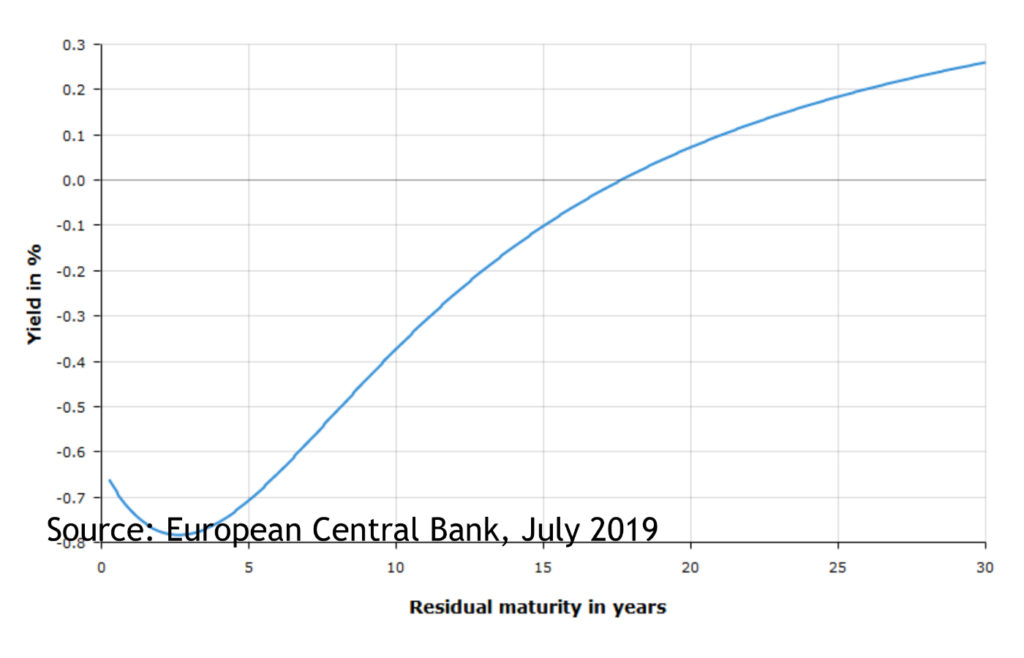

Our conclusion: An advisable approach to stock market-watching: Always be alert to any developing turmoil in bond markets. Why? Government-issued bonds are naturally stable. Unlike stocks, the basic nature of bonds (and market interest rates) prevents creditworthy bond prices from fluctuating significantly. So, conditions such as inversion of government bond yield curves and, recently, foreign central bank-driven negative interest rates are alarm bells; they point to de-stabilizing bond market trends which can quickly lead to, or cause stock market upheaval.

Dark clouds are gathering in world bond markets. Negative interest rates, unthinkable until recently, now abound in many of the mature markets. And they are apparently not temporary. Indeed, Japan and EU central banks are becoming addicted to them. Many negative-yield bonds, especially in the Eurozone, began their life paying positive interest; they still pay, and will until they mature, even though market interest movements have gone negative.

EU is SUB-ZERO: AAA bonds under 17 years to maturity have negative current yields

More recently, Germany, Japan, Switzerland and others have been putting out new bonds that actually require the buyer to pay an interest penalty for owning them… for the next 17 years or so! Just as you thought, “investing” in negative interest yields is in fact nuts (except to a central banker). The world’s investors who look for return will completely avoid these pay-as-you-go bonds, On the other hand, central banks (which have no return goal, or profit motive) do not care much about yields. After all, they will simply declare the new money into existence with which to buy more bonds. In theory, this scheme could go on without end. But make no mistake: once there are no bond investors, there will be no bond market in those places. The game of musical chairs comes to mind.

Meanwhile, the US bond market continues to be only modestly abnormal, looking none the worse for dealing with its now dormant fiat currency binge. US interest rates are so high, in worldwide terms, that the rest of the world’s bond investors are very logically flocking here. This demand drives bond prices down and makes the strong US Dollar even stronger (very bad for export sales). As a delicious topper, foreign investors have always enjoyed the ease and security provided by the world’s most welcoming money storage locker. In summary, the chips are falling such that the US bond market will likely become the last investor-driven debt trading post in existence.

Q4: Can S&P 500 companies continue to deliver the dividend growth they have been showering on shareholders since 2010?

Surely dividends will continue to serve as the backbone of equity investing. And profit growth will continue to compound dividend growth.

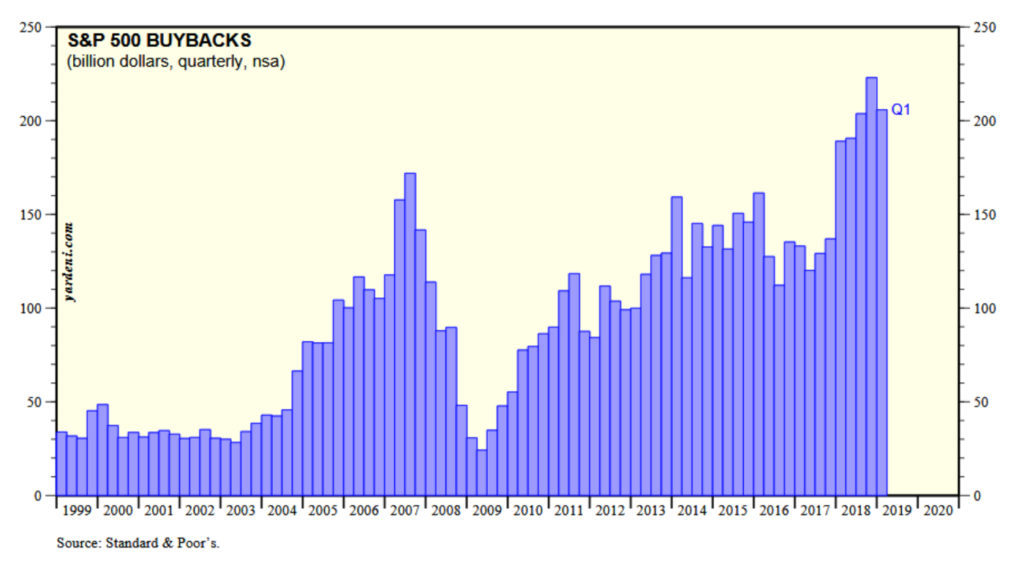

Q5: Can S&P companies wean themselves from recently faddish self-injections of earnings-per-share enhancements, produced from buying-in record levels of their own stock, purchased at escalating share prices, purposely pumped by this process*?

Historically, a cash flow windfall such as 2018 tax relief and repatriated overseas cash-gobs would have been deployed to expand the company’s product offerings, pay down its debt, or acquire synergistic businesses. But, not this time.

*Traditionally, corporate financial managers bought-up some of their stock when shares were persistently under-valued in the market, i.e., they seized a “value investment” opportunity. Today, not only are shares acquired programmatically, at increasingly premium market prices, but the purchases are often financed with newly issued, un-collateralizable short term debt**, floated on the rationale that, because of the Fed’s long horizon/low interest rate policy, corporate borrowing represents a sort of “compound opportunity” to execute cash efficient, leveraged share re-purchases. But, unlike most corporate borrowings, these loans offer virtually no prospect for positive leverage… after all, the shares purchased with loan proceeds are not an asset; they literally disappear at purchase. The “residual” penalty from buyback borrowings is a drag on future earnings and a risk of cash flow stress, especially when those loans must soon be rolled over at higher borrowing rates.

**According to Bank of America (June 2019), over the past 5 years, US companies bought-in $2.7 trillion of their own shares and took on $2.5 trillion of additional debt. Meanwhile, corporate managements are bathing in the success of their buyback-stimulus tactic: About 30% of average growth in earnings per share has resulted from buybacks, says BofA.

Buybacks Bottom Line: In 2018, $800 billion of public equity was gobbled up (which was 41% of $2,019 billion total profits). Another 23% of profits went to pay dividends. Ergo, about 35% of net profits are left over to carry on typical capital expenditures, such as re-investing in the businesses, paying down debt, funding self-insured risks, making pension contributions, etc.

Factoid: Using World Federation of Exchanges data, we determined that the $800 billion 2018 buyback total took a significant 2.4% bite out of total 2018 trading volume in US stocks.

Q6: Has international trade deal-talking gone dormant?

US stock market investors (including throngs whose home is outside the US) not only expect continued robust US stock growth, they also anticipate Good News, sooner or later, on the international trade and nuclear negotiating fronts. Unfortunately, the evident slow-walking pace recently indicates that Kim, Xi & Khamenei (great name for a law firm?) may have each reached a freeze-point that might well be stymied until November 2020. “What’s the rush?” they may be saying. Each of them could be assuming that further negotiations will either be: (a) unnecessary, after the US election, or (b) resumed at that time, with no significant add-on penalty for the delay. After all, they know that, because all those tariffs are paid into the Treasury by US importers, not by foreign producers, US business interests are suffering both a direct, and an indirect hit from the negotiational waiting game, which K, X & K may believe will cause President Trump to blink…. before they do.

Commentary

Commentary was prepared for clients and prospective clients of FiduciaryVest LLC. It may not be suitable for others, and should not be disseminated without written permission. FiduciaryVest does not make any representation or warranties as to the accuracy or merit of the discussion, analysis, or opinions contained in commentaries as a basis for investment decision making. Any comments or general market related observations are based on information available at the time of writing, are for informational purposes only, are not intended as individual or specific advice, may not represent the opinions of the entire firm and should not be relied upon as a basis for making investment decisions.

All information contained herein is believed to be correct, though complete accuracy cannot be guaranteed. This information is subject to change without notice as market conditions change, will not be updated for subsequent events or changes in facts or opinion, and is not intended to predict the performance of any manager, individual security, currency, market sector, or portfolio.

This information may concur or may conflict with activities of any clients’ underlying portfolio managers or with actions taken by individual clients or clients collectively of FiduciaryVest for a variety of reasons, including but not limited to differences between and among their investment objectives. Investors are advised to consult with their investment professional about their specific financial needs and goals before making any investment decisions.

Investment Risk

FiduciaryVest does not represent, warrant, or imply that the services or methods of analysis employed can or will predict future results, successfully identify market tops or bottoms, or insulate client portfolios from losses due to market corrections or declines. Investment risks involve but are not limited to the following: systematic risk, interest rate risk, inflation risk, currency risk, liquidity risk, geopolitical risk, management risk, and credit risk. In addition to general risks associated with investing, certain products also pose additional risks. This and other important information is contained in the product prospectus or offering materials.