Q4 Market Commentary: We Didn’t Start the Fire

Billy Joel’s famous (Billboard Hot 100 #1 1989) song referenced above threads together in a stream of consciousness the plethora of events over his life to that time. In one sense it seems that he just couldn’t make up his mind what was the most momentous event of his epoch, so he tossed them all in, spanning decades of time and arenas from politics, fashion, popular culture, the arts1, and science (opening with “Harry Truman, Doris Day, Red China, Johnnie Ray,”, before progressing to, “Roy Cohn, Juan Perón, Toscanini, Dacron2…” you get the idea.). As the song advances, time periods compress a good bit, perhaps reflecting the lack of perspective for more recent events and historical figures.

Capital markets and the events to which they are linked always offer much on which to similarly comment and categorize, because they supply such immediate barometric readings of diverse information flows and investor opinions. The benefit of hindsight usually offers us a few key items that crystallize sentiment, a la Mr. Joel. 1986: Dow 2000 (yes, the Dow Jones Industrial Average was priced around 2,000 in those days, whereas the S&P 500 occupies that strata today; one of us at least can nostalgically recall the Standard & Poor’s measuring in the hundreds on the ticker crawl on Boston’s Federal Street in 1987; but we’re dating ourselves…3). Speaking of 1987: two words –Black Monday (down 500 Dow points when that was a -22% ONE-DAY crash!). 1990-1991: War, Iraq/Kuwait, Scud/Patriot missiles. 1998-2001: Dot-com, followed by dot-bomb, with a little WorldCom and Enron (Houston, we have a problem) book-cooking thrown in for good measure. 2006-2009: Liar loans, Flip This House, the Lehman moment, TARP/bailouts, financial crisis and Great Recession. 2010/2011: Possible euro monetary breakup and sovereign debt crisis. (“Dylan, Berlin, Bay of Pigs Invasion…”)

Here in early 2015, it’s challenging to pick from a long list of current events, concerns and distinctive issues one could say lead the news / markets. Some of them probably have legs, like the beginning of Mr. Long Island’s montage, while others may prove ultimately more forgettable. But there’s no shortage of menu items to choose from:

- The recent announcement of $1.1 Trillion4 in QE EU (quantitative easing Europe –almost always capitalized we note, for reasons that escape us. The QE part, not the Europe part).

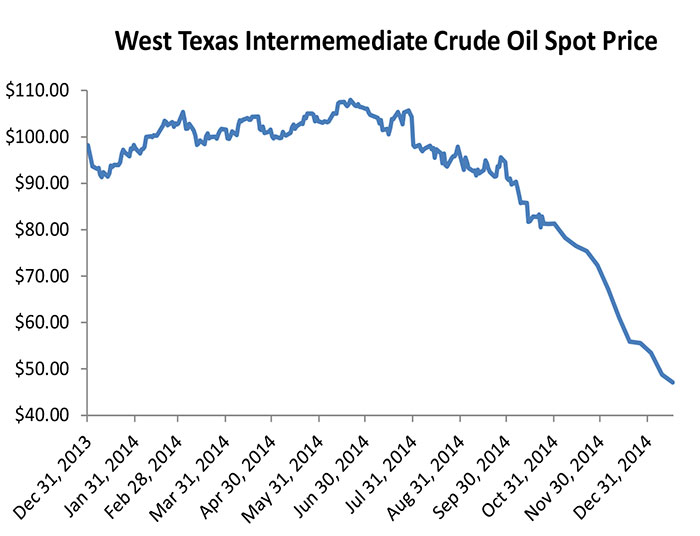

- A continuing free-fall in oil prices. See chart below.

- A bolt from the blue sky behind the Alps, as Switzerland abandons its cap on the franc.

- Rising dissatisfaction with the political/fiscal/monetary status quo solutions (“austerity”) by European voters, evidenced in recent Greek elections5.

- Terrorism on the march and tragically hitting a major European capital (again). “Foreign debts, homeless Vets, AIDS, Crack, Bernie Goetz…”

- Middle East turmoil: ISIS also on the march, talks aimed at preventing an Iranian nuclear weapon “sprint,” the death of the Saudi king, the collapse of the ruling regime in Yemen.

- Oh and China, now the world’s second largest economy slowing more than expected (and likely more than is being reported), depressing global commodity prices and perhaps ending the building super-cycle that gobbled up raw materials for over a decade. “…Hypodermics on the shore, China’s under martial law, Rock and Roller Cola wars, I can’t take it anymore. We didn’t start the fire…”

Like the Piano Man’s topics, these aren’t of equal import; Switzerland, as much as we love chocolate, watches and skiing (not to mention Tamiflu, Riccola, and yodeling) is too small an economy and currency to really shake the world. Greece too is small, though its semi-communist election outcome reflects growing weariness with the austere aftermath of a financial crisis that few voters comprehend – they only know that, in its wake, they and everyone they know feels poorer. Or is poorer.

China’s slowdown is more worrisome, as they have provided an important offset to global GDP contraction on such an enormous scale since 2009. It is hard to imagine they too will not have some ‘fessing up to do about the true value of everything their controlled economy selected for local governments’ “investment” in the financial crisis aftermath (which apparently included construction of a number of entire cities with no residents; how does Potemkin translate in Mandarin?). And finally of course the as yet unabated oil price change impacts the entire globe as all nations are either/both producers/consumers for the world’s most popular energy source. We expect that this will yet have HUGE currently unforeseen financial and even geopolitical (think regime change) repercussions6.

2014 Market Results

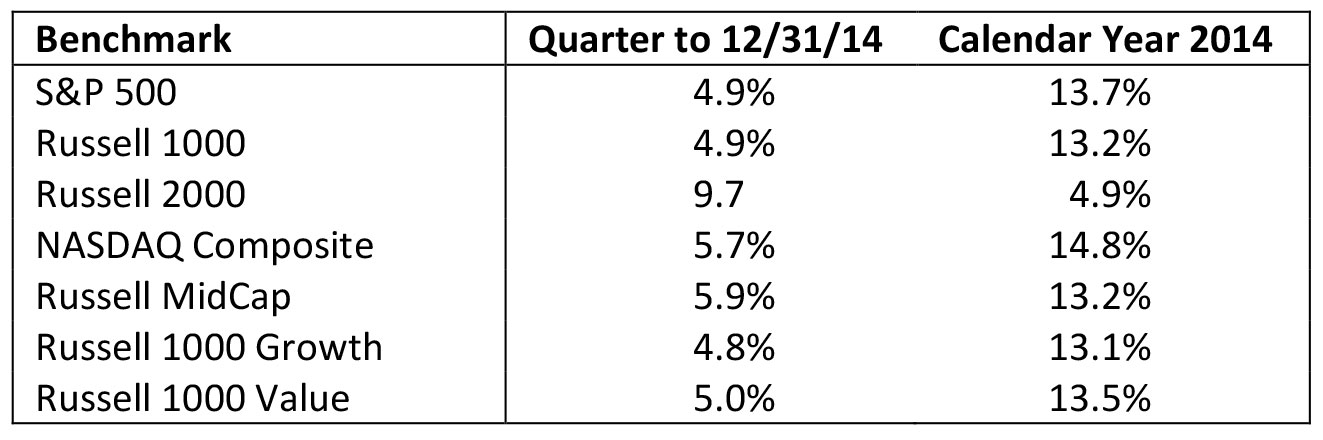

4Q 2014 US stock returns were robust across the board, particularly so in light of a mid-October mini-plunge, boosting low single digit large-cap 2014 returns into surprising low teens territory. 4Q also saved the bacon of small caps from posting a loss for the year, while mid-caps were quite robust for both 4Q and full calendar periods, burnishing their reputation as a diversification tool.

Other, typically smaller, portfolio diversifying strategies were likely disappointing in the absolute, with most hedge fund universe composites clustering in the low single digits, including equity long-short (+2%), event-driven (+3.5%) and the fund of funds composite (+3.3%). Commodities were 2014’s biggest losers, through diversified baskets (Dow Jones Commodity Index -18.8%) and a good bit worse in the largest component (Energy -42.4%).

Commodity prices (in US $) are determined in global markets, and their mono-directional downward move is a strong indicator of broad-based deflationary pressures. [We also note that the yield curve in the US is getting flatter, a long-time directional “tell” of slower growth ahead. Yield curve inversion – short-term rates higher than long-term ones – should we get there, is a historically reliable long term indicator of pending recession.]

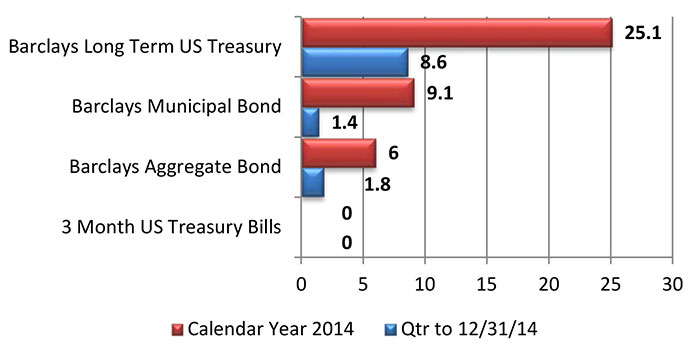

Bond results were uniformly impressive in 2014 for the standard investor benchmark areas (aggregate/intermediate bonds). Recall that the 10-Year started 2014 at a 3% yield and was uniformly dismissed in terms of return potential given the continued fear of rising interest rates. High yield took a pause (that refreshes?) as credit risk concerns took center stage, particularly for energy-related issues challenged by plunging oil prices. The real surprise however was in long maturity fixed income, with the Barclays Long Term US Treasury Index posting a whopping +25% for the full year, 8.5% during the fourth quarter alone.

If any investor profited from this occurrence in any sizable trade, they (any or all):

- kept it to themselves, as no one to our knowledge was out on the “take massively more duration risk” limb a year ago,

- are yukking it up on a beach somewhere smoking (newly legal!) Cuban cigars, and/or,

- will forever dine out on making this call via infomercials, books hawked on late night TV, or hedge fund management.

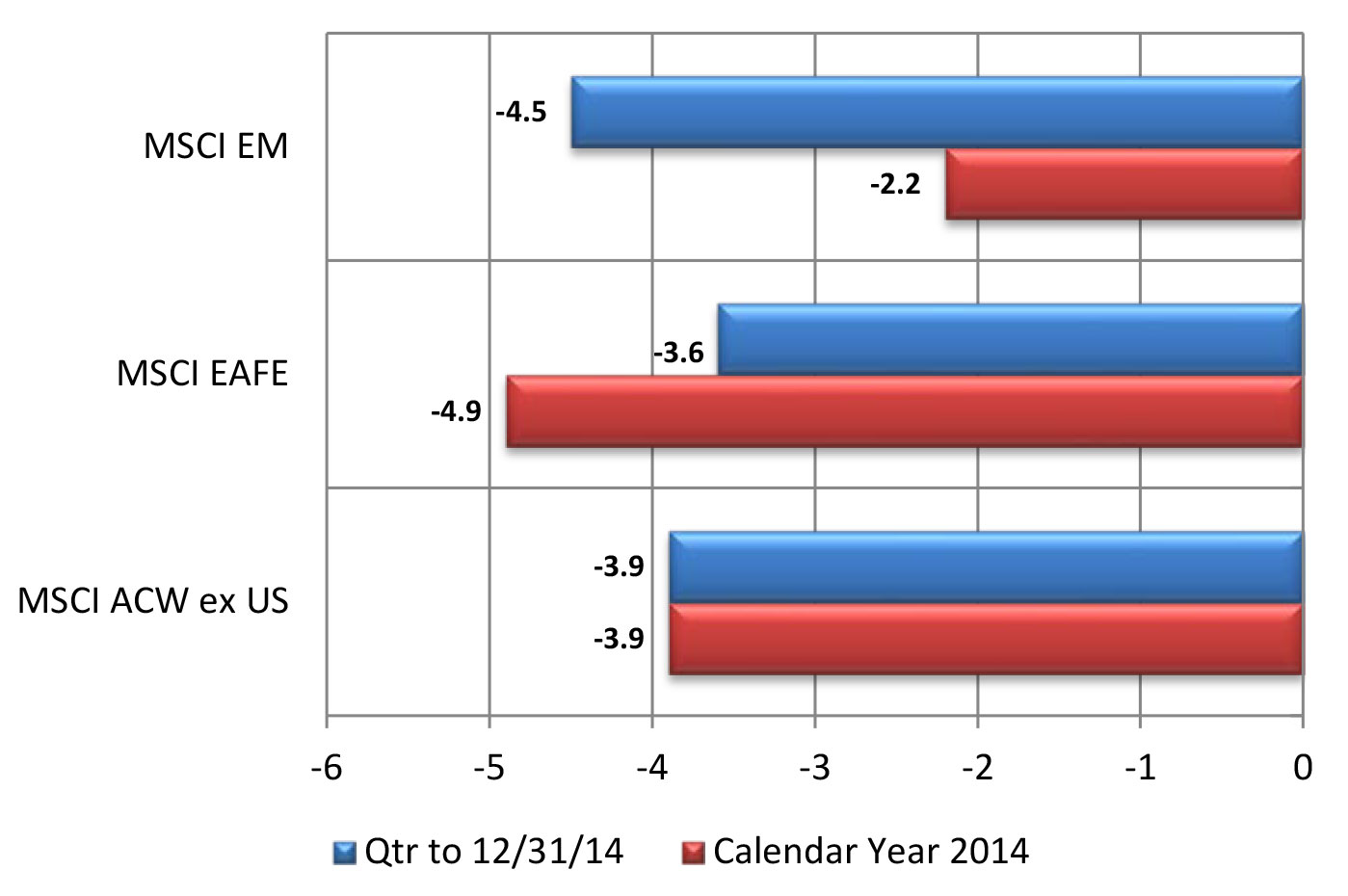

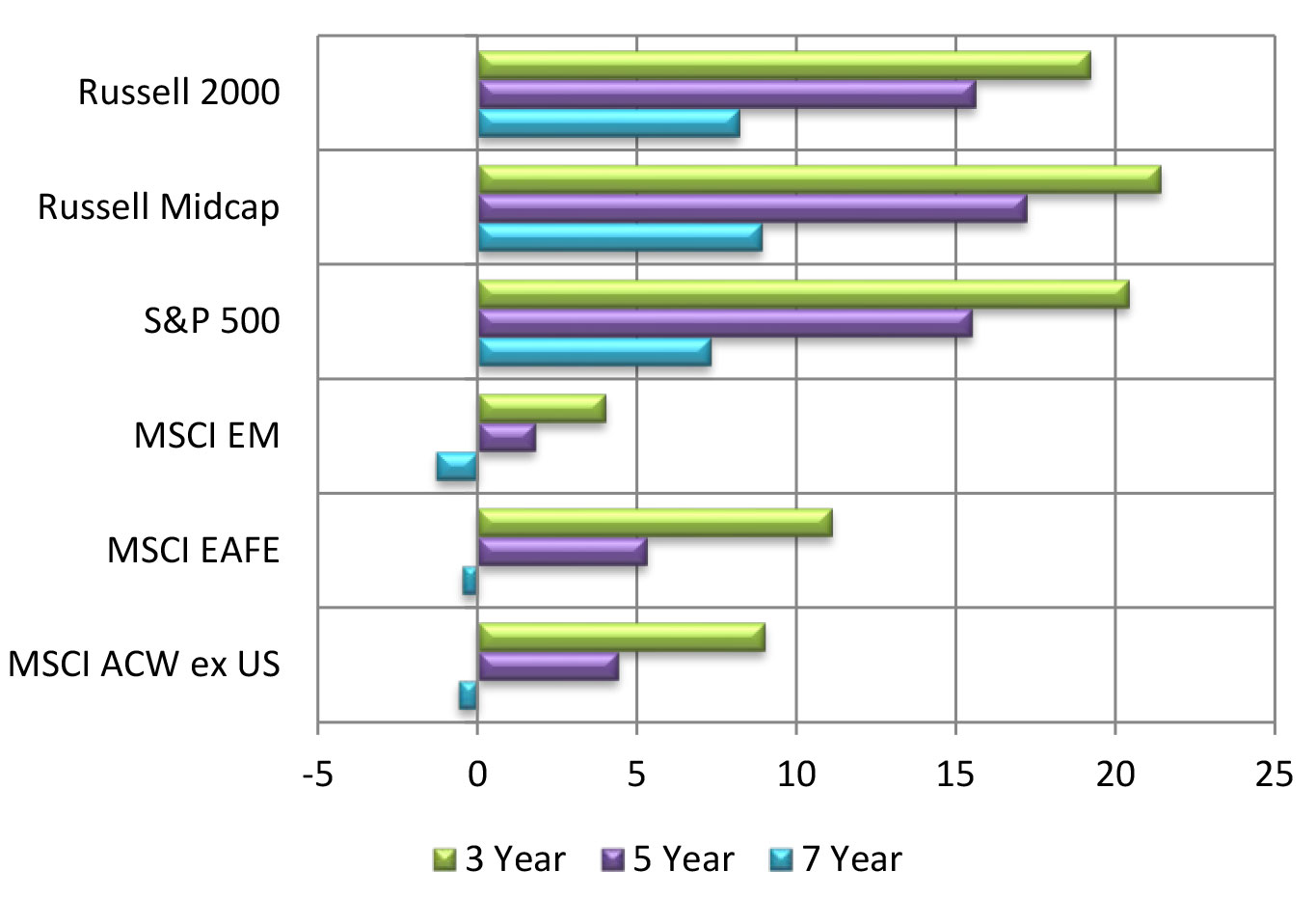

Non-US equity segments were a different story entirely, with 4Q losses generally driving results (further) into the red for the full year – see chart below. Emerging markets offered no refuge from this offshore downdraft, with EM and developed markets losing similar ground for 2014. The trailing 3, 5, and 7 year results (2012-2014, 2010-2104 and 2008-2014, respectively) for equity indices outside of the US are now looking quite paltry (see second chart below) relative to domestic benchmarks.

Goin’ Through the Big D

(and Don’t Mean Dallas)

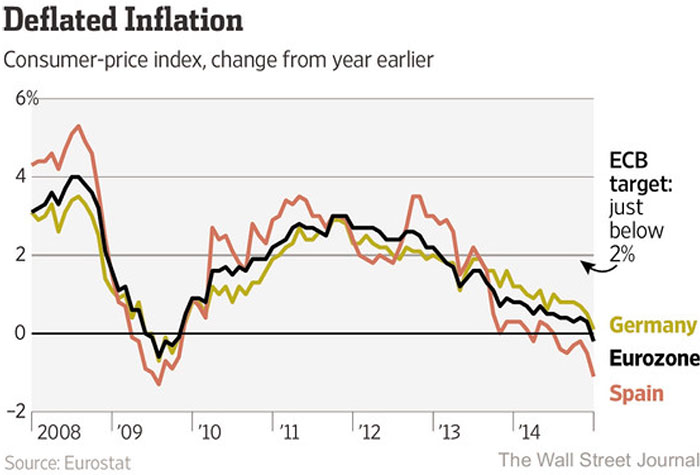

Here’s another very big story from 2014 that is carrying into 2015: there is plenty of deflation talk to go around, really serious business for the first time since the 2008 Financial Crisis/2009 Recession. The price of oil is a big factor and is contributing to falling prices for goods and services in Europe. With an oil price adjustment looking long-lived if not permanent, there also is a good bit of deflation in capital spending and jobs creation across America, as a goodly percentage of the total growth in both over the past five years have come from an energy renaissance that is a good bit less well lubricated at $40-ish oil/barrel vs. >$90. Ditto for all kinds of already-floated debt backing energy extraction projects which will face insolvency absent a return to much higher fossil fuel prices. And while a boon for consumers paying less at the Gas-N-Sip, there will be a noticeable shaving of the S&P 500’s prospective earnings sourced from energy constituents. There is also a giant sucking sound emanating from petro-economies from South America to the Middle East and Russia7, as billions and billions in revenues disappear from sovereign income statements and spending budgets.

Consumer price deflation in America, too? Yes says the last CPI8 print, with prices falling 0.4%. We even had football deflation debates overshadowing the usual ones over the best Super Bowl commercials, spicy chicken wing recipes, and cul-de sac/garage tailgate encampments – where does it end?

Speaking of football, let’s not forget that Japan’s prime minister solidified his support – via a “snap” election which he won – for the ultimate QE long ball he is throwing to fight deflation. Japan will therefore continue the printing of Yen on a scale9 that dwarfs the American and European10 versions. We always understood Japan as primarily a Shinto and Buddhist stronghold, but it sure strikes us as an Abe Maria if ever we saw one (forgive us our puns, as we forgive those….).

Seriously, do forgive us our mildly hectoring mother-in-law tone, but in a very real sense, there’s nothing funny about all this “money,” or rather there is – funny strange, not funny ha-ha. As we’ve written in this space before, the massive expansion of the Fed’s balance sheet is largely unprecedented in modern economic history, and no one wants to consider for very long the few precedents that exist given how disastrously they ended; what we do know is that monetary expansion on this scale is a necessary if not yet a sufficient condition for long term inflation.

Yes, we know, there isn’t any to be found, anywhere, really. On the

“-flation” battlefront, “de” is in while “in” is down and out. For now, when considering the possible perils they face, global policy makers are focused on slaying the deflation dragon and living to fight another day if its evil twin, inflation, darkens the door later. For our money (pun intended) they are probably making the best Hobson’s choice they can – in the face of high indebtedness, inflation means slowly “robbing” the lender by keeping borrowers afloat and paying back with slightly devalued dollars (or euros or yen), while deflation means default11, usually sooner rather than later. But all those trillions… it’s just a bit much – literally.

- As an aside, we lament the distressing tendency toward the mingling of politics, art, and fashion – we use the term loosely – in popular culture. For example, would someone please explain Che Guevara inspired t-shirts, tattoos and street graffiti designed, presumably, to idealize a form of government – communist totalitarianism – that has been documented as being responsible for tens of millions of murders and countless other crushed lives? (Here’s our personal favorite twist on this hideous movement – https://www.thoseshirts.com/lousy.html). Or our strategic or geopolitical rationale for re-opening relations with his intellectual – again used loosely – remnant spawn in Cuba at a time when they appear closer to collapse which will free their long-suffering and caged countrymen? And let’s not mention Kim Jong Un (Dear Leader #whatever), Seth Rogen, and The Interview fiasco. Note to self: watch out for North Korea cyber-hacks. But we digress.

- https://www.azlyrics.com/lyrics/billyjoel/wedidntstartthefire.html

- Dilbert (after making a “way-back” reference): “But now I’m dating myself.” Dogbert: “It’s not as if anyone else would date you.”

- There’s that T-number again – trillion – twelve zeroes – 1, 000,000,000,000 – (we counted this time and it’s still a lot).

- Greeks elevated the Syriza party to power status in late January; the far-left group is decidedly on record as wanting to renegotiate fiscal bailout terms with larger ECB neighbors. Proving once again the old adage: when someone owes you a small sum, it’s their problem; when they owe you a large one, it’s YOUR problem.

- See our 01/14/15 and 12/24/14 blog posts for more on the implications of oil’s slide.

- For additional thoughts on everyone’s favorite territory-grabbing oligarchy see our 10/31/14 blog post at https://fiduciaryvest.com/halloween-yen-shock-another-money-machine-ruble-shock-winter-withering/

- The Consumer Price Index for All Urban Consumers (CPI-U) declined 0.4 percent in December on a seasonally adjusted basis, the U.S. Bureau of Labor Statistics reported today. 1-16-15 https://www.bls.gov/news.release/cpi.nr0.htm

- “… the Bank of Japan has expanded its balance sheet from 40pc to around 50pc of GDP over about 18 months…announcing a boost to a quite incredible 70pc of GDP over the next three years. By that time, Japan’s monetary base will be close to the same size as that of America, even though the US economy is three times bigger and home to two and a half times more people. https://www.telegraph.co.uk/finance/economics/11247881/Japanese-QE-tsunami-risks-global-meltdown.html

- Head of the European Central Bank, Mario Draghi, (who famously said in 2012 he would do “whatever it takes” to preserve the euro common currency) announced a new $1.1 trillion bond-purchasing scheme that will last through 2016.

- “Do you realize what this means? It means bankruptcy and scandal and prison! That’s what it means!” Character quotes – George Bailey It’s a Wonderful Life IMDB – https://www.imdb.com/character/ch0004658/quotes

Copyright ©2015, FiduciaryVest, LLC; all rights reserved.

This publication is NOT intended, or suitable as a basis for investment decisions. Before taking any significant action, readers should seek professional investment advice that will incorporate their specific investment needs and circumstances.