Market Commentary August 2015

A friend with a penchant for sociological observation and musical appreciation titled a recent email about a 1980s “renaissance” tour – Rick Springfield1, Loverboy, and The Romantics– with a cheeky question: where to begin? We feel similarly about economic and market conditions with almost two-thirds of 2015 already in the history books.

A friend with a penchant for sociological observation and musical appreciation titled a recent email about a 1980s “renaissance” tour – Rick Springfield1, Loverboy, and The Romantics– with a cheeky question: where to begin? We feel similarly about economic and market conditions with almost two-thirds of 2015 already in the history books.

Had we published in early summer, several conspicuous economic matters were vying as big news items occupying investor attention, most obviously the discussion about the timing and pace of US interest rates’ pending upward adjustment by the Fed after eight years (!) of zero-interest-rate-policy. A close second would have been the halting “progress” on (another) renegotiation of Greece’s sovereign debt in Europe, which rightly had other highly indebted EU neighbors (and their creditors) on edge all summer. Oil’s price recovery (as of now clearly a head fake) was another potentially long-tailed major economic factor in the early summer. Oh, and Puerto Rico defaulted by paying less than 2 cents on the dollar for a $58 million payment due August 3, a mere fraction of $72 billion in borrowings that PR’s governor has termed ‘not payable.’

But for really big news, the pixels were barely dry on our Greece2 blog post when East muscled West off center stage (have you noticed how Asia is in the right hand margin on Western maps?) with several shots across the global economic bow from China. There have long been misgivings about the Middle Kingdom’s slowing economy (the world’s second largest and only major one to grow robustly post-2008), national and local government debt binge, and uncertain political retrenchment and motives of its relatively newly reconstituted communist leadership.

These underlying rumblings are now accompanied by a serial run of large gaps in the Shanghai stock market, coupled with a confusing and unexpected downward adjustment by China to its stated currency relationship with the US dollar. (As well as a currency injection to its banks, which works contrary to the currency adjustment. Got all that? Neither do we – or the markets).

While Shanghai stocks remain in the black year-to-date (at publication after another -8% day) and the devaluation was <2% (the yuan is also positive relative to other major currencies in 2015, along with the US dollar), these twin signposts have observers concerned about the opacity and presumed sporadic fabrications of a “market-facing,” yet highly state-controlled economic system. The Chinese government’s “management” of its stock “market” (that those two terms are placed together in a sentence is its own indictment) is particularly troubling for its ham-handedness, with widespread and weeks-long suspensions of trading, sudden “encouragement” of local Chinese pension fund ownership of equities, outright forced buying of shares, meting out ‘punishments’ for ‘spreading rumors’, (posted: floggings will continue until morale improves!) and other market-unfriendly behavior.

2Q 2015 Market Results

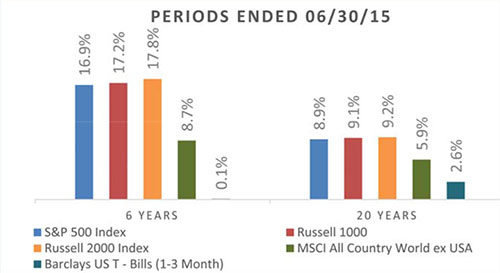

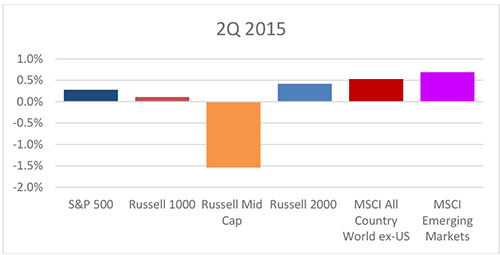

While Greece’s interim dénouement (really just another delay) and China’s jitters were future events in 2015’s second quarter, the markets’ discounting mechanism likely was hard at work incorporating these (and other – see our Outlook section below) risks and concerns into an uninspiring array of market returns – pretty much all rounding to zero – across the asset class board.

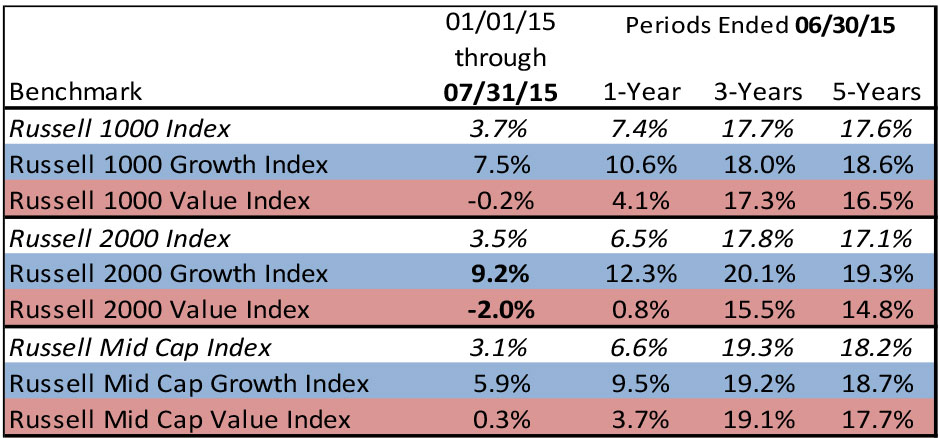

It is also noteworthy that quite a sizable gap has opened up between the growth and value equity management styles, particularly in recent time periods and in a VERY pronounced fashion for small-caps. While not a formal component of our proprietary rebalancing methodology, the chasm between growth and value shares suggests at least a return to an equal-weighted relationship between the two styles where both are present in portfolios, if not a slight tilt towards the under-performing value segment.

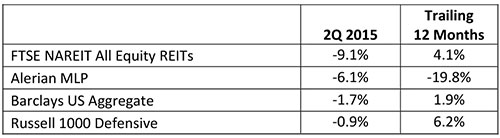

Yield sensitive market segments – bonds of course, but also REITs and MLPs, and defensive equity styles where dividends may weigh more heavily in stock selection – generally lost ground given the well-publicized intention of the US Fed to raise interest rates beginning in late 2015.

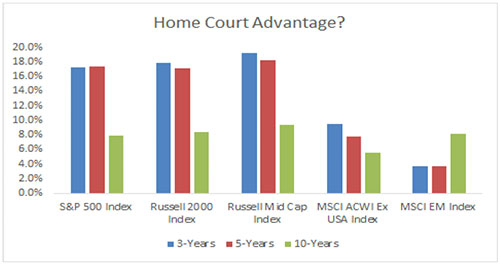

In addition to the growth/value dichotomy, there are at least two other noteworthy divergences in reviewing historical investment performance for diversified portfolios. The first is the gulf between domestic and ex-US benchmark returns for equity markets.

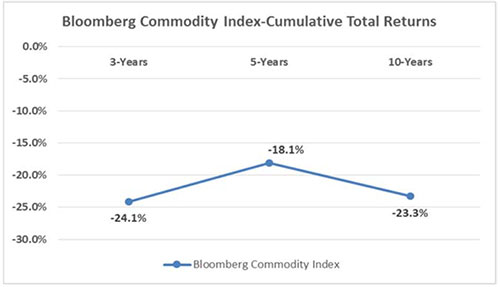

A second anomaly one can also not help but notice is the absolutely abysmal returns for commodities, which is unsurprisingly the only asset class in our systematic review that is giving a recent positive rebalancing signal. Our preference for executing commodity-related portfolio exposure is through managed futures strategies, which allow for both long and short positions and include trading in currencies and financial futures instruments in addition to commodity contracts. While these generally diversifying strategies have also lagged equities in the up-leg of the post-recovery market cycle, adding the short side and expanded universe has allowed them to remain merely disappointing in their overall impact on portfolio returns, buffering the ghastly performance indicated in the chart for long-only broad-based commodities.

It is plausible that value-oriented investors with long time horizons and decision making structures that encourage patience and a contrarian bent might want to consider averaging their way into a commodity exposure in the face of what is sure to be near revulsion among investors considering trailing historical results. For our part, we still do not recommend “catching the falling knife” that commodities today appear to be, though we generally support maintaining managed futures target weights for exposures that are derivatively (pun intended) related to commodities, and which historically provide a form of insurance against the underperformance of traditional stock/bond positions.

Outlook

As we prepared to publish, China’s stock market adjustment continued and has influenced more mature capital markets, with US equities recently posting their worst drawdown since 2011. Against this backdrop, we proffer a few notable concerns we’ve seen reported/been pondering, connected by the stream of consciousness quotes to which our mind seems unavoidably drawn.

Toto, I’ve a feeling we’re not in Kansas anymore…

– Dorothy

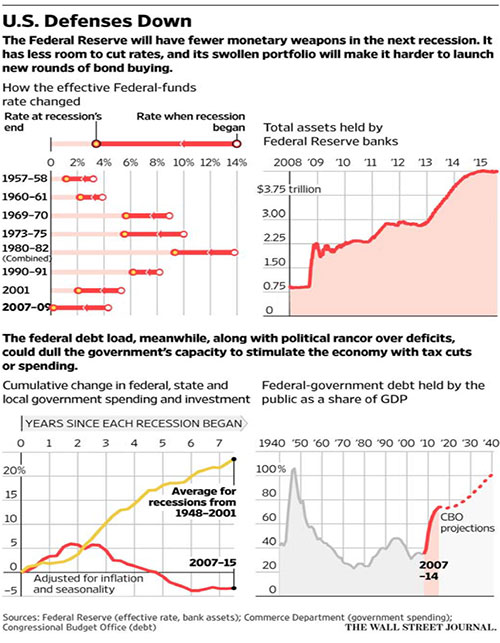

The US Fed is loudly on record as indicating they want a gradual return to normalized interest rate policy, sooner rather than later, though it faces a bit of a dilemma in now delivering said move. To a degree, Fed Governors have painted themselves into a corner on interest rate policy – if they don’t raise soon, they are inconsistent at best and markets rightly worry: “when exactly will it be a good time to get back to ‘normal’?” [An excellent question, in our view.] If they do follow through on an initial hike, they risk sending an already strong US dollar higher, denting exports, dampening liquidity, and extending recent market jitters, perhaps into a full blown bear market.

Proper direction is far from obvious. US economic headline data – low calculated unemployment, cheaper oil keeping a lid on consumer prices and money in their pockets, weak but positive GDP expansion – lends credence to the view that it might be time to see what the economy can do without monetary training wheels. Yet China’s stream of surprises make the Fed’s job demonstrably harder, as investors remain nervous about the US dollar attracting even more relative capital in a yield-starved world. There are justified worries over the knock-on impact of crimping US company exports and threatening the economy’s fragile “green shoots.” All while the rest of the world may be competitively devaluing their currencies.

That the US is the envy of the developed economies with ~2% GDP growth and a 5.3% unemployment rate – goosed by a decades-low labor participation rate3 – are two exemplars of “the soft bigotry of low expectations” in the post-crisis world. PIMCO labeled it the ‘new normal;’ ‘actually zero after inflation, sort of tepid and maybe someday mediocre-at-best’ is less catchy but more descriptive. We’re raising rates to ‘keep a lid’ on a ~2% growth rate?

And here’s a thought we’ve seen nowhere else yet: if the Fed doesn’t move rates up soon as expected, they defer the decision to calendar 2016, which happens to be a US presidential election year, in case Donald Trump hasn’t told you. Hiking rates during elections tends to be unpopular with incumbents of either party seeking to extend their occupancy of 1600 Pennsylvania Avenue.

All I wanna tell you is now you’ll never, ever, ever have to compromise…

– Rosanna, by Toto

We don’t want to get off on a rant here, but…Yes, you’ll never have to compromise; unless you choose to do so by throwing money at speculative business models like the two highlighted below in today’s ultra-forgiving, ‘just promise me tomorrow’ equity environment, one that is starting to remind us a bit of 1999, in direction if not quite magnitude or breadth (yet).

“Amid Tesla4 Motors Inc.’s rising share price Thursday in the wake of announcing a $500 million stock sale, the auto maker on Friday morning disclosed in an SEC filing that the deal’s minimum size was raised (emphasis ours) to 2.7 million shares from 2.1 million…”

“Honest5 Co., the baby-products retailer co-founded by movie star Jessica Alba, has raised $100 million in a new round of funding, valuing it at about $1.7 billion, according to a person familiar with the matter. The funding boosts the e-commerce startup’s value by more than 50% since it last raised funds a year ago.”

In our view, such anecdotal cases of relatively unproven businesses raising gobs of easy money indicate an attitude of at least capital market permissiveness if not outright absurdity. Elon Musk may6 be today’s, um, Nikola Tesla as far as we know. We love babies as much as the next guy, and while pleading the Fifth on affections towards Ms. Alba, her company may prove as good an investment as she is fetching. We have our doubts about either example (for investors, not hucksters…ah… we mean founders, or for customers necessarily), but our larger point is that deals like these only get done when investors’ collective risk-sensitivity has become dulled, by the opiate of years of positive returns barely interrupted by any real downside pain.

Well, Jane, it just goes to show you, it’s always something — if it’s not one thing, it’s another.

– Roseanne Roseannadanna

Because you don’t have to look too far really for legitimate concerns in economics or geopolitics, any of which might re-price the risk environment in a hurry. The revolving door of Greek restructuring indicates an apparent lack of political will for structural economic reform in major developed Europe. The US may be the best house on a bad block on this front, but has shown similar intransigence in tackling the long term entitlements which multiply our debt-to-GDP load (73% at 4Q 2008 to 102%! Q1 2015) several times over.

The Middle East remains a draw of armed resources of all stripes and may be entering a new military expansion phase – plausibly including nuclear weapons – of its divided (and sub-divided) local states. Recent high tension on the Korean peninsula with a young untested leader on one side of the border is a reminder of the potential for low-probability but very high-severity events in Asia.

And of course we’ve noted China, which pretty much sailed right through the 2008 crisis, and its recent strains; they too have created money via a debt binge that no one can really measure because their economic model makes Greece appear a paragon of financial transparency. Now that the mandarins7 seem to have lost their fine-tuned control of the economic machinery, and since China was the only global growth counterbalance post-crisis, their disarray and economic slowdown are having serious after-shocks.

Then there is domestic politics, where Peggy Noonan nicely summed up the presidential race so far in a recent Wall Street posting, “No one knows, because we’re in new territory, with a rogue real-estate developer and reality-TV star as a prime presidential prospect.” There must be other items we’re missing, but the above litany gives an idea of the abyss into which Janet Yellen and Co. stare, (with frogs, hail and locusts possibly to follow).

“Life is just like a fruitcake. When you look at it, it’s rich and sweet with honey and sugar and spice, tastes delicious, makes your mouth water and everything. But if you look at it real close, there’s these weird little green things in it and all that and you don’t know what it is!

-Nana Roseannadanna

Such macro events have the investment world on tenterhooks largely because we have simply “never-ever” been where we are today in terms of interest rates and monetary policy on a global basis. We know rates are low, close to zero, and even negative globally. We know that much of the institutional memory of current investors consists of a falling rate environment and a smaller but meaningful cohort to the era of presumed central banker omniscience/omnipotence. We know that central bankers globally have implicitly and sometimes explicitly pledged to do ‘whatever it takes8’ to prevent disorderly price adjustments (our term) in the financial markets. We know that trillions of dollars, euros, yen, and yuan have been spun as from whole cloth to facilitate the market stability goal.

What we do not and cannot yet know is what will be the consequences, intended or not, of all this financial engineering. As one possible flashpoint, we offer the parade of worries we’ve heard from asset managers related to price gaps in any liquidity strain inspired by a Fed move in a post Dodd-Frank regulatory era where investment banks are restricted from taking proprietary positions.

We do not know who will buy when everyone wants to sell. We do not know what will happen to collective investment vehicles like ETFs and their prices where they offer more liquidity than the underlying assets they own. We do not even know how, exactly, the Fed will engineer their diktat of one (or more!) rate increases should they wish to. The traditional protocol suggested selling securities into the private marketplace, sucking up liquidity, raising competition for cash and increasing its price, i.e., the rate of interest. But now we do not know if the Fed is prepared to meaningfully shrink its sizable balance sheet which was built through successive QEs. We do not know how a semi-generation of traders, conditioned for such QEs to ride to the rescue in every whiff of price correction, will react to the first move up and the prospect of others to follow.

Lions, and tigers, and bears! Oh, my!

We view all of this as pretty fertile ground for the equity selloffs that history tells us are periodically going to happen. To wit, we said a few months ago that if you believe in mean reversion (and we do), you should also prepare for and expect lower nominal returns from risky assets than those we’ve gotten used to since 2009. The only way for the left and right sides of the chart below to be reconciled is for much lower/negative returns to intrude into the return pattern, unless you expect permanently higher returns from capital markets.

We just don’t know and we suspect it comforts no one (certainly not us) that in an article dedicated to acknowledging the argument proposed in the paragraphs above and inquiring what is to be the ‘second act’ associated with any new financial shock, former Fed Chair Ben Bernanke waxed rhapsodic that “It does look like rates can go more negative (emphasis ours) than conventional wisdom has held9.” Strange experimental monetary policy not adequate to the task of saving the financial world? Rinse and repeat, with ‘new and improved’ shampoo. Of course that’s just our opinion; we could be wrong.

What makes the Hottentot so hot? What puts the “ape” in apricot? What have they got that I ain’t got? Courage!

‐ The Cowardly Lion

We know none of the above is particularly welcome news in the near term, but we adhere to the ‘forewarned is forearmed’ principle in assisting clients in managing assets and risk. After all, our esteemed – and now emeritus, see box to right – CIO long ago taught us a timeless principle of investing: one of the most important things we can do is to set expectations appropriately. If we do that well, surprises are less… well, surprising, and we’ve a hope of clear-headed response when turmoil rules the day.

We are encouraged that we’ve developed solid tools and processes (especially the broad asset class diversification and portfolio rebalancing that usually get most loudly questioned during the bull portion of a full market cycle) to help fiduciaries deal with asset price changes intelligently. In terms of the measures we consult to guide portfolio decision making, the data will presumably have something to say about the above narrative and market price changes when they combine into actionable data. Not perfectly of course and not without some pain, but with a thoughtful response mechanism to try to repair and capitalize on some of the near term pain experienced (inevitably, as part of investing in risky assets as the trade-off for higher potential returns) to our clients’ investment portfolios.

In Tribute to a Beautiful Investment Mind*

To Gregg Buckalew, FiduciaryVest’s CIO Emeritus, who officially retired on June 30 after a long and distinguished career: Thank you to a generous friend and mentor over decades to many who still follow; you allowed us to stand on very tall and able shoulders, with many a laugh along the way; we offer unbounded “appreciation” from your friends and colleagues at FiduciaryVest and its predecessors Clark, Arthur Andersen and Wyatt.

We are grateful that Gregg will maintain an office at FiduciaryVest for as long as he wants to continue to work on his own new endeavors side by side with us, and that he will regularly consult with us for such interesting investment ideas as we may together discover. There are always new dragons to be slain…

* With apologies to the late, great John Nash

- Good tickets still available

- Now Batting…Greece

- With discouraged workers simply dropping out the job search, the labor-force participation rate of 62.6% is at a multidecade low. The Fed Flirts With the Right Move at the Wrong Time, WSJ 8/23/15

- Tesla’s Just Raised the Size of Its Equity Sale

- Jessica Alba’s Startup, Honest, Valued at $1.7 Billion

- Lewis Carroll – jam tomorrow and jam yesterday… – (or PT Barnum for that matter) had nothing on Elon Musk in our view, but we digress.

- A young family member had us rolling in the aisles recently when he referred to Ben Kingsley’s ostensible ‘Mandarin’ character from Marvel’s Iron Man 3 as a “souped-up hobo.” But we digress. Again.

- Whats Another Trillion Among Friends – FiduciaryVest Website

- https://www.wsj.com/articles/u-s-lacks-ammo-for-next-economic-crisis-1439865442?mod=trending_now_2

Copyright ©2015, FiduciaryVest, LLC; all rights reserved.

This publication is NOT intended, or suitable as a basis for investment decisions. Before taking any significant action, readers should seek professional investment advice that will incorporate their specific investment needs and circumstances.