A New Decade, a New Package of Market Fears, and a Political Bullfight

Market Commentary January 2020

Fear of Irrational Exuberance, Fear of Missing Out (on the Equity Melt-Up), Fear of Global Virus and Rumors of World War

US investment market indexes are roaring off the early 2020 launch pad, perhaps aiming at another set of all-time record levels. The economic climate is fertile on the heels of healthy holiday sales, borrowing rates are at rock bottom, price inflation is nearly non-existent, there is growth in full-time employment, and wages are rising (significant percentage at the low end). The investing environment is floating on a high number of “soft” earnings forecasts, which is a good thing, because when forecasts are rosy, the market raises stock prices to reflect that optimism. But now, a cautious, nervous, under-committed stock market is actually ripe for support of rising share prices, because so much money is still on, or has gone to, the sidelines or bonds (despite the healthy dividend yields available on many stocks being competitive with many current bond yields).

Speaking of health, just as this paper was winding up, a tidal wave of fear seized global investment markets, borne by the potentially deadly breath of an unseen viral pandemic sweeping across and outside of China. Within a few days, share prices in China, and to a lesser degree in the US, retreated in anticipation of a rapidly unfolding, potentially catastrophic situation. China and the US had just completed a trading semi-truce. It was apparently finalized in half-baked status in order to relieve the sheer exhaustion of the negotiating process. The agreement does not seem to be a milestone of trading “reform”; in fact, it may be little more than a partial recovery for both sides. The 2nd agreement, if there is one before November, will likely be more consequential.

There is one current, robust economic factor that is always un-nerving: significantly high and rising debt-burdens. Today, most borrowers, corporate and individual, are cruising on loans with historically low interest rates. Because of that, more lenders are more anxious to lend to low-credit borrowers… at higher interest rates… and allow those borrowers to repay on stretched out terms. (Example: automobile buyers’ interest rate sensitivity is not often a major factor. Instead, it’s all about the monthly payment. Personal auto/truck loans are attracting people to strap themselves into deluxe, full-featured, super-size trucks that ride on irresistibly low down payments with 7 or 8 years to repay.)

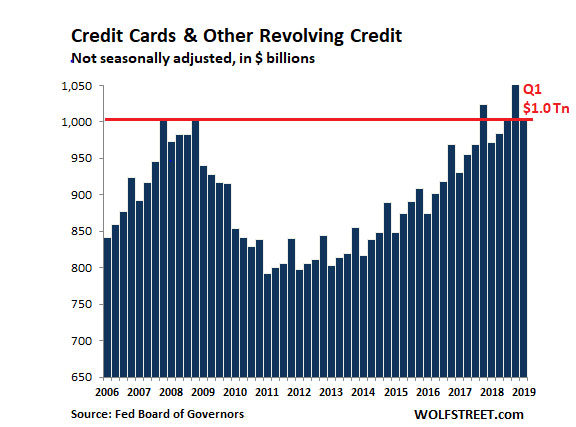

Perhaps never before have so many consumers borrowed so much, for so many years into the future, against their rapidly depreciating autos. In addition, a torrent of new plastic cards is flooding the marketplace. Apparently, most of this credit binge involves newly adjusted credit scores that allow more cash-strapped people to have more cards with higher borrowing limits. It amounts to a “compound debt” scenario.

Market traders and investors alike have a freshly created worry-bin for their stock market misgivings:

1.The (Permanently?) Changing Global Energy Picture: The Middle Eastern pot is boiling, again! …. a guerilla campaign, a high-level Iranian execution-by-drone and, according to an energized mob of US media mongers, a budding World War. But, “this time it’s different”. Yes, domestic US oil fracking-recovery from plentiful deposits of shale have boosted the US from its 1970s petroleum-hostage status to its recently-achieved status as a global net exporter of petroleum. So, now that another periodic Middle Eastern turmoil is brewing, the US’s self-interests can literally permit its leaders to view the endless, tribal/religion-driven conflicts through a wide angle lens. Now, the US can sidestep the many opportunities to re-inject its human and hardware resources into the heart of yet another set of locally passionate regional troubles; the US can also now avoid sending streams of cash to support corrupt and disorderly governments that happen to produce oil.

Footnote: Late in 2019, ARAMCO, Saudi Arabia’s oil company, was finally able to sell its much delayed initial offering of public shares… The issue amounted to a puny 1.5% of the company. Such a small sale, mostly to locals, could just be the Saudis sticking a toe in the oil, getting ready for a much bigger sale to a worldwide investor pool. After all, there are only a few (maybe only one) significant reason(s) why an owner of a key worldwide product would want to share the pie with outsiders. And the timing of any initial offering of shares by any asset owner is typically a revealing aspect. New issue investors, anywhere, anytime should always want to know: Why am I invited to buy into this prestigious punchbowl? Perhaps the semi-curious ARAMCO stock sale was Part 1 of a semi-exit strategy, indicating that the Saudi Royal family may have reached a dim, long term conclusion that their un-diversified family business, peddling oil for a living, faces a significantly declining demand. Perhaps.Counterpoint: Meanwhile during the 2nd half of 2019, the infamously trouble-ridden and mismanaged, all-electric car company, Tesla, Inc., steam-rolled a number of important achievement milestones. Now, Tesla is a profitable company; and suddenly a futuristic Tesla truck appeared (for all to see it get its windows smashed); and suddenly the company is meeting/exceeding its production forecasts; and suddenly there is a Tesla assembly plant, in-production, in China (reportedly constructed from scratch in a formerly muddy field, within a matter of months); and suddenly, in January 2020, Tesla shares have skyrocketed to nearly $600 (up 40+% in the first 14 trading days of 2020 and 340% in the past 7 months). The investment markets will quite likely reward the US’s newfound energy independence status. In the immediate future, that status will allow the US to re-focus on renewing its rusting infrastructure, in order to catch up with China’s massively overhauled and modernized economy. And, though it’s not publicly discussed much in Washington, essentially every US legislator, plus the President recognizes: (a) how fundamentally crucial and long term the infrastructure challenge is, and (b) what a whopping economic stimulus will be unleashed, if/when such a massive upgrade investment program is adopted. After all, this is the category of government investment that really does pay for itself, both during and afterward. But, action is on hold, awaiting (a) the 2020 elections and/or impeachment, and (b) the political compromises needed to spread the political credit across both parties and the White House. [Our view: This infrastructure program is potentially bigger than was President Eisenhower’s 41,000 mile, 90% user-funded Interstate Highway Network (1956). Today, there is enough “infrastructure credit” stored up now, behind the legislative dam to assure glory for every elected person, for the rest of his/her Washington career. Such a massive US infrastructure commitment has not occurred in the past 65 years, largely because $trillions of National Defense spending outside the US (mostly borrowed) took priority: Vietnam (for 20 years), Iraq (9 years, officially) and Afghanistan (19 years, so far).]

2. The Alleged Old Age of US Stock Market Run-up: The current stock market Wall of Worry is itself aging. Expert forecasts of major market downturns have prominently appeared in every financial corner… literally for years now. There is, and has been a widely shared notion that the Bull Market will surely crush its horns when it runs into a proverbial brick wall that is not yet in sight. Investors’ memories of 1999 and 2008 seem to be fostering a level of foxhole behavior, that its true-believing Bears consider to be experience-based insights. The current 2019-2020 market does share the technology-sector characteristic with its 1999-2000 predecessor. But, the 1999 version floated skyward in balloons sold by cash-eating start-up companies. Then, the 2008 stock-crash came along. That calamity was not about an over-valued market; instead, its manhole cover was blown by Wall Street’s devilishly creative, hyperactive mortgage debt-binge that had been fertilized by well intentioned, but ill-considered federal housing legislation. Current market crash fears are strong enough that, in 2019, a considerable volume of nervous equity money has been driven into cash (which pays no real return) and into bonds (which pay very, very little).

According to unsourced data reported in Investopedia last September, there was an estimated $22 trillion of investable assets, of which more than $9 trillion (40+%) was sitting in cash. If this cash estimate is even one-half accurate, the amount of dry powder which could support an equity market that falls off the current Bull hilltop is staggering. Moreover, the number of “conservative” investors who sat out most of the past ten years of the equities boom are, this time, not likely to risk being left at the market bus stop… again. In the bright glow of equity returns, let’s not ignore the bond market’s 2019 version of the stock market’s Happy Times Are Here Again. For a US bond market that began 2019 with almost nowhere to go but down, it fooled everyone. The year began with interest rates on the rise (bond prices falling), but the Federal Reserve totally reversed its early January course and, by year-end, the broad US Aggregate Index had turned in a surprising 8.7%, while its Corporate High Yield cousin had delivered 14.3% and the

Aggregate Long Credit Index had laid a 23.4% egg.

3. The Sharpest US Government Cleavage (Ever?): The American public’s 2020 political sentiments are intensifying. There are highly motivated camps of culture warriors, each with a detailed checklist of uniform issue-positions who are attempting to convert a large “middle of the road” group that is neither uniform, nor outspoken. Three cable TV “news” channels spend every weekday evening preening partisan feathers before relatively small, but opinionated audiences… a format that has proven to be quite profitable. [For perspective: Just under 130 million people voted in the 2016 elections. In 2019, weekly primetime audiences of the 3 channels attract a total of just over 5 million viewers (less than 4% of the voters), ranging from CNN’s 900,000 to Fox News’s 2.5 million, while programs such as Sunday Night Football regularly capture 22 million sets of eyes and Super Bowls annually attract well over 100 million.] Whether cable news is a political pulse-taker or not, the whole country does seem to be collectively dreading its Constitutional leap-year responsibility to deliver a full set of election results. Indeed, the November 2020 version will likely end with one (maybe both) of the camps refusing to swallow the results, and showing even less willingness to digest them. Since 2016, we have found that culture warriors have managed to maintain a continuous combat posture.

In brief, there are several potential combinations of key 2020 US election outcomes; any and all of them will likely merge into an acid kettle of fish.

So far, US and foreign investment traders are whistling past the fish-kettle and generally looking the other way, whenever a warring camp springs forth with a fresh volley of made-for-TV gotchas. Perhaps the large portion of foreign players in US markets is causing its insensitivity to the political bomb throwing. Along the way this year, market traders will develop their own odds and expectations for election outcomes and impact. In due course, they will place two sets of investment bets: one to hedge and the other to capitalize on developing expectations for tax, judicial and regulatory consequences.

Market mavens, at this time, are dividing their 2020 expectation-set into football-like halves: the first half will see a number of market touchdowns (despite push-back from stockholders who have caught onto the share-buyback/executive pay schemes that convert bottom line results into earnings “growth” at the per-share level). The 2nd half of 2020, as they see it, will necessarily use up all of the time-outs, in order to devise offensive and defensive investing adjustments. Finally, despite scientifically designed voter prediction polls, the actual election will likely leave a confounding basket of kittens on the national doorstep, which neither the warring-camps, nor the market traders will be prepared to deal with.

Commentary

Commentary was prepared for clients and prospective clients of FiduciaryVest LLC. It may not be suitable for others, and should not be disseminated without written permission. FiduciaryVest does not make any representation or warranties as to the accuracy or merit of the discussion, analysis, or opinions contained in commentaries as a basis for investment decision making. Any comments or general market related observations are based on information available at the time of writing, are for informational purposes only, are not intended as individual or specific advice, may not represent the opinions of the entire firm and should not be relied upon as a basis for making investment decisions.

All information contained herein is believed to be correct, though complete accuracy cannot be guaranteed. This information is subject to change without notice as market conditions change, will not be updated for subsequent events or changes in facts or opinion, and is not intended to predict the performance of any manager, individual security, currency, market sector, or portfolio.

This information may concur or may conflict with activities of any clients’ underlying portfolio managers or with actions taken by individual clients or clients collectively of FiduciaryVest for a variety of reasons, including but not limited to differences between and among their investment objectives. Investors are advised to consult with their investment professional about their specific financial needs and goals before making any investment decisions.

Investment Risk

FiduciaryVest does not represent, warrant, or imply that the services or methods of analysis employed can or will predict future results, successfully identify market tops or bottoms, or insulate client portfolios from losses due to market corrections or declines. Investment risks involve but are not limited to the following: systematic risk, interest rate risk, inflation risk, currency risk, liquidity risk, geopolitical risk, management risk, and credit risk. In addition to general risks associated with investing, certain products also pose additional risks. This and other important information is contained in the product prospectus or offering materials.