Back to Work!

Well…Perhaps Not So Fast

At this time a year ago, the US was dipping its toes into the delights of on-street drinking and dining with one or two family and friends. A limited-mingling-Thanksgiving lay just ahead. But, on the bummer-side of October 2020, creation and distribution of a Covid vaccine was not in the cards; months earlier, prominent bio-scientists had cautioned that such a development was surely years away.

Airlines, cruise lines and hotels were about one level above being lights-out dormant. Convention gatherings, performing arts, professional golf and cheering throngs in sports stadia all languished in a fug-get-about-it zone. Institutional education functions had been reduced to an on-screen experience, to the extent it took place at all.

In the workforce, Covid was extremely unfair. There was of course an unprecedented demand for overtime-exhaustion level healthcare workers and high risk, mostly blue-collar jobs that required 100% on-site workers, such as midwestern meat packers, grocery and drug store employees. For millions of others whose on-site presence was not required, white-collar, pajama-clad workers sat at home computers, participated in virtual meetings and delivered near normal job performance.

Meanwhile, the US stock market shot upward on an astounding run, following its five-week [2/12 to 3/23] 37% Dow Jones “Covid-crash”. The late April 2020 surge turned out to be a never-look-back skyrocket that made the March crash into a straight down, but temporary blip, especially among NASDAQ’s technology shares. In September 2008, we had seen the US Congress emerge from an emergency economic briefing that “sucked the air out of the room” following an abrupt financial-sector collapse. Likewise, the spring of 2020 again saw the Congress in bipartisan panic about prospects for an economy-wide, government-ordered shutdown of countless business operations caused by a worldwide virus for which there was no medical preventative, or treatment. So, Congress swung into an un-accustomed bipartisan working mode that produced a new avalanche of cash “stimulus” payments to many/most working Americans, and to most of their employers and to state and local governments. After a predictably rocky start, it worked mostly according to intentions.

Congress swung into an unaccustomed bipartisan working mode that produced a new avalanche of cash “stimulus” payments to many/most working Americans.

But then, as the worst economic stagnation began to ebb and un-freeze in late 2020, the Congress re-doubled those cash distributions. And, in early 2021, they did it a third time. The immediate-impact “Covid relief” legislative packages enacted into law total $5.3 trillion 1 . The last of these bills was a nearly $2 trillion package that was the most controversial of all the Covid bills, because it provided direct cash payments to a large majority of individuals, regardless of their economic need, or absence thereof. In addition, it extended the monthly payout of beefed-up benefit amounts delivered under the unemployment compensation structure.

Bizarre Economic Wrinkle

As discussed above, the economic stage had been set for a well-tended, very costly sail through the pandemic shutdown. But something hard to believe had happened on the way to 2021 workplace recovery: job openings in nearly all industries were cascading down the chute so fast that many jobs remained unclaimed. And, as of now, they are still open…. vast numbers of them. This, despite the fact that big box retail employers, notorious for their huge, predominantly minimum-wage workforces suddenly increased their starting minimum pay by a large percentage. Nearly all manufacturing employers are unable to get necessary raw materials from their labor-starved suppliers and, even when they succeed on the supply-side, their own labor shortages gum up normal production volume. And, in between those labor-challenged employers, there are the shippers who cannot adequately staff their trucks, ships and planes. More than a half-million transport jobs are now unfilled, according to the US Dept of Transportation.

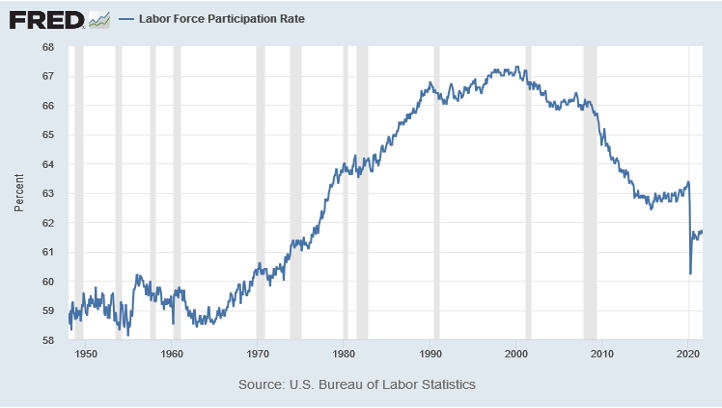

The deep economic disruption that occurred in 2008 caused a sharp spike in the number of people seeking, but not finding employment. Not so in 2021. The unemployment rate in September was actually good… 4.8% and falling. But, that good-getting-better percentage is not mostly caused by more people finding jobs. Instead, it’s because the number of people currently being paid to work + those who are seeking work (i.e., the Labor Force 2) is shrinking. In fact, the Labor Force as a percentage of the eligible Population2 has been steadily declining for most of the last 20 years. Very recently, we have experienced a pronounced Labor Force down-spike. As things stand now, almost 40% of the eligible job holders and self-employed are not even seeking to earn an income, while millions of advertised jobs go unfilled. Not since about 1970, has there been such a low Work Force percentage of the eligible. Please see the graph below.

The Fed Continues to Rule

The 13-year US Federal Reserve manipulation of essentially all things financial not only continues but was recently amped-up to create and deliver a fresh avalanche of new 2020-21 Covid-fighting dollars (a 116% new-dollars increase, since January 2, 2020). The Fed’s process first creates, then lends those new dollars to the US Treasury, by way of open market purchases of the Treasury’s newly issued and existing debt and Treasury-guaranteed home mortgage-backed bonds. It’s a pretty slick system: every new dollar is automatically deemed to have the same purchasing value as every “old” dollar. So, every week the Fed goes to market makers and buys bonds, using mostly new-born dollars. It works every time. Sellers of those bonds have never (yet) insisted upon a discount for accepting payment in new dollars.

Meanwhile, the Treasury comes out well, because the Fed’s charter requires it to pay back to the Treasury its net interest income collected from the Treasury on its bond holdings. As of September 30, 2021, the Fed’s bond investment assets amounted to just below $8 trillion. By comparison, in late September 2008 (the beginning of this program), the Fed’s bond holdings amounted to a mere $0.5 trillion, a 16-fold expansion. Today, the Fed’s buying program is still adding bonds every month, at its accustomed $1.4 trillion annual rate, although it has indicated that its buying volume will probably be reduced, by some amount, beginning sometime later this year. The bond market has predictably responded by modestly beginning to fidget with interest rates.

Make no mistake; this 13-year, off-and-on money creation scheme is not only unprecedented, it is now deeply embedded and institutionalized among central banks and market makers worldwide; therefore, its unwinding, if attempted, will likely be a homeward journey without a compass, made especially delicate because it will necessarily pressure market interest rates higher amid unpredictable, uncontrolled global economic conditions and market-maker reactions. Why would such a successful money-creation regime be unwound? Indeed, it amounts to an ordained Belief System, shared among the world’s leading fiat currency issuers [led by the dollar, euro, yen and pound-sterling issuers]; it appears to be unimpeachable; it offers total control over currencies, and it offers complete financial flexibility and accountability, all without much, if any need to deal with market forces.

Not so fast…. There is a serious and rapidly expanding challenger to the Belief System’s trusted dependability: cryptocurrencies. Unless the fiat currency-world’s governments can manage to regulate and de-fang the cutting edges of blockchain technology, it appears that the cryptos will soon emerge as a credible threat to the free-wheeling respect that is accorded to fiat currencies. A significant volume of transactions is occurring, and their pace is accelerating.

At last, inflation awakens

Beginning in 2012 (i.e., not long after the Fed’s bond-buying program got to center-stage), the Ben Bernanke-led Fed officially began to target a 2% annual inflation rate, as a partial goal of its responsibility to manage monetary policy. The Fed was never very straightforward about its new inflation targeting regime, but indications were that the Fed had been so spooked by the 2008-09 threat of de-flation that it came to believe a modest inflation rate is the appropriate tool for continuously fulfilling its Congressional Charter mandate to maintain “stable prices”. Because of the Fed’s 2009-until-now massive bond-buying program, inflation rates (and interest rates) have been below 2%, for most of the last 10 years.

That was then; this is now. The CPI-U index’s inflation rate, across nearly all categories of consumption, has spiked from around 1.7% in early 2021 to a steady 5%+ in every month since April. Despite Fed Chairman Powell’s springtime pooh-pooing of the potential for any longevity in the inflation spike, the economy seems to be proving him to be off the mark. Moreover, everyday consumables such as gasoline and food are posting fierce price increases which predictably produce an almost forgotten public sense of “inflation expectation thinking.” For various chain-linked reasons, those expectations naturally beget more inflation, notwithstanding technical news to the contrary.

China in change

Despite its perch as the world’s 2nd largest economy, which is home to the world’s 2nd largest number of billionaires , communist-governed China is officially categorized as an “emerging market” country. How is that? The answer seems to be the ranking of a country’s GDP per capita. The US, for example, recently ranks 8th and China ranks only 79th, according to the World Bank. China’s two largest stock exchanges (Shanghai and Shenzhen) have a combined recent market value of not-so-tiny US$8.6 trillion, compared to the NYSE’s $29 trillion.

The MSCI China Index is composed of 5 share classes, representing 740 corporate shares; “B” shares are quoted in foreign currencies and open to foreign investors and some large China companies have ADRs, or shares traded outside of China. The Index return for the quarter ended September 30, 2021, was -18.1% and -16.6% YTD. China’s two mega-companies are Tencent Holdings (TCEHY: $341B) and Alibaba Group (BABA: $277B).

China’s currently significant regulatory re-org is in process, up and down the social spectrum. US advisors are generally rating China shares as currently requiring a risk premium return.

Covid redux

The world’s battle with pandemia is laboring under a second surge delivered by Covid’s so-called delta-variant which tends to strike people who escaped the first version and also many who have already been vaccinated. Meanwhile, in the 9 months year-to-date, vaccinations are progressing by the millions.

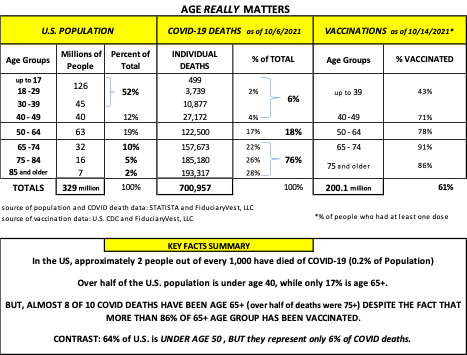

Since the beginning of the always on-screen Covid-counts being published and maintained minute by minute, we have always considered the data reporting to be little more than raw information having neither perspective, nor impact measurement. This writer determined that the most meaningful Covid data ought to measure Covid’s death rate, and more specifically the death rate by age groups, because it was clear, early-on, that the age 65+ demographic group was suffering a heavy, tragic death rate that was many times higher than that of younger ages. The age-phenomenon was therefore a logical category to produce a higher death rate which was easily understood by hospital physicians, because older covid patients often had pre-existing, diseased vital organs. Another general condition that became a prominent death-cause is obesity.

Please see our table of various death-focused covid statistics, below.

Commentary

Commentary was prepared for clients and prospective clients of FiduciaryVest LLC. It may not be suitable for others, and should not be disseminated without written permission. FiduciaryVest does not make any representation or warranties as to the accuracy or merit of the discussion, analysis, or opinions contained in commentaries as a basis for investment decision making. Any comments or general market related observations are based on information available at the time of writing, are for informational purposes only, are not intended as individual or specific advice, may not represent the opinions of the entire firm and should not be relied upon as a basis for making investment decisions.

All information contained herein is believed to be correct, though complete accuracy cannot be guaranteed. This information is subject to change without notice as market conditions change, will not be updated for subsequent events or changes in facts or opinion, and is not intended to predict the performance of any manager, individual security, currency, market sector, or portfolio.

This information may concur or may conflict with activities of any clients’ underlying portfolio managers or with actions taken by individual clients or clients collectively of FiduciaryVest for a variety of reasons, including but not limited to differences between and among their investment objectives. Investors are advised to consult with their investment professional about their specific financial needs and goals before making any investment decisions.

Investment Risk

FiduciaryVest does not represent, warrant, or imply that the services or methods of analysis employed can or will predict future results, successfully identify market tops or bottoms, or insulate client portfolios from losses due to market corrections or declines. Investment risks involve but are not limited to the following: systematic risk, interest rate risk, inflation risk, currency risk, liquidity risk, geopolitical risk, management risk, and credit risk. In addition to general risks associated with investing, certain products also pose additional risks. This and other important information is contained in the product prospectus or offering materials.