The Debt Saga

History Is Us 1

The history of sovereign democratic governments’ money borrowings began with the continuous need for those organized societies to fund their militaries so that they could conduct the always-expensive wars of both conquest and defense against neighboring societies. That said, peacetime periods have not historically proven to be times when war-debt was repaid, or even reduced. In about 460 B.C., the Athenian statesman Pericles was apparently the first politician to understand the most powerful mechanism in a democracy: the engine of debt, he said, was… getting the populus to bribe themselves with their own money—which naturally created massive, ongoing entitlements and, hence, budget deficits. Later on, the belief of profound thinkers of antiquity, like Plato and Aristotle, told us that democracies are inherently fiscally irresponsible.

Governmental debt crises and debt impasses are not new to history. The refusal of great nations to solve their debt problems has had catastrophic results, from the days of ancient Athens in the 5th century B.C. right on up until our own time. Instructive examples include the fall of the Roman Republic, the French Revolution, and the rise to power of Adolf Hitler.

That lesson was apparently the primary reason why the founders of the United States gave its Congress complete control over the purse strings, including debt and borrowing.

In the year 60 B.C., Rome was still a republic. It had adopted an amazingly comprehensive, fair and balanced constitution which, about 18 centuries later, was greatly admired by the founders of the United States. There was the assembly of all Roman people—this was democracy, but it was carefully held in check by the power of the aristocratic Roman Senate. No motion traditionally could be brought before the people unless sanctioned by the Senate. The Senate had complete control of the finances. That lesson was apparently the primary reason why the founders of the United States gave its Congress complete control over the purse strings, including debt and borrowing.

Rome was perhaps the earliest global superpower among then-known nation-states. In an era that knew only one mode of mass transportation, i.e., on foot, Rome’s power was remarkably maintained by a widely dispersed, full-time professional army that was impressively organized and effective. But the army was also a heavy drain on the Roman treasury.

As magnificent as Rome was, it became un-attentive to its foreign policy; it hardly reacted to two competitors that rather quickly grew up on its frontiers—one was the central European tribes of Germans and Gauls and the other was Iran. In less than a century, Iran grew from a divided and weak nation-state into an economic powerhouse with a superb army which was badly underrated by the Romans. Moreover, Iran owned a great deal of Roman debt, and Rome had a huge negative trade imbalance with Iran (a la China’s 21st Century situation vs. the US).

This self-inflicted Roman foreign policy weak spot was accompanied by its lack of foresight in fiscal matters. So, in Rome the entitlements of the Roman citizens included everything from free food to free entertainment in the form of gladiatorial games and chariot races. Moreover, Roman citizens paid no taxes. No politician in Rome dared to either cut the entitlements or impose new taxes.

All of Rome’s taxation income was wrung out of the conquered working stiffs in Gaul and other provinces. They were not even granted Roman citizenship. But, even with those provincial taxes, the Roman treasury was essentially empty by the year 60 B.C. In fact, not only was there no money in the treasury, it had run up a huge debt that couldn’t be serviced. Even worse, the public debt was matched by massive private debt, because most Roman citizens behaved as though they had an unlimited ability to borrow money for spending on luxuries. This was also true of the Roman Senate…. bill after bill was brought forward to balance the budget and to pay down the debt. Massive infusions of money into the economy had no effect. Every sensible bill was blocked by the bitter partisan politics in the Senate.

Roman political life was divided between two parties. One was the Populares, which literally means the Democrats. They were the party of entitlements and an aggressive foreign policy. The other party was the Optimates, a name which translates into…. the party of traditional Roman family values; they were, only in principle, opposed to entitlements. In fact, they too gave birth to a number of freebees.

The two co-heads of Roman government and its Senate were in crisis and impasse until, in 59 B.C., they decided upon an un-democratic bailout; they desperately turned to a non-philosophical, no-nonsense guy, Julius Caesar, to become a consul… a chief operating officer as it were… despite his widely known status as a drunkard and womanizer. Julius understood that the only solution to Rome’s governmental mess was to have a dictator for life, a king. Over the next 12 years, through the conquest of Gaul, civil war, and by the complete manipulation of the Roman political system, he finally became Rome’s dictator. In so doing, Caesar dissolved Rome’s once-prized democracy. He was quite successful in fixing the apparently un-fixable Roman debt, deficit and taxation problems. He filled the Roman treasury by winning wars of conquest. He made the economy so sound that the welfare rolls were cut in half. And he established an equitable tax system by which the inhabitants of the Roman Empire worked just two days a year to pay their taxes. Despite Julius’s amazing military and governmental successes, he actually held his dictator status for less than a year before his ides of March assassination at the Senate building in 44 B.C.2

Money Devaluation, Roman style

The ever-mounting cost of foreign wars and the re-building of Rome after its disastrous fire in 64 A.D. caused Emperor Nero to raid the empire’s temples for their gold and silver. Perhaps more importantly, he reduced both the size and the purity of Rome’s gold and silver coinage…. i.e., the same purchasing value was backed by reduced precious metal content (identical to the US’s silver coin content reductions in the mid-20th Century). Rome’s devaluation process continued at a steady pace for the next 250 years or so. The decline and fall of the Roman coinage tracked its political disintegration and near collapse.

While Rome’s politicians fiddled away much of the power and success of their democracy, they did face up to the need to re-structure into a dictatorship that did what was necessary to re-boot financial soundness via new taxation and the necessary supporting hierarchy.

The global money pie has a formidable new slice

Today’s US Government seems to be at the depths of a 50-years-in-the-making bog that is hardening from within. Unthinkable a few years ago, today’s BRICS coalition of nations is apparently set to launch a formidable, competitive trading giant. It’s original namesake membership (Brazil, Russia, India, China, South Africa) will have a combined 2023 GDP of about 26% of the global total. Including its four new 2023 members (Saudi, UAE, Iran and Ethiopia), the coalition’s expected GDP climbs to almost 30% of the global total. Perhaps more importantly, the new BRICS will represent 43% of global oil production. More than a dozen other countries have applied for membership. We have little doubt that the BRICS will soon pursue a Euro-like currency that may push the US Dollar into a serious challenge against its global reserve status (held since the end of World War II).

Of debt and deficits

We have written many times about the US Dollar devaluation process that has gone on for the past 90 years. The government’s ballooning debt, fueled by its persistently growing annual budget deficits has created the same situation as ancient Rome experienced. In the 21st Century, physical manipulation of the gold-backed currency (which ended in 1971) is no longer possible. Now, the Federal Reserve: (1) creates whatever amount of new dollars that are needed (2) to fund newly issued US Treasury debt that will (3) “pay for” the new federal deficits, which then creates (4) the periodic need for Congress to “bless” the next chunk of debt balloonizing. For convenience, and apparently for political psychology, the US federal debt which grew into such a huge number of billions was conveniently re-stated as a thousand-fold smaller number of trillions.

Is this infinite-debt-and-money-supply process a game that can go on indefinitely? It turns out that its continuation seems to merely require a single element of what we might call “no-cost sustainment”, i.e., unwavering system-trust among the players (a body of global central banks and other key operatives who adopt nearly identical money policies) that have no choice but to believe that the system must and will continue. Even when there is a break in its watermain (bank runs, major corporate debt defaults, pandemics), the rescue-plumbers at the US Fed and Treasury have to believe they can guarantee/create/re-assure/sidestep obstacles, as needed to allow financial flood waters to drain harmlessly into the global ocean of expanding amounts of US Dollars.

Where does the US Government stand on its debt?

The US is struggling all by itself, within itself, to govern itself. On August 1, a 2nd credit ratings agency, Fitch, cut the US Government debt’s topmost credit rating by one notch. After considerable analysis, research, and interviews, Fitch said its decision “reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance”, being political difficulties that the U.S. government has had in addressing spending and tax policies compared with other countries with similar debt ratings. These are strong words indeed, and they are plain and clear enough for all to understand without misinterpretation….. plain enough to cast considerable shame on both major political parties. Moreover, in the six weeks until now since Fitch’s August 1, 2023, downgrade, the Republican members of the US House of Representatives have staged a never-before, open-ended internal battle over debt and spending that is rendering the House unable to carry out any legislative functions…. Maybe Fitch will have to re-visit its rating again.

Our long-time readers know that we never attempt to predict anything near term about the US stock market. Instead, we find that tapping the pulse of the debt markets is the most reliable way to set expectations for upcoming stock (and bond) market movements.

Fitch’s conclusions surely included calculations to measure and incorporate the impact of the downgrade’s add-on interest expense, coupled with the Fed’s rapid, robust interest rate bumps during the 18 months since March 2022. Together, these braking moves will mean that taxpayers must shoulder a huge interest cost increase on the federal debt, compared to the Fed’s previous near-zero-percent interest rate regime….. held for more than 14 years!

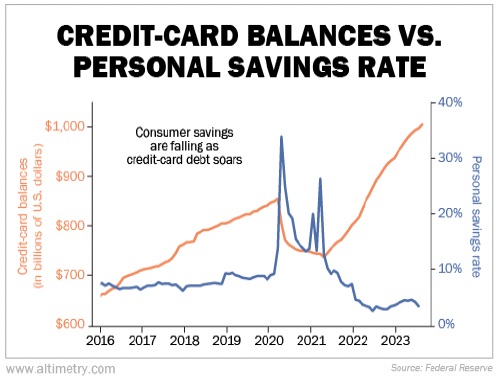

Where do consumers stand on their debt?

Pulse: Consumers have played post-pandemic “consumption catch-up”, just in time to pay much higher interest rates on their credit cards.

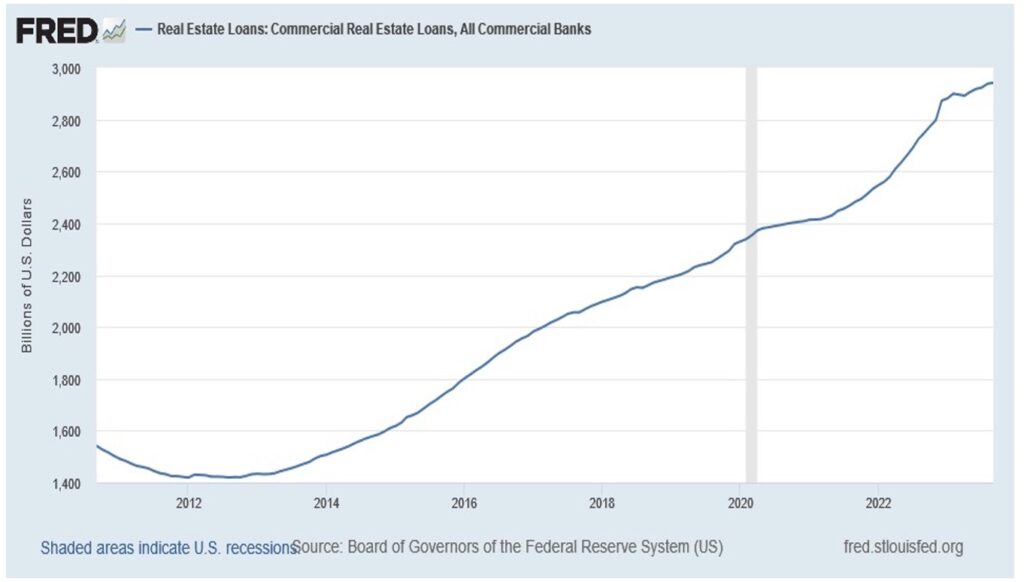

The status of US commercial mortgage loans

Pulse: Commercial real estate loans (office, apartment, hotel, shopping center and other buildings that operate on income from leases) have mortgages that typically mature within 3 to 10 years and are expected to be rolled over to new financing. A ton of commercial re-financings will occur, apparently in the teeth of unusually high market interest rates.

According to Trepp data, an estimated $528.7 billion of commercial mortgages mature in 2023, and an estimated $2.75 trillion of loans are set to mature between this year and 2027, which is nearly half the entire $5.67 trillion of commercial loans outstanding. In addition, office building leases are on the rocks, as the work-from-home infection has set in, apparently permanently, causing office tower owners to plan for costly office-to-apartment conversions and the inability to lease during construction.

Conclusion

The US government’s political element and its monetary and fiscal managers are facing a tidal wave of financial challenges… a massive, less than 3 year old debt-pile that will see massive increases in its interest burden, inflation that is not yet killed (auto industry labor union demands for 40% pay increases apparently mean they are convinced that significant inflation is very much alive), a federal budget that is yet to be prepared while the House of Representatives is squarely in a non-functioning legislative ditch…. all of which is challenging enough, but the political failure seems determined not to budge. A work-through will require a reasonable level of order and co-operation that replaces the current utter disorder, reasonably strong and focused leadership that replaces rigid ideological pettiness.

Viewpoint: The August 1st Fitch downgrade of US Government debt quality from AAA to AA+ is bad enough3, but we think that credit rating company’s starkly gloomy words should get most of the attention from everyone in financial circles. Fitch offered no hopeful words in describing the seriousness of the immediate (3-year horizon) federal debt situation, although they did rate the situation as stable. Despite the historically damaging impact of emerging debt crises upon equities, as of this writing, the US stock market, and the US Dollar are glowing brightly, perhaps in part to reflect a temporary surge of non-dollar investors seeking to avoid the weakness of local currencies.

[1] Roman facts acknowledgement: J. Rufus Fears (Ph.D., Harvard University) classics professor, University of Oklahoma, March 6, 2012

[2] The first and second Centuries A.D., the age of Roman rule under a string of Emperors (Pax Romana) beginning with Augustus Caesar (Julius’s adopted son) remains, to this day, the most peaceful times ever known among what we now call the Middle East countries.

[3] Let’s not forget that until rather recently, US Government bonds and notes were universally considered to be the world’s only risk-free investment paper.

COMMENTARY

Commentary was prepared for clients and prospective clients of FiduciaryVest LLC. It may not be suitable for others and should not be disseminated without written permission. FiduciaryVest does not make any representation or warranties as to the accuracy or merit of the discussion, analysis, or opinions contained in commentaries as a basis for investment decision making. Any comments or general market related observations are based on information available at the time of writing, are for informational purposes only, are not intended as individual or specific advice, may not represent the opinions of the entire firm, and should not be relied upon as a basis for making investment decisions.

All information contained herein is believed to be correct, though complete accuracy cannot be guaranteed. This information is subject to change without notice as market conditions change, will not be updated for subsequent events or changes in facts or opinion, and is not intended to predict the performance of any manager, individual security, currency, market sector, or portfolio.

This information may concur or may conflict with activities of any clients’ underlying portfolio managers or with actions taken by individual clients or clients collectively of FiduciaryVest for a variety of reasons, including but not limited to differences between and among their investment objectives. Investors are advised to consult with their investment professional about their specific financial needs and goals before making any investment decisions.

We welcome readers’ comments, questions, criticisms, and topical suggestions about our Commentaries, which always contain a mixture of researched facts and conclusions about their impact. We diligently strive to avoid controversial, or partisan views. However, our conclusions clearly cannot always align with our readers’ various interests and personal points of view.

The research topics and conclusions herein are not “FiduciaryVest, LLC viewpoints,” nor are they attributable to its individual employees.

INVESTMENT RISK

FiduciaryVest does not represent, warrant, or imply that the services or methods of analysis employed can or will predict future results, successfully identify market tops or bottoms, or insulate client portfolios from losses due to market corrections or declines. Investment risks involve but are not limited to the following: systematic risk, interest rate risk, inflation risk, currency risk, liquidity risk, geopolitical risk, management risk, and credit risk. In addition to general risks associated with investing, certain products also pose additional risks. This and other important information is contained in the product prospectus or offering materials.