What If Stocks Threw a Party, and Only a Few Companies Showed Up?

It has been said that “history does not repeat, but it rhymes.“ (We’ve discovered that knowing “who said it“ is a real challenge, with adage mis-attribution apparently rampant1. We’ve considered rotating between Aesop, Winston Churchill, and Oprah. But we digress, already – a new record.) We are certain, however, of the provenance of our headline, since in a “former life” we penned a derivative of it, a mere two decades ago:

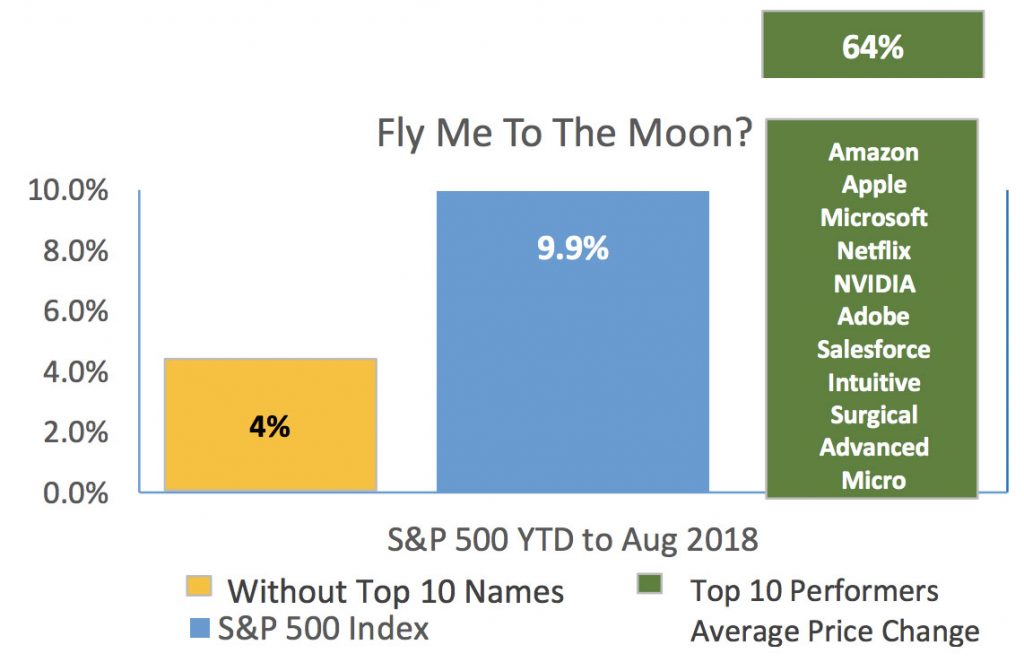

Now, we don’t want to get off on a rant here2, but….when we see market outcomes like this…

…we start to get a little worried. Listening to CNBC these days is also a familiar “happy talk” exercise, with “how high is up?” the dominant theme amidst an admittedly robust US economy. But we still feel a bit like Bill DeVasher, the head of security in the movie adaptation of John Grisham’s first novel, The Firm 3. “I get paid to be suspicious when I’ve got nothing to be suspicious about.”

We’d still categorize our intelligence as anecdotal, but we‘ve observed some troubling signs of late:

- a steady diet of news lead-ins in the vein of: “Buoyant performance of U.S. tech stocks is driving some fund managers to dismiss longstanding valuation concerns as short-sighted,” aka ‘this time it’s different’;

- a chorus of voices (often twenty-somethings) holding forth on the investment worthiness of novel “investment” categories such as crypto (or is that klepto?) currencies;

- thinning market leadership to a narrow set of companies, often focused in innovative, high projected growth segments of the economy;

- over-the-transom4 email titles like “buying funds of funds like a drunken sailor“ (we do NOT make this stuff up).

(Diversification) What Have You Done for Me Lately (ooh-ooh-ooh-yeah)?

– (With Apologies to) Janet Jackson

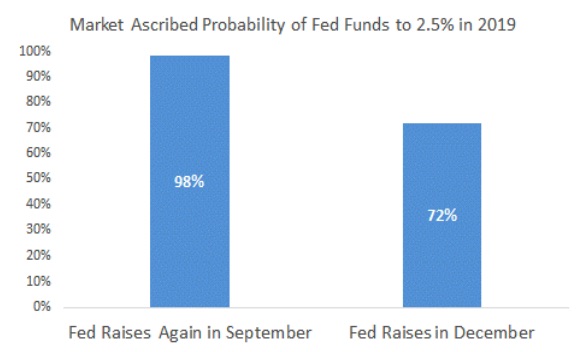

It is also quite relevant we think, to juxtapose these episodes with a Fed that seems bent-for-leather on raising interest rates – three times in 2017 and twice already in 2018 – with the setup for the remaining FOMC meeting outcomes as follows:

We’ve also noticed a very nervous equity trading backdrop that tips toward panic every time the ten year US Treasury flirts with the 3% yield level. With rising rates and the proliferation of such curious anecdotes as those indicated above, we‘ve learned that it’s usually appropriate to think more about return of, rather than return on, capital. Of course that’s just our opinion; we could be wrong.

Former Fed Chair Alan Greenspan has taken much criticism for the timing of his 1996 “irrational exuberance” comments, as the stock market (with perfect hindsight of course), then had 3+ years yet to run. But recall that his famous quotation was embedded within a question, “how do we know when irrational exuberance has unduly escalated asset values5…?” (emphasis ours) How indeed?

And in point of fact, US equity market outcomes so far this year are making us look “wrong!” 6, in more ways than one, if your measuring stick is large US companies, or worse some derivative of the “FANMANG7” stocks.

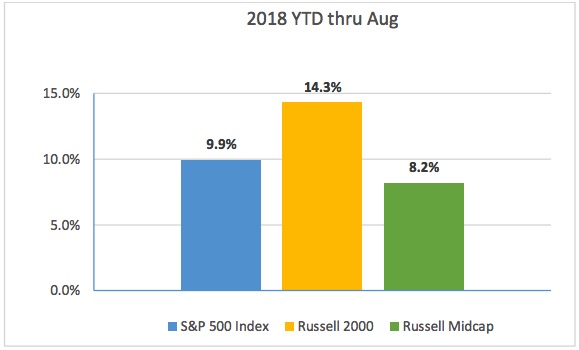

2018’s “bloodless verdict of the market”8 has been more mixed, with a return to diversity in outcomes across investment types that has not been prevalent in recent years. US stocks have been rewarding investors with broad index results pushing/exceeding double digits through August, while both bonds and equity results outside of the US, for US dollar investors, have been on the other side of the ledger.

Bonds are simply subject to the cruel arithmetic assault of rising interest rates, as price declines surpass the meager starting yields investors have been offered throughout the Quantitative Easing period.

| 2018 YTD thru Aug | |

| Barclays Intermediate Gov’t/Credit | -0.4% |

| Barclays Aggregate | -1.0% |

| Barclays Global Aggregate (ex-US) | -2.0% |

“Take my wife…(please)” – Henny Youngman

To make the point more clearly about bonds, take debt markets globally (we are tempted to add Henny Youngman‘s famous punch line, above). Against today‘s interest rate backdrop – miniscule and even still negative yields outside the US, and the associated higher interest rate risk – the forward profile of bonds is asymmetrically structured against investors if rates rise.

For example, the Barclays Global Aggregate Bond Index sports a duration of almost eight. This suggests sizable capital losses when rates go up from today’s market levels – a good bit more loss potential than what we suspect are most investors’ expectations for “fixed” income.

Our point here is that given the broad asset class diversification that most portfolios employ, investors’ overall results in 2018 are falling quite short of the headline grabbing US indices – see chart above right.

| Data as of 8/31/18 | 2017 | YTD 8/31 | 5 Years | 10 Years |

| S&P 500 | 21.8% | 9.9% | 14.5% | 10.9% |

| Russell Midcap | 18.5% | 8.2% | 12.8% | 10.9% |

| Russell 2000 | 14.6% | 14.3% | 13.0% | 10.5% |

There are three main sources of this dispersion in order of likely impact.

- Bonds make up a substantive position for all but the most aggressive/long term horizon portfolios, and they’ve been money losers all year.

- Growth style investing has outdistanced its value cousin by a wide margin, so any actively managed portfolios with exposures to both (or worse a value tilt) are lagging broad indices which skew toward the growth style.

- Any non-US exposure has been a losing proposition for US dollar investors, largely due to the dollar strengthening vis-à-vis international currencies 9 – see chart above left.

| Data as of 8/31/18 | 2017 | YTD 8/31 | 5 Years | 10 Years |

| MSCI EAFE | 25.0% | -2.3% | 5.7% | 3.7% |

| MSCI EM | 37.3% | -7.2% | 5.0% | 3.5% |

| MSCI ACWI ex-US Small | 3.9% | -3.2% | 8.1% | 6.7% |

“We do know that the less the prudence with which others conduct their affairs, the greater the prudence with which we should conduct our own…” – Warren Buffett

Whether you find the phrase “Make America Great Again” uplifting, off-putting, or somewhere in between, positive momentum in US company earnings and economic statistics are lately ahead of the rest of world. The US dollar has responded positively to that reality, as well as to corporate tax reform and US rate increases. The US Dollar Index Futures price has gone from 81 to 95 in 2018 through August.

In our view, none of this suggests that investors ought to abandon diversification, advice which is borne of roughly equal parts:

- respect for the difficulty of making accurate predictions, and the corollary challenge of knowing the most profitable adjustments to make even if you’re right (the future always surprises);

- observation of how susceptible current views are to the tendency to buy more of what has worked well and shun that which has not; and

- recognition that markets already discount not only what has happened, but also current consensus expectations about what will.

As a result, we remain supportive of healthy allocations to non-US equities, partly in expectation of mean reversion in the US / Non-US return relationship, but also in recognition that the relative valuations of the markets are set up in support of staying the diversification course (see chart left).

We’re likely early in our nagging concerns transmitting themselves into market corrective outcomes – perhaps by several years if history is any guide. Dr. Greenspan in 1996 was way out front; our internet stock concerns in 1998 were “too early” – 1999 is when it got really goofy (e.g., eToys, Webvan, and Pets.com). In consideration of that prior experience (and others), though we monitor and frequently discuss a variety of top-down, macro market influences, we limit our recommended actions in response to them.

In that regards, our answer to the natural “so now what?” question will be relatively 1) few in number, 2) limited in scope, and 3) bounded by minimum/maximum guidelines for changes relative to base investment strategy. The US/non US equity diversification tilt indicated above is one adjustment; a preference for value style equities over growth is another.

In summation, our caution expressed herein is not a call on a market top, nor a prediction of impending doom; it’s just a set of observations coupled with some experienced-based advice, encapsulated in our header from Warren Buffett above10

- For a fun and enlightening view on this topic, read “Hemingway Didn’t Say That.”

- Hat tip: Dennis Miller; we know, we’re dating ourselves.

- There we go dating ourselves again; but as Dogbert taunted Dilbert: “it’s not as if anyone else would date you.” But we digress. Again.

- For you millennials, the metaphor refers to a rotating window above an office door, through which would-be novelists used to deposit their manuscripts for editorial review. Analogous to posting on Instagram and seeing how many ‘likes’ you get.

- Remarks by Chairman Alan Greenspan December 5, 1996, a very worthwhile read.

- Hat tip: Donald Trump / Alex Baldwin

- Facebook (admittedly a poor 2018 performer), Amazon, Netflix, Microsoft, Apple, Nvidia, Google, or some other mnemonically popular combination of very large capitalization “platform” technology-related stocks.

- Hat tip: Jefferey Gundlach, Doubleline Capital CIO

- YTD Local Market Returns: EAFE = -0.1%, ACWI ex-US = 0.0%, MSCI EM = -1.7%, ACW ex US Small Cap = 0.0%.

- 1988 Berkshire Hathaway Chairman’s Letter. We simply could not believe this was thirty years old. Though were just an investment babe in the woods when we first heard it, it seems like just yesterday. But we digress, again. And on that note…the quotation referenced above followed a description of Berkshire’s success in merger arbitrage activities and the plan to reduce them dramatically in the then-current environment due to a poor risk-reward setup. It has always been Mr. Buffett’s habit to be forward rather than backward looking for investment opportunity, or as he said later in that same letter, “investor(s) cannot obtain superior profits from stocks by simply committing to a specific investment category or style…. can earn them only by carefully evaluating facts and continuously exercising discipline.”

COMMENTARY

Commentary was prepared for clients and prospective clients of FiduciaryVest LLC. It may not be suitable for others, and should not be disseminated without written permission. FiduciaryVest does not make any representation or warranties as to the accuracy or merit of the discussion, analysis, or opinions contained in commentaries as a basis for investment decision making. Any comments or general market related observations are based on information available at the time of writing, are for informational purposes only, are not intended as individual or specific advice, may not represent the opinions of the entire firm and should not be relied upon as a basis for making investment decisions.

All information contained herein is believed to be correct, though complete accuracy cannot be guaranteed. This information is subject to change without notice as market conditions change, will not be updated for subsequent events or changes in facts or opinion, and is not intended to predict the performance of any manager, individual security, market sector, or portfolio.

This information may concur or may conflict with activities of any clients’ underlying portfolio managers or with actions taken by individual clients or clients collectively of FiduciaryVest for a variety of reasons, including but not limited to differences between and among their investment objectives. Investors are advised to consult with their investment professional about their specific financial needs and goals before making any investment decisions.

INVESTMENT RISK

FiduciaryVest does not represent, warrant, or imply that the services or methods of analysis employed can or will predict future results, successfully identify market tops or bottoms, or insulate client portfolios from losses due to market corrections or declines. Investment risks involve but are not limited to the following: systematic risk, interest rate risk, inflation risk, currency risk, liquidity risk, sociopolitical risk, management risk, and credit risk. In addition to general risks associated with investing, certain products also pose additional risks. This and other important information is contained in the product prospectus or offering materials.