Recovery Abounds

A year ago, indeed only 6 months ago, we and the world around us were in foxholes of varying depths, prescribed by the medically guided, un-guided, sometimes whimsical barrage of mandates issued by federal, state and city governments. It was nothing short of the reaction that might have unfolded if the US had suffered a massive invasion by a foreign army, replete with TV coverage of local war-theaters and constant, on-screen death counts.

Most of humanity was left to simply make up a personal lifestyle so austere that its socio-economic toll is yet to be measured…. if it ever is. And this tender situation was further confounded by a super-brutal four-year US political election cycle and a persistent, nationwide state of urban emergency caused by nightly protest and vandalistic destruction.

All of this seemed to present a gloomy case for near-term economic recovery. However, as we had predicted, the always forward-looking US stock market was not distracted by elections, social unrest, or even a pandemic. Instead, the markets’ initial March 2020 shock at the enormity of a rapidly unfolding pandemic was very short lived. Its Tech sector and a few others, in fact, saw less than 30 days of doldrums; instead, tech’s continuing invention and unfettered sales spurred the broad markets sharply upward, although the travel, hospitality and financials were understandable laggards. Even before 2020’s year-end, the market’s huge ship was sailing the high seas again, despite the considerable economic debris in its path. Now, the emerging Covid-19 Delta-variant (despite the capital “D”, it is not a hex on the same-named airline) does not appear to pose a significant threat to the market’s optimistic outlook.

BUT…. As of July 15, 2021, the NASDAQ Index’s aggregate price-to-earnings ratio stands at almost 29 times reported earnings. The S&P 500 Index’s p/e now stands at an estimated (alarming?) 36.6X, its trailing 12-month earnings (according to Birinyl Associates, July 16), which

The pandemic caused corporate debt to increase by $1 trillion, to more than $11 trillion. It has nearly doubled since the last financial crisis.

is up from a historically robust 25X when the pandemic began in 2020. JP Morgan’s June 30 survey of analysts’ consensus projected earnings is 21.5X, which is the highest mark since the late 1990s’ dot.com boom.

Overall, corporate credit quality is at an all-time low, amid 11 straight years of near-zero market interest rates. The percentage of corporate borrowers with credit ratings below investment grade – “‘junk” credit – is now at an all-time high of 58% The pandemic caused corporate debt to increase by $1 trillion last year, to more than $11 trillion today – the highest it has ever been. It has nearly doubled since the last financial crisis. We can readily imagine some bloody scenarios which will unfold when market interest rates finally rise to healthy, historically normal levels.

Companies that don’t earn enough profits to pay for their interest costs are called “zombies,” because they have no hope of paying off their existing debt. Throughout the last two decades, the number of zombies among the US’s largest 3,000 companies rose steadily…. until last year when their number skyrocketed. Now, there are more than 600 zombies, about 20% of all large companies, wallowing in $2.6 trillion of debt. So, what keeps zombies from simply imploding? Beginning last year, the Federal Reserve began buying newly issued, Covid-induced zombie debt.

Inflation Pops

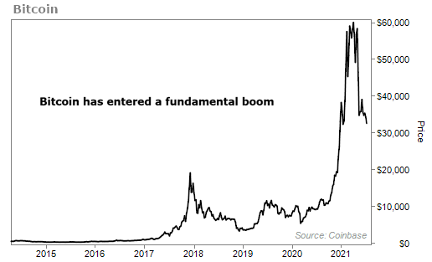

From the highest-ranking investment gurus to the least investment-sophisticated among us, the subject du jour in mid-2021 is the “I-word”, as prices of core products such as lumber, microchips, food and gasoline landed a serious blow to the solar plexus of manufacturers and consumers. The Federal Reserve’s Open Markets Committee which sets policy for interest rate targets announced that, while it was somewhat surprised by the virulence of recent price increases, it holds the cool, calm view that the current scenario (CPI up by 5.4% in 12 months, which is way, way above the Fed’s target) is “transitory”, pushed by the sharp, post-pandemic recovery of demand, versus the supply-side’s lagging ability to produce so much so quickly. So, the Fed is declaring its belief that recent price spikes will not continue to the end of the year. Indeed, the price of lumber has fallen sharply in recent weeks and crude oil futures indicate traders’ conviction that demand has peaked. One of the perhaps-bellwether indicators in the world of inflation readings is crypto-currencies, because cryptos have a precise, built-in limit to the maximum number of units that can ever exist. This characteristic therefore delivers an inflexible yardstick with which to measure the prices of goods and services paid for with cryptos, unlike purchases with US dollars that have an unlimited supply. While that equation is true, it does not ensure price-stability of cryptos.

Meanwhile, the Fed’s deep involvement in “financing” Congressional budget deficits of such enormity that World War II is the only comparison in modern history. Said financing is accomplished via the apparently simple creation of more money and then using that newly made-up money to buy real bonds, huge lots of them, monthly, in the public marketplace.

The Fed’s Chairman Powell says he’s not expecting to even consider raising interest rates until the country nears full employment, likely sometime in 2023. There are, however, so many facets of the Fed’s dollar-mill. There are so many, in fact, that we challenged ourselves to create a “Fed Impact Daisy Chain”. Our depiction of the Fed impact chain is on the last page of this article.

Double Doubleheader

On July 15th, Jeffrey Gundlach, the CEO of bond investing giant DoubleLine Capital contended in a CNBC interview that the US dollar is “doomed” in the long run.To blame are the spiraling federal budget deficit and the trade deficit, he says. “Ultimately, the size of our deficits—both the trade deficit, which has exploded post-pandemic, and the budget deficit, which is, obviously, completely off the charts—suggest that in the intermediate term—I don’t really think this year, exactly, but in the intermediate term—the dollar is going to fall pretty substantially.”

If the US Dollar really tanks, that would have an impact on the bond market, Gundlach said further: “That’s going to be a very important dynamic, because one of the things that’s helped the bond market, without any doubt, has been foreign buying, with the interest rate differentials having favored hedged US bond positions for foreign bond investors.”

Typically, a lower dollar goes hand in hand with low interest rates. As Gundlach indicated, US rates, while historically low, are higher than in many other nations. If overseas rates shoot up, we can expect foreign investors to shift money out of the US, and that would stress the US economy.

[Editorial note: This column has, for many years preached a consistent sermon: If you want to forecast the near-term stock market, use the current bond market as your basic tool.]

Gundlach is not alone in his dim dollar-view. Goldman Sachs has long argued that the US government and the Federal Reserve are making a mistake with their huge stimulus efforts that have flooded the world with dollars… $7.5 trillion of them*, up by $3.8 trillion [just over 100%] since the beginning of 2020. The dollar-creation flood may trigger a long-lasting inflationary trend that would cause serious damage to the dollar’s purchasing power value. [Please see our April 2021 Commentary, about the US Dollar’s aging reign as the world’s reserve currency.]

*The breakdown, as of July 1, 2021: the Fed’s $7.5 trillion investment holdings that were market-purchased with newly printed dollars:

US Treasury notes and bonds: $4.9 trillion

US Treasury bills: $0.3 trillion

Mortgage-backed securities** (Fannie Mae, etc.): $2.3 trillion

**The Economist magazine featured an article [the quest to quit QE] in which it growled “The Fed’s purchases of mortgage-backed securities, given America’s red-hot housing market, now look bizarre.”

COMPARISONS: the US’s expected 2021 Gross Domestic Product: $21.5 trillion and the total US Treasury debt held by the public, June 30, 2021: $22.3 trillion.

A Twenty-First Century US Monday Daisy-Chain

Nurtured by a Committee of 12 appointed Federal Reserve Executives*

*All 7 of the Fed’s Board Members, plus the NY Fed’s President and presidents of 4 Fed District Banks

The US Federal Reserve as creator/arbiter of global economics

- % Inflation-rate-targeting policy (begun in 2012, despite the Fed’s Charter requirement to promote “stable prices”)

- 21st Century fiat-Money-Creation Policy…. an “emergency” implementation scheme (3 times since 2000) that has….

- no peacetime precedent (relative to GDP)

- apparent permanence in future Fed policy

- an expanded number of dollar injection modes into the economy

- global copycatting by other primary central banks (except Swiss)

- Continuous Money Creation impact….

- upon the economy’s impact….

- upon employment/unemployment rates

- upon productive capital investment

- upon massive corporate debt-creation

- upon the US Treasury’s….

- facilitation of unlimited federal budget deficits

- wholesale issuance of “faith & credit”-backed debt

- upon the valuation of marketable securities:

- Equities:

- Market valuation mechanics (drives down investors’ earnings discount rate)

- Equity buy-back impact….

- upon (apparent) earnings per share

- upon executive compensation

- Debt: issuance & returns impact….

- upon suppression of investment yields

- upon expansion of credit risk-taking

- upon the currency’s impact*….

- upon ALL public and private debt repayments

- upon purchasing-power devaluation

- upon crypto-currency valuation

- Equities:

- upon the economy’s impact….

*Inflationary devaluation of the currency significantly reduces borrowers’ cost of fixed rate long-term debt; it also de-values the payback to lenders of their loaned principal.

Commentary

Commentary was prepared for clients and prospective clients of FiduciaryVest LLC. It may not be suitable for others, and should not be disseminated without written permission. FiduciaryVest does not make any representation or warranties as to the accuracy or merit of the discussion, analysis, or opinions contained in commentaries as a basis for investment decision making. Any comments or general market related observations are based on information available at the time of writing, are for informational purposes only, are not intended as individual or specific advice, may not represent the opinions of the entire firm and should not be relied upon as a basis for making investment decisions.

All information contained herein is believed to be correct, though complete accuracy cannot be guaranteed. This information is subject to change without notice as market conditions change, will not be updated for subsequent events or changes in facts or opinion, and is not intended to predict the performance of any manager, individual security, currency, market sector, or portfolio.

This information may concur or may conflict with activities of any clients’ underlying portfolio managers or with actions taken by individual clients or clients collectively of FiduciaryVest for a variety of reasons, including but not limited to differences between and among their investment objectives. Investors are advised to consult with their investment professional about their specific financial needs and goals before making any investment decisions.

Investment Risk

FiduciaryVest does not represent, warrant, or imply that the services or methods of analysis employed can or will predict future results, successfully identify market tops or bottoms, or insulate client portfolios from losses due to market corrections or declines. Investment risks involve but are not limited to the following: systematic risk, interest rate risk, inflation risk, currency risk, liquidity risk, geopolitical risk, management risk, and credit risk. In addition to general risks associated with investing, certain products also pose additional risks. This and other important information is contained in the product prospectus or offering materials.