Probable price target of plummeting oil

Crude oil’s price per barrel has sunk more than 50% in just six months (since June 19). Is this a bottom? Probably not.

Unlike stocks and other securities that trade on the various public exchanges in the world, a true commodity is global. A commodity represents the flip-side of an investment…. Its use is consumption; it neither generates internal growth, nor income*. All commodities, by definition, share one characteristic: their current (spot) prices are an undiluted result of their available supply versus the demand, except when significant suppliers or consumers organize a cartel. Nearly all of world’s current supply of crude oil is created inside the earth by Mother Nature, over millions of years. But oil is not uniformly available for extraction beneath the soil of very many countries. Global oil supply is one of the few commodities that is under the thumb of a formal cartel. The 12-member OPEC group of countries sits atop the world’s largest crude oil reserve. In addition, the cartel enjoys the lowest cost of finding/bringing oil out of the ground.

Unlike stocks and other securities that trade on the various public exchanges in the world, a true commodity is global. A commodity represents the flip-side of an investment…. Its use is consumption; it neither generates internal growth, nor income*. All commodities, by definition, share one characteristic: their current (spot) prices are an undiluted result of their available supply versus the demand, except when significant suppliers or consumers organize a cartel. Nearly all of world’s current supply of crude oil is created inside the earth by Mother Nature, over millions of years. But oil is not uniformly available for extraction beneath the soil of very many countries. Global oil supply is one of the few commodities that is under the thumb of a formal cartel. The 12-member OPEC group of countries sits atop the world’s largest crude oil reserve. In addition, the cartel enjoys the lowest cost of finding/bringing oil out of the ground.

Fracking — oil prices drop

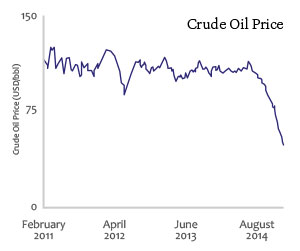

During the 3½ years from early February 2011 to the end of August 2014 (except the month of June 2012), global oil’s price per barrel was remarkably stable, between $100 and $125. During this period, US producers made huge strides in extracting oil from deep deposits of shale, via a recently developed process called fracking. The frackers have essentially caused US total production volume to double since 2008. In fact, the US was recently pumping more oil than OPEC; in fact, it became a net oil exporter, which caused many to declare that the US is now “energy-independent.” If that claim is true, it would/will predictably cause major global economic and political shifts that would make Middle-Eastern members of OPEC much less geopolitically important than they have been for nearly 50 years.

During the 3½ years from early February 2011 to the end of August 2014 (except the month of June 2012), global oil’s price per barrel was remarkably stable, between $100 and $125. During this period, US producers made huge strides in extracting oil from deep deposits of shale, via a recently developed process called fracking. The frackers have essentially caused US total production volume to double since 2008. In fact, the US was recently pumping more oil than OPEC; in fact, it became a net oil exporter, which caused many to declare that the US is now “energy-independent.” If that claim is true, it would/will predictably cause major global economic and political shifts that would make Middle-Eastern members of OPEC much less geopolitically important than they have been for nearly 50 years.

Until very recently, US frackers were happily pumping along and enjoying the steady, over-$100 barrel price… the giant North Dakota fracking-field moved from 200 thousand barrels per day in 2007 to 1 million now. BUT, fracking is an expensive process…. at least $60 per barrel and maybe as much as $100, according to The Guardian newspaper, which also reports that such producers have floated an estimated $200 billion of high yield bonds to fund their development.

OPEC on standby

In the past, whenever oil demand was falling, OPEC could be depended upon to simply reduce its production until the supply/demand balance normalized. This time is different. In fact, OPEC has announced that it isn’t, and doesn’t intend to reduce production. Why would OPEC stand by and watch its source of income and wealth head south without apparent boundary, when it holds the key to the vault-door that would stop that slide? The likely answer is that OPEC’s long term interests will best be served by forcing high-cost producers to stop producing… make them be the ones to pull back, this time around.

- STRIKE ONE: OPEC can afford to maneuver the world price so that it eventually comes to rest near, or below most frackers’ current break-even point, say, $75 per barrel.

- STRIKE TWO: In an environment where the US dollar is strengthening against other currencies, US frack-producers will likely find that domestic buyers are their only potential customers.

Russia’s in a very tight spot

A mid-2014 World Bank report stated that more than half of Russia’s total federal budget revenue comes from its oil and gas sector. According to London-based consultants, Energy Aspects, Russia’s average overall dollar-cost of oil production per barrel is a bit over $40 and the average global cost is about $50, while Saudi’s is only a little over $20. Russian officials must surely be quite concerned, because there is no current market sign of price-resilience that would indicate the oil market is nearing a bottom [Brent Crude: $51]. Moreover, oil is notorious for its price swings; when it moves, it tends to do so rather violently, in both directions; in 1998, it fell to $14 and, in 2008, it hit an all-time high of $134.

In the past week or so, various European political leaders have made a public appeal, urging an end to US-led economic sanctions against targeted Russian financial interests. They apparently fear that the sinking oil price, plus sanctions form an unanticipated double-whammy that is leading their significant Russian trading partner into economic chaos. A mid-January pow-wow of the interested European parties is scheduled.

______________

*Gold is not primarily a commodity; its price has little influence from its supply and it is mostly held as a store of wealth, rather than its consumption-use in jewelry; likewise, in varying, lesser degree are silver, timber, coal, etc.