Stubborn (lack of) Inflation, Negative Interest Rates and Midas Awakens

Market Commentary October 2019

The Federal Reserve reverses course while equity markets continue to blaze their trail, despite relentless global trading turmoil

INFLATION IS (apparently) IMPORTANT and UN-COOPERATIVE

The US Federal Reserve’s permanent, congressionally authorized, standing mandates are to promote: (1) maximum employment, (2) stable prices, and (3) moderate long-term interest rates. For more than 10 years, all three of these mandates have been playing out according to script. But, according to published Fed policy, there is a 4th objective: a moderate, positive annual “headline” inflation rate. For most years since 2008, inflation was “too low”. Inflation regularly failed to meet the Fed’s more or less arbitrary favorite 2% target, and today that stubbornness continues.

The economy has simply side-stepped an important assumption in the Fed’s economic daisy-chain script, which is: (1) If the nation has super-low unemployment (which it does), then (2) paychecks will grow fatter (which they did), causing (3) prices to heat up (which they didn’t), thus allowing the Fed to (4) preside over a series of quarter-percentage-point interest rate increases, expecting to continue until the rate reaches an historically “normal” rate. To apply this patented, easy-does-it, quarter-step routine to restore interest rates from their unprecedented 0.00% policy minimum between 2008 and 2015, it began to raise the rate in December 2015 and continued to do so through December 2018. But, a surprise pothole appeared last Christmas eve. The markets pouted. The Fed applied its brakes to rate increases and, in 2019 we have seen a stream of rate reductions that, as of now, appear to be an unfinished series.

The Big Question is: Will the Fed join most of the world’s other central banks in the unprecedented maneuver to drive down its policy interest rate without stopping at zero%? More on this topic follows below.

Moderate price inflation is not widely perceived to be an enemy of a sound economy. The Average American actually takes pleasure in seeing the “value” of their equity investments and their homes inflate. An inflationary economy can turn home mortgage debt into cost-free leverage. Moreover, the inflation elevator underneath those valuation increases goes un- noticed, simply because investment returns are very rarely reported net-of- inflation. While stocks and residences are inflating, bond investments are deflating. If a bond pays 2% annual interest and inflation is 2%, then the net real interest return is zero; and worse: when a $100,000 bond matures after 5 years, it will have suffered a decline in buying power, to only $90,600. Hence, inflation is the dear friend of long term borrowers and the enemy of bond investors. The world’s largest borrower… the US Government… can issue a 30 year, $100,000 T-bond which, at maturity, will pay the investor back only $55,000 worth of buying power, assuming a 2% average annual inflation rate.

A 2% inflation target doesn’t actually conform to the Fed’s 2nd Commandment to promote stable prices. If stable prices are considered to be ideal, then the Fed’s adoption of an inflation goal is mostly counter-intuitive. Why, then, is an eternally modest inflation rate looked upon as an economic blessing and also adopted as the Fed’s goal? Answer: So that prices of goods and services have wiggle-room to decline a bit, without quickly becoming deflation… a scenario that economists dread because they view it as the penultimate potential problem situation… the beginning of an economic death-spiral.

US DOLLAR, A PERENNIAL WINNER, BUT INFLATION LURKS

Check your wallet. Written on the face of every dollar bill is a US Government certification, of sorts, which attests that any public or private debt can be settled using this Federal Reserve Note as legal tender. Although the bill says it is a “Note” issued by the Federal Reserve, it does not commit or imply that the Fed is obligated to compensate the Note-holder in any way.

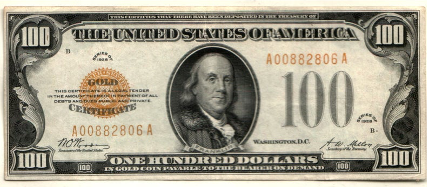

Until less than 50 years ago, paper US Dollars contained a very different,

very explicit message.

The 1926 Series Gold Certificate shown above says, on its face, “THIS CERTIFIES THAT THERE HAVE BEEN DEPOSITED IN THE TREASURY OF THE UNITED STATES OF AMERICA ONE HUNDRED DOLLARS IN GOLD COIN PAYABLE TO THE BEARER ON DEMAND”. Thus, the paper represents a claim against the US Treasury for delivery of gold coin(s) worth $100, simply by presenting this certificate to the Treasury (or a federally chartered local bank). Gold Certificate dollars were replaced (1933 to 1971) by Silver Certificate dollars which contained the same promise, payable in silver coins. In 1971, the government ceased transferring gold to foreign governments, in exchange for US currency, thus converting the dollar into a “fiat” (value-by-declaration) paper-only currency.

Meanwhile, the US’s silver coins were 90% pure silver, until 1964, after which they contained no silver at all (except 40% silver half-dollars from 1965 to 1976). Very simply, the market value of silver content had significantly exceeded the face value of the coins, providing a quick profit to enterprising coin melt-ers.

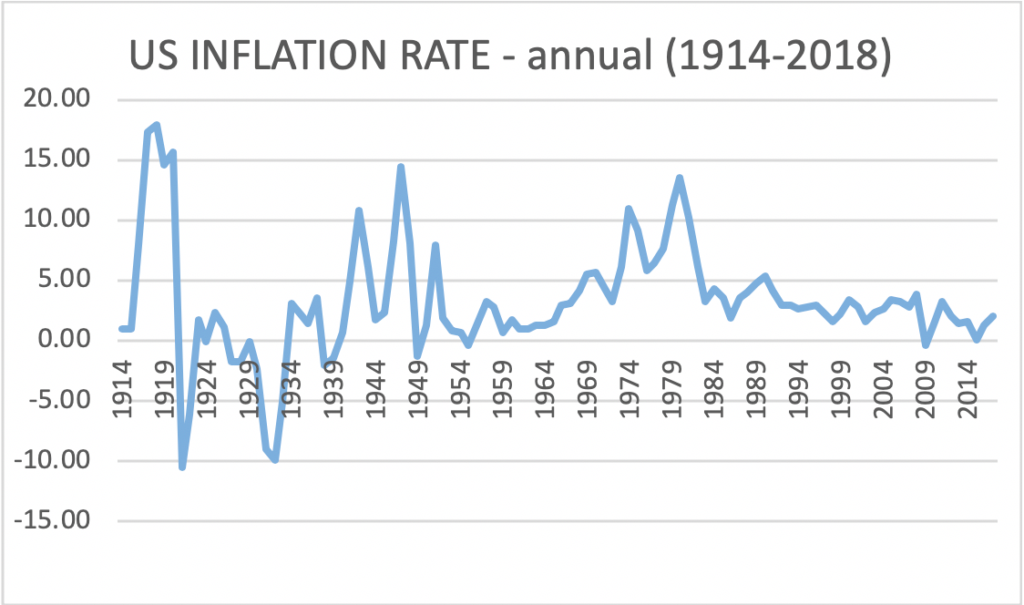

Following the post-war 1940s, the US’s annual price-inflation settled into a benign annual rate pattern of 1%, or less. But, when US military action ramped up in Viet Nam, President Lyndon Johnson’s 1960s “Guns & Butter” federal budget deficits soared and, as a consequence, the national inflation rate was spooked into 3, 4, 5, 6% per year, until mid-1971 when President Nixon issued an Executive Order directing the Treasury to “suspend” foreign governments’ option to convert their dollar holdings into gold bullion. [That 48-year-old suspension presumably continues today.] For the first time, the dollar was disconnected from gold, and all other concrete valuation-posts. Meanwhile, rampant inflation was “devaluing” people’s savings and other investments. So, there was another Nixon Executive Order that froze the nation’s wages and prices, but the inflation rate continued to run even hotter, reaching 12 and 13% shortly after he left office. And the unemployment rate amped up above a very disturbing 7%.

Meanwhile, the newly un-tethered US dollar shrank in value against major foreign currencies. In summary, the 1970s were characterized by a gloomy economic combination called “stagflation”.

INFLATION’S UNDER-BELLY: POSSIBLE DEFLATION, VIA NEGATIVE INTEREST RATES

If the US does come face-to-face with a 21st Century deflation scenario, its current Sampson-like economic muscle is available to fight off economic doom, especially compared to other countries (besides China) which have mostly ridden on US economic and military coattails since 1945. That US

strength lies in its universally recognized “reserve currency”, along with the US’s instant facility to produce more dollars, when and as needed. The dollar’s strength is mostly imputed, because it rests on a psychological assumption that, while no currencies are officially backed by a store of universally recognized hard value (such as a pile of gold), the US’s paper money is deemed to be “backed” by the US’s (a) unparalleled level of commerce and taxation, (b) steadfast commitment to constitutional law, (c) overwhelming military might (deployed worldwide), and (d) relatively efficient collection of taxes, (although the tax-take is annually insufficient to fund government operations).

Inflation War-Story: During World War 1 (1914 -1918), Germany embarked onto a war financing strategy, which was: suspend its currency’s convertibility into gold, borrow heavily to fund the war, win the war, then pay off the debt via annexing resource-rich neighboring lands. Despite losing the war, the strategy might have squeaked by; however, the Allies in 1918 imposed draconian post-war reparations: annual cash payments of 2 billion German Gold Marks (or the equivalent, paid in stable foreign currencies), plus 26% of all German exports. Reparations took such a toll on Germany’s economy that it began to print as many paper Marks as needed in order to buy the necessary foreign currency for reparations. In reaction, the (now un-backed) value of paper Marks plummeted, mostly in 1923, until it reached 1 billion paper Marks per Gold Mark… currency hyperinflation that hit the ultimate devaluation… to zero

CENTRAL BANKS PRODUCING NEGATIVE INTEREST RATE BONDS ARE MULTIPLYING

Debt investments that require investors to pay borrowers for the privilege of lending to them — once an un-thinkable possibility — are a rapidly growing reality. Since 2015, current interest yields on two-year government bonds in the European Union, Switzerland, Japan, Sweden and Denmark have all been well below 0.00%. And now, the US Fed has released (October 2019) a paper that appears to be setting the stage for US government debt yields to sink below the zero-line.

Here are some snippets from that just-released San Francisco Fed research paper (emphasis added):

“…. A few caveats regarding the analysis are worth stressing. First, it does not speak to any costs of negative interest rates such as reduced profitability of the banking sector…..Second, it cannot shed light on whether using this monetary policy tool actually helps raise inflation expectations and produce higher inflation, which is the key underlying motivation for resorting to it in the first place…… the ultimate effective lower bound for short-term nominal interest rates is significantly below zero….”

While the research paper stops short of any expected-impact analysis, it seems reasonably clear that banks and brokers… any business that makes most of its money from interest rate spreads will surely find tough going in a negative rate environment. In brief, there are three things that lead to a conclusion that the US Fed is willing (expecting) to go there: (1) the Christensen/San Francisco Fed research paper, (2) the markets are beginning to predict it and (3) the Fed is now very short on tools with which to address a recession, if such conditions take hold in the US.

Note: Negative interest yields will not be visited on investors who are holding already-issued bonds. In fact, those already-in-the-market bonds will not only pay positive cash coupon yields, the bonds will rise in market value, as rates plunge deeper into negative territory. These (older issued) bonds could be either sold at a profit, or held to maturity at full face value.

So, what will this strange bond market scenario look like? Who, among the investor community, will buy negative-yield Treasury debt paper? Answer: In order to support its skinny-dip into the negative-interest pool, the Federal Reserve will, once again, shift into QE-mode, buying vast chunks of US Treasury debt and Ginnie Mae et al mortgage paper and paying the clearing brokers with newly printed fiat-money. Keep in mind that the Treasury is, all the while, forced to continue issuing gobs of new debt paper to cover each year’s new trillion-dollar federal budget deficit, about which there is strangely little public discussion.

There is Very Limited Dry Money Supply Powder…..

KEY CENTRAL BANKS POLICY RATES

| December | China | Eurozone | Japan | US |

| 2007 | 7.47% | 4.00% | 5.00% | 4.250% |

| 2008 | 5.31 | 2.50 | 0.10 | 0.125 |

| 2009 | 5.31 | 1.00 | 0.10 | 0.125 |

| 2010 | 5.81 | 1.00 | 0.10 | 0.125 |

| 2011 | 6.56 | 1.00 | 0.05 | 0.125 |

| 2012 | 6.00 | 0.75 | 0.05 | 0.125 |

| 2013 | 6.00 | 0.25 | 0.05 | 0.125 |

| 2014 | 5.60 | 0.05 | 0.00 | 0.125 |

| 2015 | 4.35 | 0.05 | 0.00 | 0.375 |

| 2016 | 4.35 | 0.00 | (0.10) | 0.625 |

| 2017 | 4.35 | 0.00 | (0.10) | 1.375 |

| 2018 | 4.35 | 0.00 | (0.10) | 2.375 |

| 9/2019 | 4.35 | 0.00 | (0.10) | 1.875 |

| 2020 | ?? |

Source: Data: Bank for Int’l Settlements (BIS);

Chart: FiduciaryVest, LLC

Recent Historical Context: The triggers for the US financial crash in mid-2008 that pulled the rest of the global financial planet under water were: (a) early 2008, when Bear Stearns suddenly could not clear its trading transactions (i.e., inside of one day, it lost its liquidity because it lost its cross-broker Wall Street trust factor); after that mess was cleaned up by the New York Fed, in one weekend, via participation of Wall Street brethren and, (b) September 2008, when Lehman Bros collapsed, mostly from Bear-Stearns-type liquidity failures, but Wall Street bankers, this time, literally walked out on the New York Fed’s desperate weekend rescue attempts.

QUIETLY DRAMATIC GOLD

Gold struggles to keep its prominence among hot stocks and sexy high-yield bonds. The long time conventional wisdom about gold as an investment is that: (a) gold pays no income, (b) gold cannot be consumed… or even used (beyond jewelry, coins and a smidgeon in electronics), (c) in bulk, gold is expensive to store and cumbersome to move. As a currency for thousands of years, gold is unique among currencies, because it is a pure chemical element (symbol Au). Thus, every ounce of gold is identical, which is a key requirement for anything widely used as currency. As a universal currency, gold is highly suitable for accumulation as a dependable store of wealth that reflects cumulative societal inflation and becauseof its attributes: (a) It is extremely dense (difficult to steal, in quantity); (b) it requires no care, because it is impervious; it will not tarnish, or break down from being submerged, buried, burned, or frozen; (c) It is not/has never been pummeled by default or worthlessness; (d) It is rare. According to one industry source: All the gold that has ever been mined could fit under the Eifel Tower.

All of that said, it is not a very far reach-back to the 1934 point when, led by US economists and banking interests, gold’s price was fixed, by worldwide agreement, at 35 US Dollars per Troy ounce. It remained in that status for almost 40 years, until 1972, when global currencies were set free of fixed exchange rates. Gold was re-valued in the free marketplace, that same year, by almost 50%. Another 70% value-boost was realized the next year (when President Ford repealed the 40-year-old Great Depression-era prohibition against private citizen ownership of gold).

In the modern world, gold typically mirrors marketplace fears (of crashes, depressions, wars, revolutions, etc.). Its price rises most dramatically when market conditions are most uncertain, in some economically important region of the world. In the springtime of 2019, gold’s market price seems to have awakened from its 8-year pause, after reaching its all-time high, a hair under $1,900 per ounce in September 2011, following a 5-year tripling in value during the Great Recession run-up (from $632 to $1,875). As we write this, gold has surged nearly 20%, without much volatility, to $1,500/$1,550 between late May and mid-October 2019, during which time the S&P 500 Index was volatile, but managed to post a net 5% gain, reaching an all-time high.

Boosted via buy and hold recommendations from various high profile investment advisors…. to as much as 10% or more of an investor’s portfolio… gold is currently in vogue again.

WHERE TO FROM HERE?

One (somewhat likely) scenario creates a fairly certain forecast: If we see significantly negative interest rates in the US, gold will likely rise in price, because most would-be bond investors (a sizeable throng) will view gold as a quite logical alternative and, although stocks will benefit too, most bond investors will shun re-directing bond money into a record-high stock market.

Another (less likely) good-for-gold scenario: If the US Dollar is knocked off its pedestal as The Reserve Currency, because a number of governments band together and decide to do that (for many possible political, economic, and/or military reasons) the most logical replacement for the dollar would be gold, rather than the clearly localized Euro, or Yen, or Yuan. A unitized basket of GDP-weighted currencies, perhaps managed by the International Monetary Fund, might work, but something like that has been served up on various global discussion platters for decades. The problem seems to be: How does the US get demoted and then slotted into such a scheme?

Gold Price After Interest Rate Curve Inversions

| Initial Rate Inversion | Mos Before Gold Peak | Gold’s Gain |

| June 1, 1973 | 5 mos | 57% |

| Dec 1, 1978 | 13 | 356% |

| Oct 29, 1980 | * | |

| May 22, 1989 | 9 | 18% |

| July 19, 2000 | 5 | 5% |

| July 20, 2006 | 16 | 34% |

| May 23, 2019 | ?? | ?? |

*New Fed chair P. Volker declares war on “gold bugs”; Rapidly pushes Interest rates to record high teens.

Government holdings of gold (2019), top 7 countries:

- US: 8,133 metric tonnes (about $392 billion) (1 ton = 32,150 ounces)

- Germany: 3,373

- Italy: 2,451

- France: 2,436

- Russia: 1,880

- China: 1,842 (and climbing rapidly)

- Switzerland: 1,040

8 thru 20: 765 to 227 tonnes

Commentary

Commentary was prepared for clients and prospective clients of FiduciaryVest LLC. It may not be suitable for others, and should not be disseminated without written permission. FiduciaryVest does not make any representation or warranties as to the accuracy or merit of the discussion, analysis, or opinions contained in commentaries as a basis for investment decision making. Any comments or general market related observations are based on information available at the time of writing, are for informational purposes only, are not intended as individual or specific advice, may not represent the opinions of the entire firm and should not be relied upon as a basis for making investment decisions.

All information contained herein is believed to be correct, though complete accuracy cannot be guaranteed. This information is subject to change without notice as market conditions change, will not be updated for subsequent events or changes in facts or opinion, and is not intended to predict the performance of any manager, individual security, currency, market sector, or portfolio.

This information may concur or may conflict with activities of any clients’ underlying portfolio managers or with actions taken by individual clients or clients collectively of FiduciaryVest for a variety of reasons, including but not limited to differences between and among their investment objectives. Investors are advised to consult with their investment professional about their specific financial needs and goals before making any investment decisions.

Investment Risk

FiduciaryVest does not represent, warrant, or imply that the services or methods of analysis employed can or will predict future results, successfully identify market tops or bottoms, or insulate client portfolios from losses due to market corrections or declines. Investment risks involve but are not limited to the following: systematic risk, interest rate risk, inflation risk, currency risk, liquidity risk, geopolitical risk, management risk, and credit risk. In addition to general risks associated with investing, certain products also pose additional risks. This and other important information is contained in the product prospectus or offering materials.