Beware the Ides of March

— William Shakespeare, Julius Caesar Act 1 Scene 1

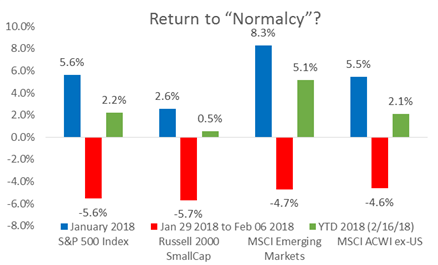

Had we jumped into publication for this market update when arctic winds were still blowing even in Atlanta rather than when the crocuses and tulips are nascent, we’d have written that early 2018 was simply adding to what had been a growing crescendo of equity returns in 2017. Then a few days in early February reminded investors that, perhaps, the demise of volatility1 has been greatly exaggerated and the possibility of losing money in stocks is quite alive and well. (Procrastination occasionally has its upside.)

After a giddy 2017 – itself a continuation of post-2016 election return buoyancy – what seems to have markets recalibrating in recent weeks? The concern seems to surround a combination of 2017’s US income tax cuts, the higher expected GDP growth those cuts may facilitate, as well as the further boost from potential infrastructure legislation in 2018. Concerted fiscal stimulus late in an economic expansion is leading to worries about higher inflation and the tighter monetary / interest rate policy that might be required to contain it. At the same time, the whole world is experiencing improved economic conditions, so the growth and inflation risks are integrated. (The “I’s” of March2 was close enough for us, and we’re unapologetic about the non-iambic pentameter poetic license.)

Financial opinion-makers spent the early months of 2017 wrestling with the stimulative impact of a “triple-play” of health insurance, income taxation, and regulatory reform. While the efficacy of each was in the eye of the beholder, and even as action related to Affordable Care Act faltered, the Federal Register was shrinking, boosting business confidence measurements.

Equity markets responded in kind, with healthy single-digit returns distributed across each quarter of 2017. Corporate earnings growth returned in earnest in 2017, after stalling in 2015 / 2016 and of course, the late December tax legislation kept analysts crunching spreadsheets throughout the holidays to determine the impact of the new 21% tax rate on profits.

Measures in the real economy also kept pace, with historic lows in unemployment measures* and GDP numbers improving to levels not seen in the post 2008/09 recovery. So much so, in fact, that market participants have begun to wonder lately if perhaps 2018 might be the year when GDP growth moves toward the “old normal“ of a 5% nominal rate in an extended recovery phase of the economic cycle5.

*An aside we may tackle in a future missive: We are lately seeing about the lowest unemployment figures ever recorded (essentially full-employment) and that makes us curious: “what kind of jobs are these?“ and “why are so many people still struggling even on two incomes?“ and “with so much automation, do we need a more complete picture from this common economic metric?“ and “what about labor force participation and the impact of an aging workforce?3” and maybe even “What’s It All About, Alfie?4” But we digress.

With such a uniformly positive backdrop, renewed concerns about potential inflation rattled the markets‘ cages a bit in February and could well keep on doing so. For now, we’re all waiting for Godot, as reported CPI remains benign. But many investors have expressed concern over strange experimental monetary policy (first zero interest rates, then negative rates, followed quantitative easing – one might say that all of the central banks’ gall is divided into three parts) and in our view honest commentators have to admit they have no idea how the reversal might play out6. [We’ve noted before that PLENTY of underlying conditions exist to foster significant price inflation, mostly the creation of trillions in new fiat money by central banks7.

With such a uniformly positive backdrop, renewed concerns about potential inflation rattled the markets‘ cages a bit in February and could well keep on doing so. For now, we’re all waiting for Godot, as reported CPI remains benign. But many investors have expressed concern over strange experimental monetary policy (first zero interest rates, then negative rates, followed quantitative easing – one might say that all of the central banks’ gall is divided into three parts) and in our view honest commentators have to admit they have no idea how the reversal might play out6. [We’ve noted before that PLENTY of underlying conditions exist to foster significant price inflation, mostly the creation of trillions in new fiat money by central banks7.

With only increased growth forecast globally, and Congress talking infrastructure turkey with President Trump, perhaps James Glassman’s classic 1999 book, Dow 36,000, may return to popularity, two decades later. (Stranger things have happened – the Philadelphia Eagles just won a Super Bowl after all).

While it always rattles the nerves a bit, we can’t say we’re unhappy about the return of market volatility – it had become so unnaturally low that its very absence was troubling. Our view was nicely summed up in a Wall Street Journal opinion piece in the teeth of February’s dyspepsia: “…finally—ten years after the financial crisis—the U.S. is returning to a real economy where markets fluctuate, private risk-taking leads to growth, interest rates don’t stay at rock-bottom levels and every bump in the financial road is not met with a federal intervention. This is progress.8“

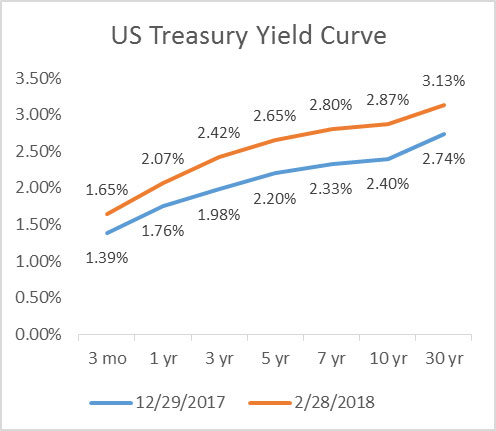

One of our favorite managers summarized the issues here so well that we feel compelled to share it in its entirety. “…the secular supply-demand dynamics of debt also favor higher rates. With QE, the Fed increased its assets from $882 billion (or 6.0% of GDP) in December 2007 to $4.5 trillion (or 23.5% of GDP) in May 2017. The Fed’s presence as a significant buyer served to keep rates low, pushing investors out on the risk spectrum and elevating all asset values. Not surprisingly, annual US QE debt purchases also often mirrored the annual US budget deficits. The current reversal of the great QE exercise, known as quantitative tightening (QT), has seen the Fed double its monthly balance sheet reductions from $10 billion to $20 billion as of January 2018 with plans to increase the pace by another $10 billion every three months. Tax reform and the prospect of growing deficits (and, therefore, growing US debt issuance) combined with sales of existing Fed inventory will create a very different environment from the one we have been in for the last decade.”

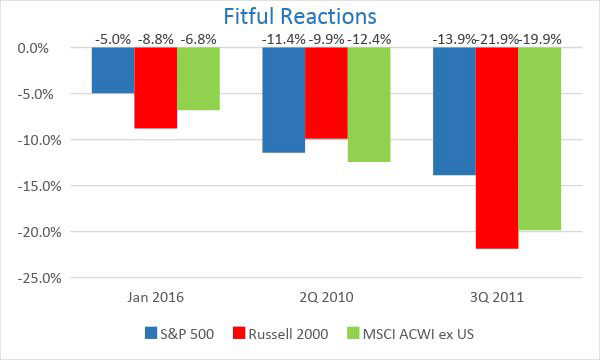

Note that immediately prior to the financial crisis, short-term interest rates were 5.25% and savers and retirees were not beggared by meager interest incomes. On the current path–recently reconfirmed by new Fed chief Jerome “Jay” Powell–US interest rates will rise gradually in the years to come, in all likelihood with overseas rates eventually following suit. It is good news that markets have been able to absorb this projected plan without melting down. This was decidedly NOT the response in 2010, or 2011 when prior normalization was mooted. Even as recently as 2016, the month of January reacted very fitfully in response to the single upward Fed move before 2017. (See “Fitful Reactions” chart, below)

Markets will surely react to higher rates with increased volatility as they have begun to do. Higher discount rates may well trim p/e ratios, but at least this is occurring in an environment where earnings growth offers some positive offset in that ratio. Most analysts expect the tax code changes to add meaningfully to US companies’ profit potential for many years. Even Warren Buffett*, who has been all but begging Washington for a tax increase for years, noted in his annual letter last weekend that US tax changes have provided a wind to the back of corporate earnings.

*Speaking of the Oracle of Omaha and to curb any excess enthusiasm for stock price returns in the short term, we quote him again to add one more “I” to our caution list. Mr. Buffett said a few months ago something to the effect that stock price multiples were not unreasonable If interest rates remained at their historically low levels (emphasis ours). Always loath to make guesses about market levels or direction in the near term, his statement may in hindsight be viewed as something of a dog whistle that significantly higher rates should enter into investors calculus perhaps sooner rather than later. If that was his intention, his veiled cautionary statement looks prescient. But we (re)digress.

The almost ten years since the 2008 financial crisis have been marked by lots of macro financial engineering9 and it’s important to recall that this has facilitated returns on financial assets that were anticipated by practically nobody during its depths. The future tends to surprise, and we risk little chance of contradiction to observe that the next decade will most certainly not resemble the past one. As we’ve indicated for a few years now, it’s not really time for portfolio heroics and risk management should be valued over risk seeking. If asked to guess on portfolio actions we may see in 2018, we’d bet on 1) our mechanisms for tweaking asset allocation within ranges to indicate risk reduction rather than increases, but 2) that interim market volatility may also offer windows to move equity allocations higher in response to lower market prices.

- After slumbering in the 10-11 range for months, the VIX measure of S&P 500 market volatility leapt over 50 intraday on February 6th and has lately settled into its more historic high teens range.

- Regulatory reform is often cited as an additional economic tonic, but one that is akin to the proverbial bottom two-thirds of the iceberg: not visible. We prefer to leave it that way, since it disturbs our “I / Ides“leitmotif.

- Hat tip, FiduciaryVest CIO, emeritus Gregg Buckalew: Baked-in Jobs, August 2014 commentary

- Hat tip Burt Bacharach/Hal David/Cilla Black/Dionne Warwick.

- Perhaps prompting millions of voters to write their new congress-folk with a simple message: we know he’s unconventional, boorish even, but 5% growth hardly qualifies as a high crime or misdemeanor.

- Hat tip to, well, us, in 2015’s What’s Another Trillion Among Friends?

- Stocks Get Cheaper, 2/5/2018

- We are probably not done with that forever; our sneaking suspicion is that part of the Fed’s motivation for normalization is to give them some future room for monetary maneuvering should a significant negative series of months and /or some unexpected bolt from the blue rattle markets.

COMMENTARY

Commentary was prepared for clients and prospective clients of FiduciaryVest LLC. It may not be suitable for others, and should not be disseminated without written permission. FiduciaryVest does not make any representation or warranties as to the accuracy or merit of the discussion, analysis, or opinions contained in commentaries as a basis for investment decision making. Any comments or general market related observations are based on information available at the time of writing, are for informational purposes only, are not intended as individual or specific advice, may not represent the opinions of the entire firm and should not be relied upon as a basis for making investment decisions.

All information contained herein is believed to be correct, though complete accuracy cannot be guaranteed. This information is subject to change without notice as market conditions change, will not be updated for subsequent events or changes in facts or opinion, and is not intended to predict the performance of any manager, individual security, market sector, or portfolio.

This information may concur or may conflict with activities of any clients’ underlying portfolio managers or with actions taken by individual clients or

clients collectively of FiduciaryVest for a variety of reasons, including but not limited to differences between and among their investment objectives. Investors are advised to consult with their investment professional about their specific financial needs and goals before making any investment decisions.

INVESTMENT RISK

FiduciaryVest does not represent, warrant, or imply that the services or methods of analysis employed can or will predict future results, successfully identify market tops or bottoms, or insulate client portfolios from losses due to market corrections or declines. Investment risks involve but are not limited to the following: systematic risk, interest rate risk, inflation risk, currency risk, liquidity risk, sociopolitical risk, management risk, and credit risk. In addition to general risks associated with investing, certain products also pose additional risks. This and other important information is contained in the product prospectus or offering materials.