December 2018 Market Commentary

“The tradition of Festivus begins with the airing of grievances. I got a lot of problems with you people! And now you’re gonna hear about it!” “Frank Costanza” Seinfeld character

It’s hard to review 2018 results without granting investors a fair cause for grievance, in recent market results and perhaps in outlook. We are headed into the year-end holidays with capital markets looking neither calm nor bright and the US Federal Reserve ponders its next rate change decision as we type, with markets hanging expectantly on the outcome. Results through this month were nothing to tweet about.

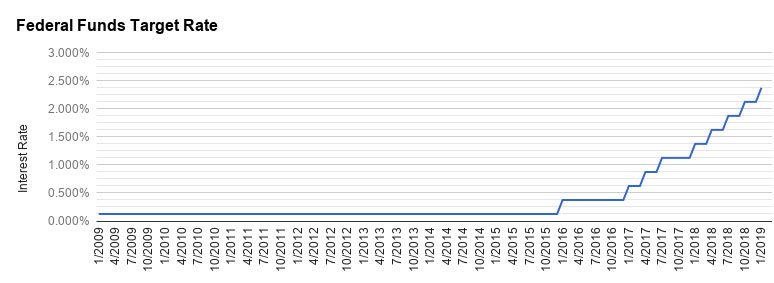

Mere weeks ago the US economy at least was humming along nicely, and another 25 basis point move upward in the federal funds rate appeared a near certainty. And then stocks started to go wobbly. We’ve been suggesting for some time now that the Fed seemed determined to continue rate increases until something in markets “broke;” we may be amidst it right now.

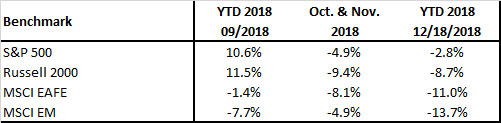

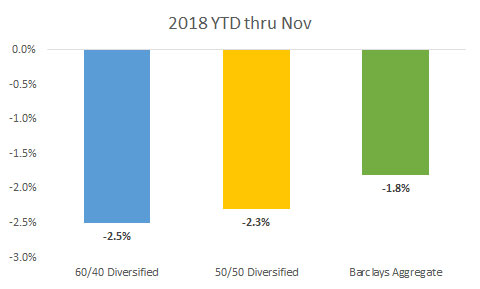

As Exhibit A we offer diversification1, as tried and true a risk management technique as there is in investing, though of late there is legitimate griping about its recent impact and outcome. It’s been a pretty equal opportunity year for losses. Stocks are down across the spectrum: large and small, growth and value, inside and outside the US.

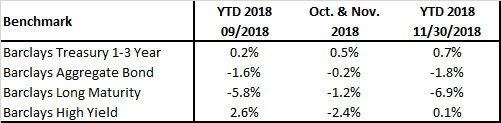

Even “fixed” income has been a cause for grief, posting losses YTD that get worse the longer you go on the maturity spectrum. With rates largely on the rise, very short maturities have been in the black thus far, and junk bonds barely clung onto a positive sign until this month, though they have lost over 2% since we cracked open the cranberry sauce just a few short weeks ago.

In short, owning a diverse pool of assets lately doesn’t seem to offer much to feel cheery about.

“Nowhere to run to, baby, nowhere to hide.”- Martha and the Vandellas

At the same time, the economic outlook has turned

And frankly, even that’s a bit of a shaky prospect, with the US yield curve having flattened a good bit and the 10 year Treasury yield retreating from its high of just north of 3.25%. We’ve written in this space before that equities start to look shaky when the ten-year Treasury heads above a 3 handle, and now despite a retrace below that level equities have breached the colloquial -20% bear market metric.

We wish we felt like the grievances could be purged, as at a Festivus (for the rest of us!) dinner, but we like the near-term outlook little better. It seems the market dominoes have fallen as the year has progressed:

first emerging markets fell sharply, down almost 10% in the second calendar quarter;- then small caps, -10% in October;

- large US stocks held awhile, levitated by big tech – the S&P 500 was still +5% through November;

- then the FAANGs retreated – e.g., Apple was recently down nearly a third from its October peak;

- taking the cap-weighted S&P 500 index with them.

Markets’ major headwind in our view is the change afoot from a world of global quantitative easing (QE) to its opposite. At the risk of being overly dramatic, it sure looks like the end of an era, what overpaid MBAs like to call a paradigm shift3.

For most of the decade since the 2008 great financial crisis, central bankers have been pursuing interest rate cuts and (essentially) money printing in the form of QE. Trillions of new dollars, euros, and yen have been (metaphorically) spun from whole cloth from about 2010 onward, and used to buy financial assets, inflating their prices.

It’s hard to know precisely to what degree assets have been bid up (among other unknown economic distortions) courtesy of all this cash largesse. But it’s safe to say that zero (and globally negative) interest rates and a multi-trillion dollar spendthrift buyer pushed asset prices higher to a significant degree. The problem in our view is this: what happens when the process goes in reverse?

In 2002, Warren Buffett made the case that company’s employee stock options were a real cost of doing business though accounting rules permitted companies to ignore them in calculating earnings. He asked, three pointed “if” questions4 In the current environment, we ask only one: If QE was good for risky asset prices, isn’t QT going to be bad?

Because it seems to us that the backdrop has changed. US short rates have now moved up seven times in two years to 2-2.25% from zero. The Fed is has reached cruising speed on balance sheet asset runoff, slated for -$600B in 2019. The ECB formally ceased its asset purchase program last week, though it will continue to reinvest that portfolio “for as long as necessary.”

We were assured by policy makers that QE provided large benefits to the real economy. If so, won’t its reversal in the form of QT come with a cost? It can’t all be rainbows and unicorns — Stan Druckenmiller, WSJ OpEd 12/17/18

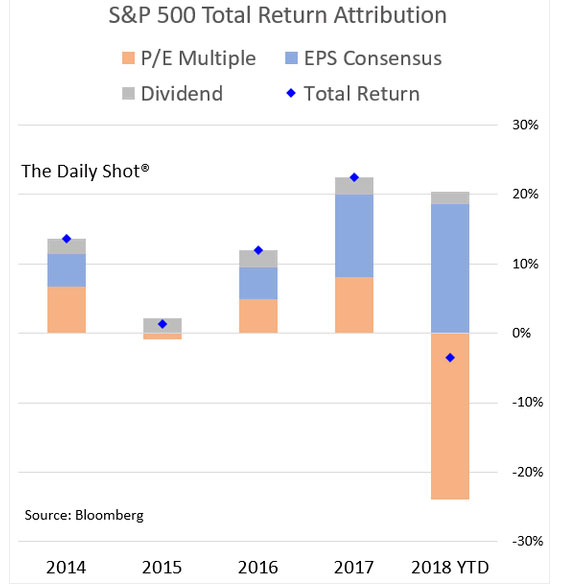

We don’t think it’s a coincidence that investment returns are looking Scrooge-like against this macro-est of macro settings. Fixed interest rates are a counterweight to equity risk, offering competition for capital that will restrict (or contract) p/e multiples by siphoning off marginal investment dollars. A number of investors will just naturally prefer lower risk income that helps pay the bills to uncertain gains in stock prices.

We’re also flirting with a trade war, especially with China. Presidents Trump and Jinping agreed to hit the pause button on implementing tariffs (which presumably will work better than the infamous Russian reset button); uncertainty will continue to rattle market prices until there is some clarity whose oxen will be gored. There was also a US election last month that flipped the House of Reps to a Democratic Party which has promised multiple investigations of Donald Trump’s actions in and out of the Oval Office.

There’ll be plenty of political contention and by next summer the 2020 presidential campaign will be in full vigor. (As we type, the DC pols can’t quite decide whether to shut down the government or not as they argue (endlessly and fruitlessly it seems) about who can and cannot enter the country illegally and whether they’ll be using a tall ladder or a bulldozer. But we digress.)

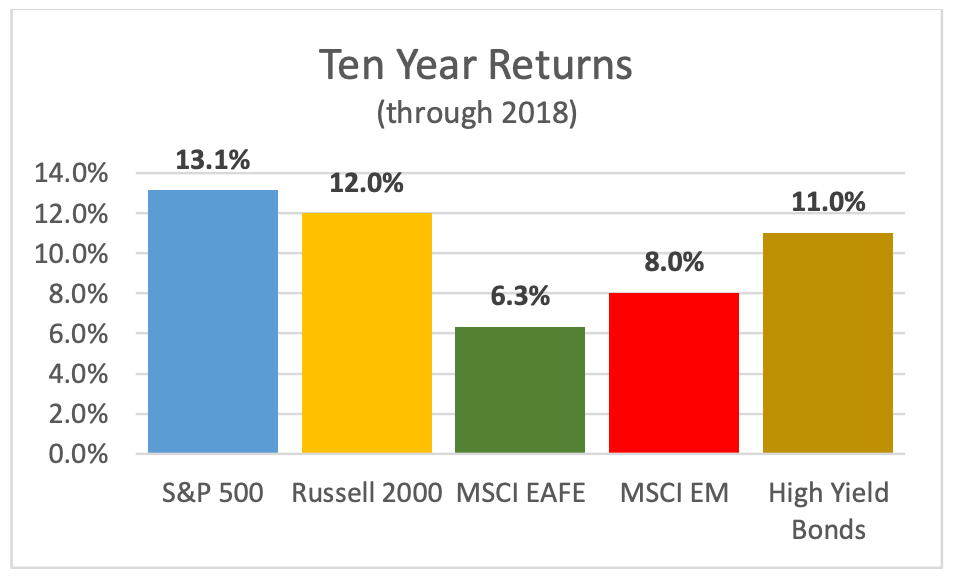

We’re not trying to spoil anyone’s holiday turkey. In one sense, it’s healthy that markets have taken something of a pause in 2018 given the shifting big picture backdrop and the huge returns preceding this year, especially 2017 which no one expected. Our sense is that with long term risk asset returns now well above historical averages, the next decade is more likely to moderate.5 Especially if the 30+ year downtrend in interest rates reverses.6

“In the West, you have the notion that if somebody hits you on the left cheek, you turn the other cheek,” he told the foreign executives, according to people familiar with the session. “In our culture we punch back.” – attributed to Chinese Premier Xi Jinping

Despite all our concerns, we’re content to stay there until something changes in market behavior or conditions. As we’ve said in this space previously, it just isn’t time in our view for portfolio heroics, and risk management should trump risk seeking this late in a market cycle. Going forward, there will still be plenty of opportunities for investors, and in particular, we think that, all else equal:

- Non-US stock (including EM) will outperform US indices, erasing a sizable historical return gap and reverting to more normal relative price relationships between regions;

Value will outperform growth style, reversing a trend we’ve seen at least once before during this bull cycle;- Shorter maturity, higher quality bonds are preferable to longer / lower, as both the interest rate and credit cycles are asymmetrically set up against

fixed income investors; - Passive investing in general and pure indexing specifically will perform poorly relative to carefully chosen actively managed portfolios. This decade has witnessed a hugely growing pile of assets being managed according to rules, algorithms, and systems, often momentum based, with if any little regard for underlying economic fundamentals.7 When market conditions change, especially with respect to market liquidity, we suspect the consequences to be brutal8, and we suspect a good amount of paper wealth that was ephemeral will evaporate.

- In the same vein, alternative strategies, especially the ultimate active managers of long-short equities (again, managers

chosen selectively) will be more successful, partly due to their current unpopularity and partly due to a better backdrop for making money betting against things.

Importantly, we aren’t voting against equities with

our feet from an asset allocation perspective. We’ve noted in the past a

sometimes sizable delay in our nagging concerns transmitting themselves into

market corrective outcomes – perhaps by several years if history is any

guide. (Note that former Fed chairman Alan

Greenspan was way out front in 1996 with his “irrational exuberance“ comment.) We have some clients looking to grow their

long-term allocations to return-seeking assets and our standing recommendation

is to move incrementally, saving some dry powder for what is likely to be

continued market volatility. This is the

type of market environment where sticking to the plan becomes more and more

important.

Commentary

Commentary was prepared for clients and prospective clients of FiduciaryVest LLC. It may not be suitable for others, and should not be disseminated without written permission. FiduciaryVest does not make any representation or warranties as to the accuracy or merit of the discussion, analysis, or opinions contained in commentaries as a basis for investment decision making. Any comments or general market related observations are based on information available at the time of writing, are for informational purposes only, are not intended as individual or specific advice, may not represent the opinions of the entire firm and should not be relied upon as a basis for making investment decisions.

All information contained herein is believed to be correct, though complete accuracy cannot be guaranteed. This information is subject to change without notice as market conditions change, will not be updated for subsequent events or changes in facts or opinion, and is not intended to predict the performance of any manager, individual security, currency, market sector, or portfolio.

This information may concur or may conflict with activities of any clients’ underlying portfolio managers or with actions taken by individual clients or clients collectively of FiduciaryVest for a variety of reasons, including but not limited to differences between and among their investment objectives. Investors are advised to consult with their investment professional about their specific financial needs and goals before making any investment decisions

Investment Risk

FiduciaryVest does not represent, warrant, or imply that the services or methods of analysis employed can or will predict future results, successfully identify market tops or bottoms, or insulate client portfolios from losses due to market corrections or declines. Investment risks involve but are not limited to the following: systematic risk, interest rate risk, inflation risk, currency risk, liquidity risk, geopolitical risk, management risk, and credit risk. In addition to general risks associated with investing, certain products also pose additional risks. This and other important information is contained in the product prospectus or offering materials.

[1] Because they assets they own are subject to slightly different economic influences (in type, degree, and timing), diversified portfolios offer improved results across time, especially adjusted for their pattern of return variability.

[2] See our Beware the Ides of March commentary of March 6, 2018

[3] You know, paradigm; it’s all paradigm-ish, and stuff.

[4] 1) If options aren’t a form of compensation, what are they? 2) If compensation isn’t an expense, what is it? 3) And if expenses shouldn’t go into the calculation of earnings, where in the world should they go?

[5] And yet, we well recall that in the late 1980s, most investors “knew” that prospective equity returns “had” to come down from their

[6] Which in our view is one primary reason why the 2020s won’t resemble the 1990s for stocks, our exculpatory note above notwithstanding. But we re-digress.

[7] The past decade especially has been one long rising tide lifting all boats, but especially so the ocean liners that drive the indexes. Very little failure has occurred in the form of market discipline let alone actual bankruptcy for poorly contrived, managed, or financed businesses. 2009-2018 has been an economic environment that is like an anti-New York; if you can’t make it there, you can’t make it anywhere.)

[8] For those old enough to remember, think 1987 and portfolio insurance and how well that worked out.